Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tax Software Assignment Problems $623,000 Her adjusted cost base for these shares was $216,000, resulting in a capital 2017 In this year she sold

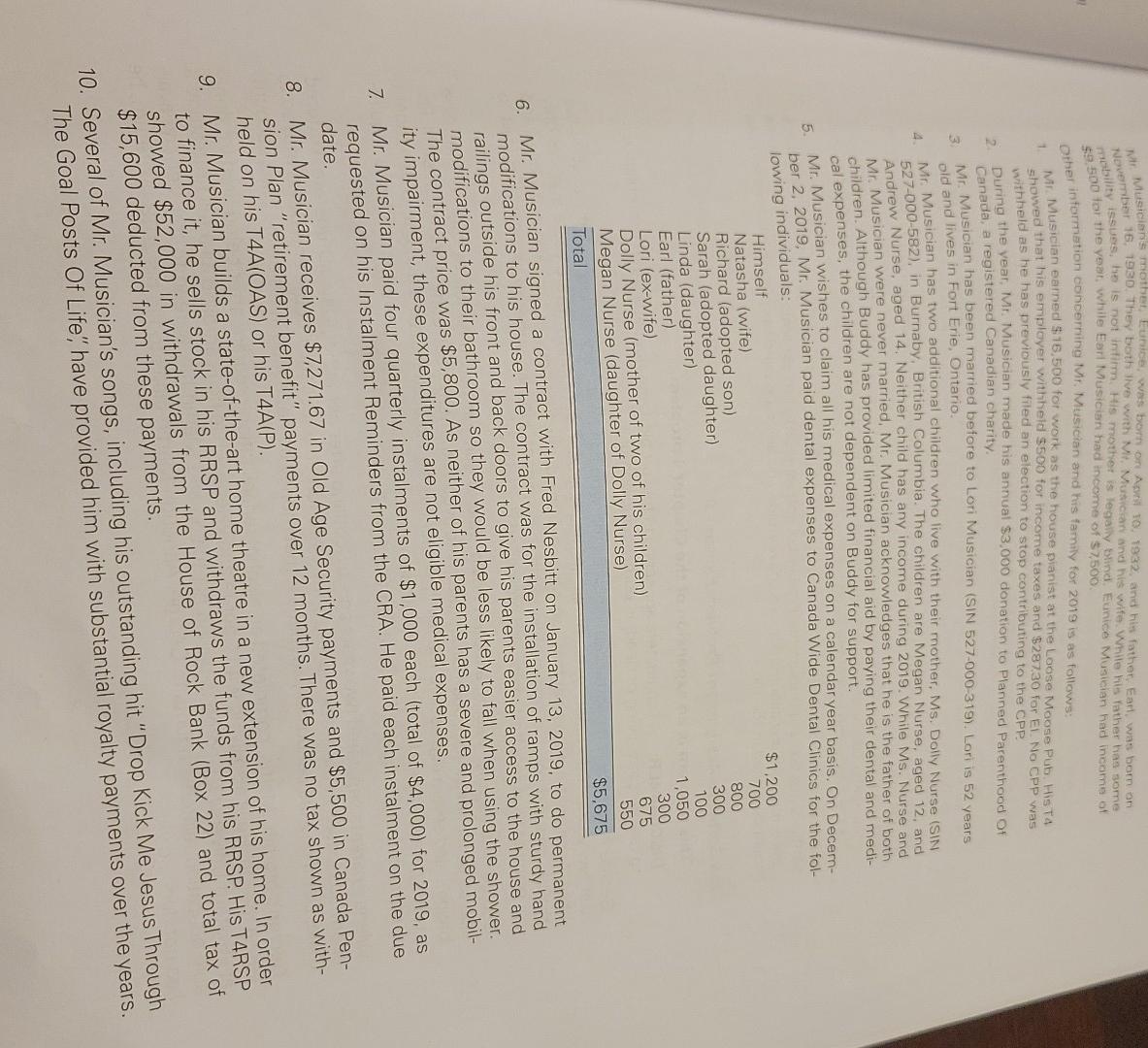

Tax Software Assignment Problems $623,000 Her adjusted cost base for these shares was $216,000, resulting in a capital 2017 In this year she sold shares in DEF a qualified small business corporation, for gain of $407.000 Once again, the taxable amount of this gain was eliminated using the lifetime capital gams deduction. All of Estelle's income is derived from her corporate holdings. During 2020, she received a total of $32,000 in non-eligible dividends from these corporations. Estelle hed no other dispositions of capital assets prior to 2020. In 2020, she had the following dispositions: Shares of GHI, a qualified small business corporation, for $662,000. Her adjusted cost base for these shares was $360,000, resulting in a capital gain of $302,000. .Shares of JKL, a non-qualified small business corporation, for $230,000. Her adjusted cost base for these shares was $250,000, resulting in a capital loss of $20,000. deduction. She would like to use this deduction in 2020, regardless of whether her lifetime capi- she has chosen not to use this carry forward in order to maximize her lifetime capital gains For several years, Estelle has been carrying forward a $15,000 net capital loss. In previous years, tal gains deduction is maximized. Estelle has never had a CNIL balance. Required: Ignore GST/HST/PST considerations in your solution. A. Determine Adam's federal Tax Payable for 2020. B. Determine Estelle's federal Tax Payable, including alternative minimum tax for 2020. In both Part A and Part B, indicate any carry forward amounts available at the end of 2020. Tax Software Assignment Problems Tax Software Assignment Problem Eleven - 1 This problem is an expansion of the Chapter 4 problem. DISCLAIMER: All characters appearing in this problem are fictitious. Any resemblance to real persons, living or dead, is purely coincidental. Mr. Buddy Musician (SIN 527-000-061) was born in Vancouver on August 28, 1952. He has spent Vans of his working life as a pianist and song writer. He and his family live at 111 WWW Street, Vancouver, B.C. V4H 3W4, phone (604) 111-1111. Mr. Musician's wife, Natasha (SIN 527-000-129), was born on June 6, 1994. She and Mr. Musi- can have four children. Each child was born on April 1 of the following years: Linda, 2014; Larry, 2015; Donna, 2016; and Donald, 2017 Natasha's only income during 2019 is $3,200 from singing engagements. Buddy and Natasha Musician have two adopted children. Richard (SIN 527-000-285) was born on March 15, 2002, and has income of $2,800 for the year. Due to his accelerated schooling, he started full time attendance at university in September of 2019 at the age of 17. His first semes- ter tuition fee is $3,000 and he requires books with a total cost of $375. These amounts are paid by Mr. Musician. The other adopted child, Sarah, was born on September 2, 1999 and is in full time attendance at university for all of 2019 (including a four month summer session). Her tuition is $9,600 and she requires textbooks that cost $750. These amounts are also paid by Mr. Musician. Sarah ha no income during the year. Neither Richard nor Sarah will have any income in the next three years. They both have agree that the maximum tuition amount should be transferred to their father.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started