Answered step by step

Verified Expert Solution

Question

1 Approved Answer

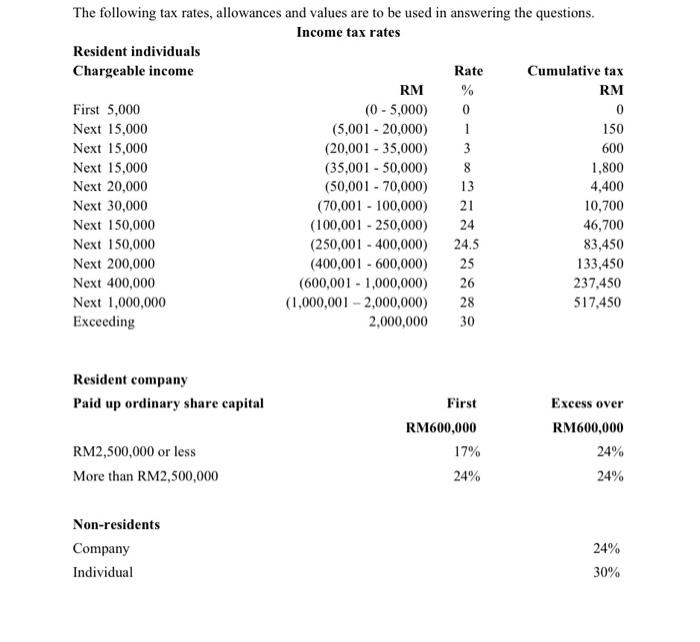

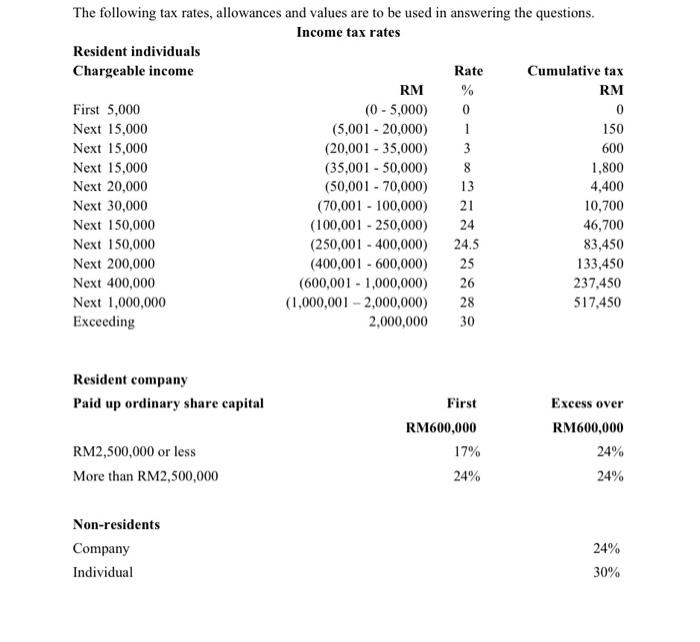

Taxation 1 The following tax rates, allowances and values are to be used in answering the questions. Income tax rates Resident individuals Chargeable income Rate

Taxation 1

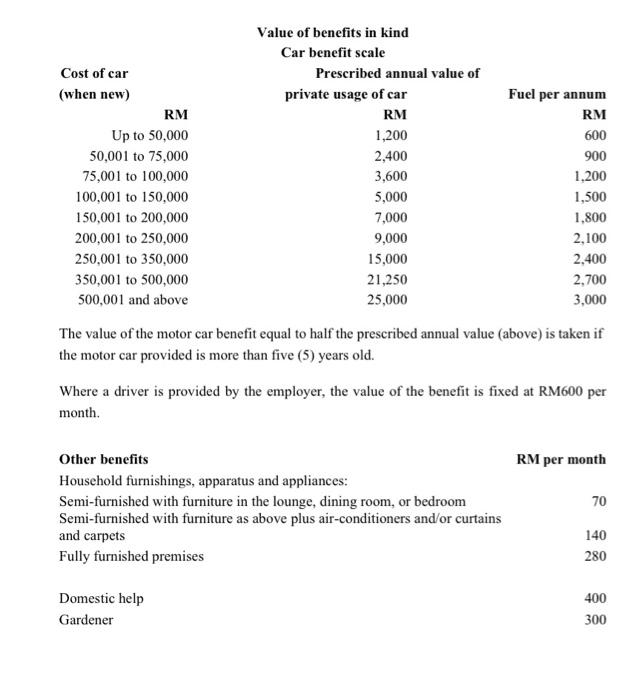

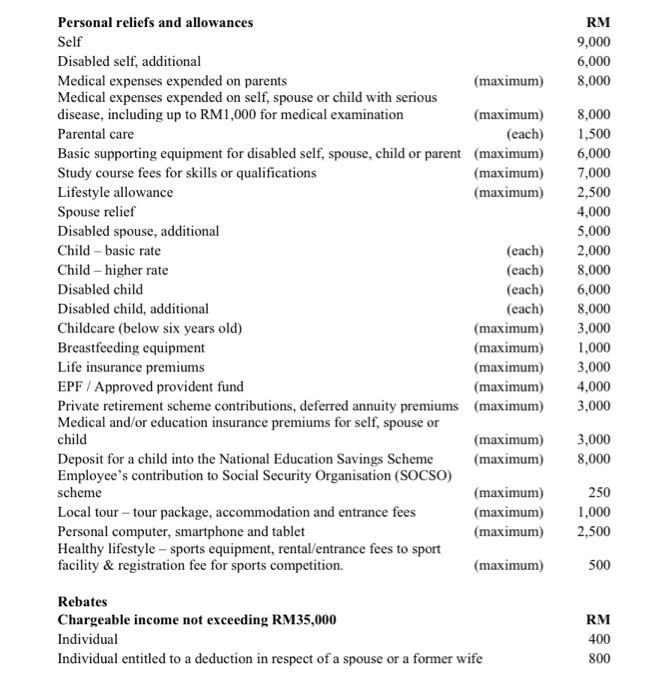

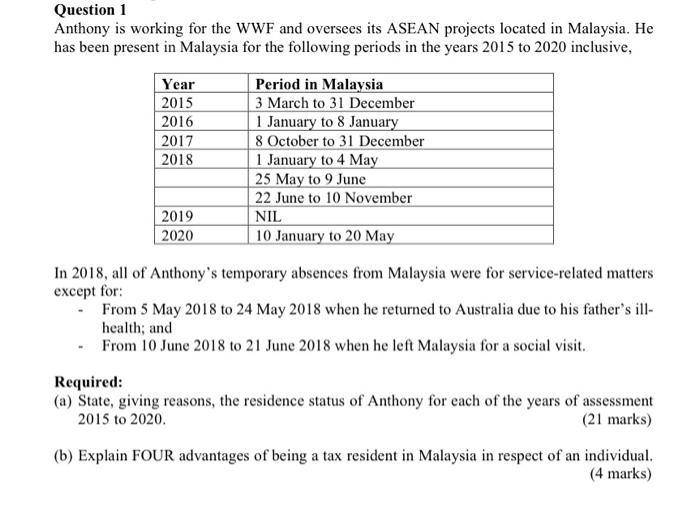

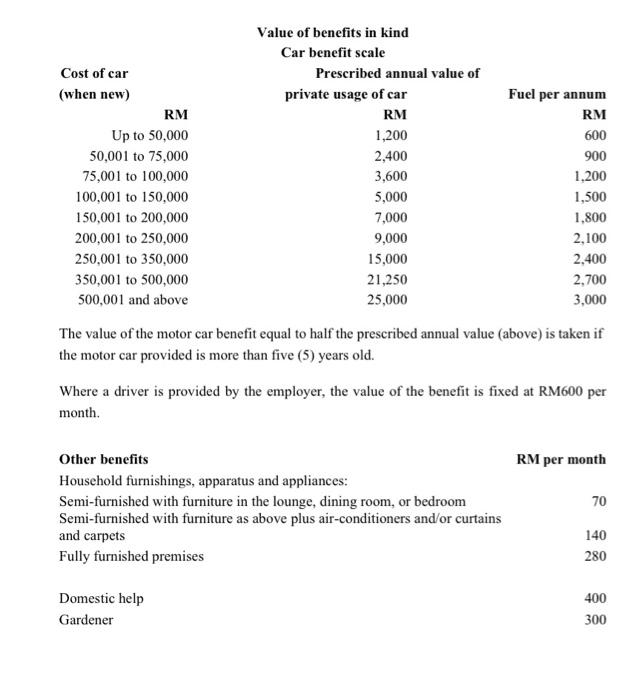

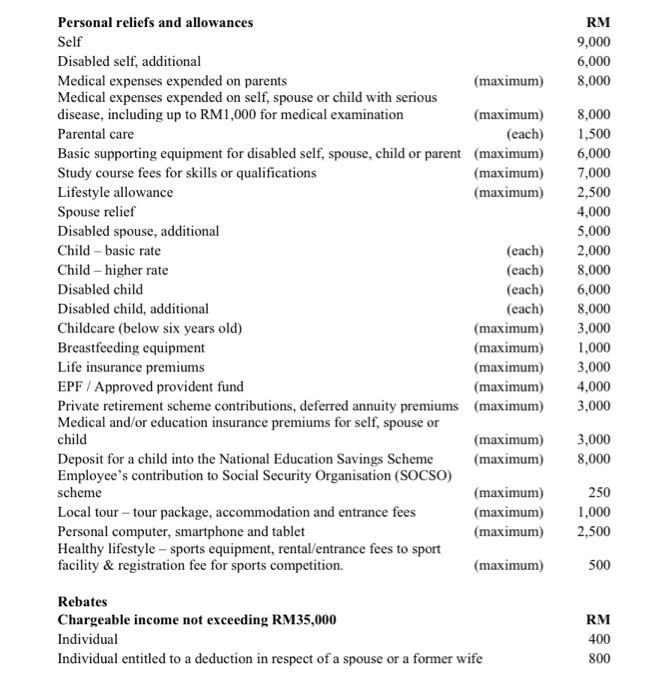

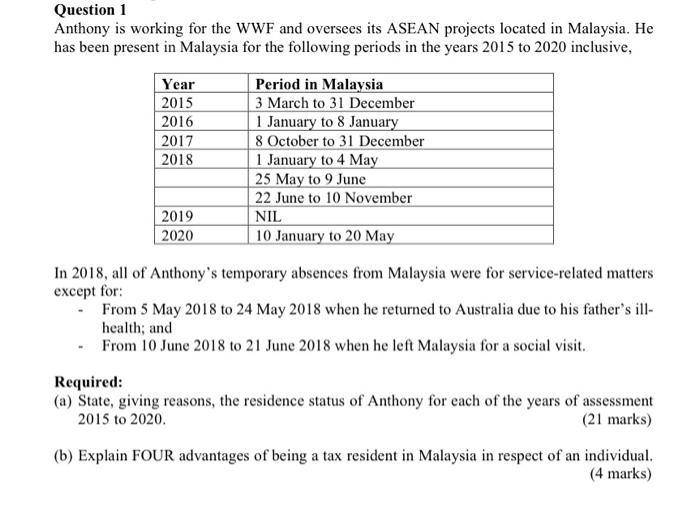

The following tax rates, allowances and values are to be used in answering the questions. Income tax rates Resident individuals Chargeable income Rate Cumulative tax RM % RM First 5,000 (0 - 5,000) 0 0 Next 15,000 (5,001 - 20,000) 1 150 Next 15,000 (20,001 - 35,000) 3 600 Next 15,000 (35,001 - 50,000) 1,800 Next 20,000 (50,001 - 70,000) 13 4,400 Next 30,000 (70,001 - 100,000) 21 10,700 Next 150,000 (100,001 - 250,000) 24 46,700 Next 150,000 (250,001 - 400,000) 24.5 83,450 Next 200,000 (400,001 - 600,000) 25 133,450 Next 400,000 (600,001 - 1,000,000) 26 237,450 Next 1,000,000 (1,000,001 - 2,000,000) 28 517,450 Exceeding 2,000,000 30 8 Resident company Paid up ordinary share capital First RM600,000 17% 24% Excess over RM600,000 24% 24% RM2,500,000 or less More than RM2,500,000 Non-residents Company Individual 24% 30% Value of benefits in kind Car benefit scale Cost of car Prescribed annual value of (when new) private usage of car Fuel per annum RM RM RM Up to 50,000 1,200 600 50,001 to 75,000 2,400 900 75,001 to 100,000 3,600 1,200 100,001 to 150,000 5,000 1,500 150,001 to 200,000 7,000 1.800 200,001 to 250,000 9,000 2,100 250,001 to 350,000 15,000 2.400 350,001 to 500,000 21,250 2,700 500,001 and above 25,000 3,000 The value of the motor car benefit equal to half the prescribed annual value (above) is taken if the motor car provided is more than five (5) years old. Where a driver is provided by the employer, the value of the benefit is fixed at RM600 per month. RM per month 70 Other benefits Household furnishings, apparatus and appliances: Semi-furnished with furniture in the lounge, dining room, or bedroom Semi-furnished with furniture as above plus air-conditioners and/or curtains and carpets Fully furnished premises 140 280 Domestic help Gardener 400 300 RM 9,000 6,000 8,000 Personal reliefs and allowances Self Disabled self, additional Medical expenses expended on parents (maximum) Medical expenses expended on self, spouse or child with serious disease, including up to RM1,000 for medical examination (maximum) Parental care (each) Basic supporting equipment for disabled self, spouse, child or parent (maximum) Study course fees for skills or qualifications (maximum) Lifestyle allowance (maximum) Spouse relief Disabled spouse, additional Child - basic rate (each) Child - higher rate (each) Disabled child (each) Disabled child, additional (each) Childcare (below six years old) (maximum) Breastfeeding equipment (maximum) Life insurance premiums (maximum) EPF / Approved provident fund (maximum) Private retirement scheme contributions, deferred annuity premiums (maximum) Medical and/or education insurance premiums for self, spouse or child (maximum) Deposit for a child into the National Education Savings Scheme (maximum) Employee's contribution to Social Security Organisation (SOCSO) scheme (maximum) Local tour - tour package, accommodation and entrance fees (maximum) Personal computer, smartphone and tablet (maximum) Healthy lifestyle - sports equipment, rental/entrance fees to sport facility & registration fee for sports competition. (maximum) 8,000 1,500 6,000 7,000 2,500 4,000 5,000 2,000 8,000 6,000 8,000 3,000 1,000 3,000 4,000 3,000 3,000 8,000 250 1,000 2,500 500 Rebates Chargeable income not exceeding RM35,000 Individual Individual entitled to a deduction in respect of a spouse or a former wife RM 400 800 Question 1 Anthony is working for the WWF and oversees its ASEAN projects located in Malaysia. He has been present in Malaysia for the following periods in the years 2015 to 2020 inclusive, Year Period in Malaysia 2015 3 March to 31 December 2016 1 January to 8 January 2017 8 October to 31 December 2018 1 January to 4 May 25 May to 9 June 22 June to 10 November 2019 NIL 2020 10 January to 20 May In 2018, all of Anthony's temporary absences from Malaysia were for service-related matters except for: From 5 May 2018 to 24 May 2018 when he returned to Australia due to his father's ill- health; and From 10 June 2018 to 21 June 2018 when he left Malaysia for a social visit. Required: (a) State, giving reasons, the residence status of Anthony for each of the years of assessment 2015 to 2020. (21 marks) (b) Explain FOUR advantages of being a tax resident in Malaysia in respect of an individual. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started