Answered step by step

Verified Expert Solution

Question

1 Approved Answer

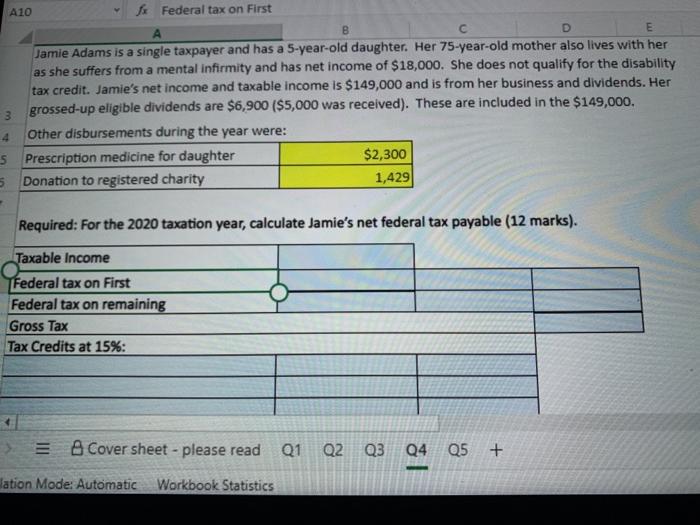

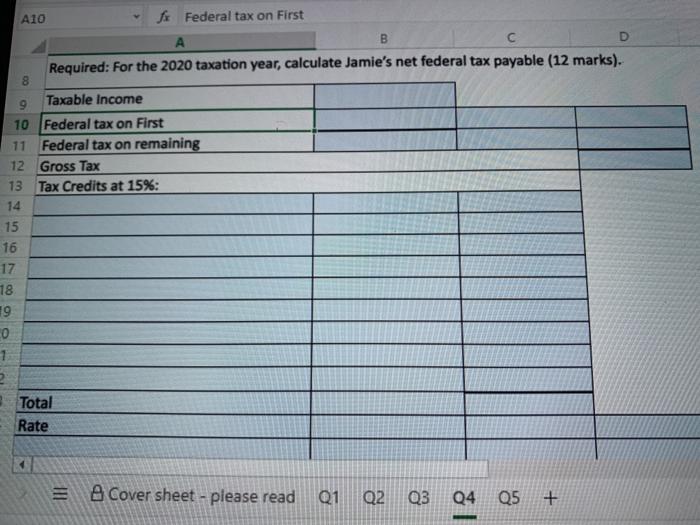

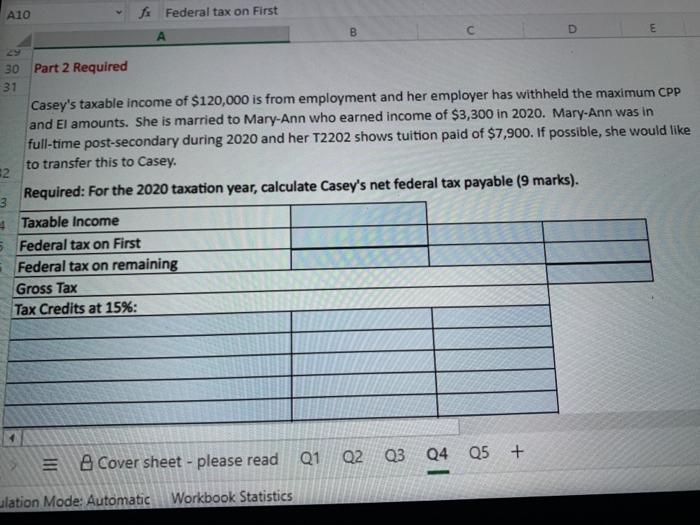

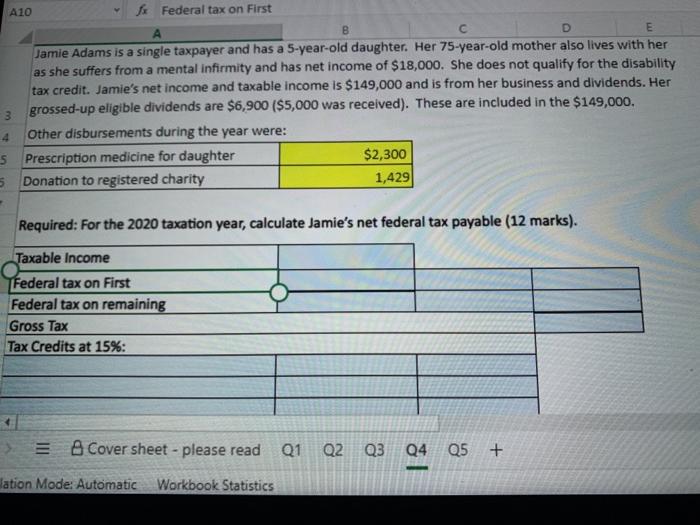

taxation A10 f Federal tax on First B E Jamie Adams is a single taxpayer and has a 5-year-old daughter. Her 75-year-old mother also lives

taxation

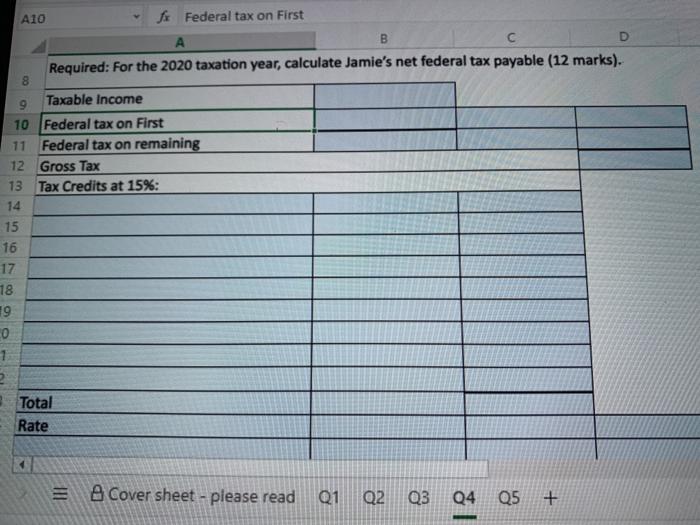

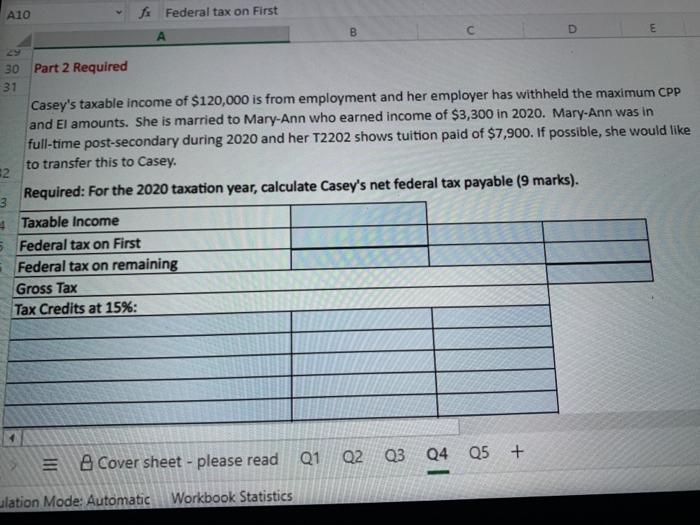

A10 f Federal tax on First B E Jamie Adams is a single taxpayer and has a 5-year-old daughter. Her 75-year-old mother also lives with her as she suffers from a mental infirmity and has net income of $18,000. She does not qualify for the disability tax credit. Jamie's net income and taxable income is $149,000 and is from her business and dividends. Her 3 grossed-up eligible dividends are $6,900 ($5,000 was received). These are included in the $149,000. 4 Other disbursements during the year were: 5 Prescription medicine for daughter $2,300 Donation to registered charity 1,429 Required: For the 2020 taxation year, calculate Jamie's net federal tax payable (12 marks). Taxable income Federal tax on First Federal tax on remaining Gross Tax Tax Credits at 15%: >= A Cover sheet - please read Q1 Q2 Q3 Q4 Q5 + Nation Mode: Automatic Workbook Statistics A10 fx Federal tax on First B Required: For the 2020 taxation year, calculate Jamie's net federal tax payable (12 marks). 8 Taxable income 9 10 Federal tax on First 11 Federal tax on remaining 12 Gross Tax 13 Tax Credits at 15%: 14 15 16 17 18 19 0 1 2 Total Rate = A Cover sheet - please read Q1 Q2 Q3 Q4 05 + A10 fi Federal tax on First B C 30 Part 2 Required 31 Casey's taxable income of $120,000 is from employment and her employer has withheld the maximum CPP and El amounts. She is married to Mary-Ann who earned income of $3,300 in 2020. Mary-Ann was in full-time post-secondary during 2020 and her T2202 shows tuition paid of $7,900. If possible, she would like to transfer this to Casey. 2 Required: For the 2020 taxation year, calculate Casey's net federal tax payable (9 marks). 3 4 Taxable income 5. Federal tax on First Federal tax on remaining Gross Tax Tax Credits at 15%: Q1 Cover sheet - please read Q2 Q3 Q4 Q5 + III ulation Mode: Automatic Workbook Statistics 40 41 42 43 44 45 46 48 Total 49 Rate 50 51 52 3 4 3 A10 f Federal tax on First B E Jamie Adams is a single taxpayer and has a 5-year-old daughter. Her 75-year-old mother also lives with her as she suffers from a mental infirmity and has net income of $18,000. She does not qualify for the disability tax credit. Jamie's net income and taxable income is $149,000 and is from her business and dividends. Her 3 grossed-up eligible dividends are $6,900 ($5,000 was received). These are included in the $149,000. 4 Other disbursements during the year were: 5 Prescription medicine for daughter $2,300 Donation to registered charity 1,429 Required: For the 2020 taxation year, calculate Jamie's net federal tax payable (12 marks). Taxable income Federal tax on First Federal tax on remaining Gross Tax Tax Credits at 15%: >= A Cover sheet - please read Q1 Q2 Q3 Q4 Q5 + Nation Mode: Automatic Workbook Statistics A10 fx Federal tax on First B Required: For the 2020 taxation year, calculate Jamie's net federal tax payable (12 marks). 8 Taxable income 9 10 Federal tax on First 11 Federal tax on remaining 12 Gross Tax 13 Tax Credits at 15%: 14 15 16 17 18 19 0 1 2 Total Rate = A Cover sheet - please read Q1 Q2 Q3 Q4 05 + A10 fi Federal tax on First B C 30 Part 2 Required 31 Casey's taxable income of $120,000 is from employment and her employer has withheld the maximum CPP and El amounts. She is married to Mary-Ann who earned income of $3,300 in 2020. Mary-Ann was in full-time post-secondary during 2020 and her T2202 shows tuition paid of $7,900. If possible, she would like to transfer this to Casey. 2 Required: For the 2020 taxation year, calculate Casey's net federal tax payable (9 marks). 3 4 Taxable income 5. Federal tax on First Federal tax on remaining Gross Tax Tax Credits at 15%: Q1 Cover sheet - please read Q2 Q3 Q4 Q5 + III ulation Mode: Automatic Workbook Statistics 40 41 42 43 44 45 46 48 Total 49 Rate 50 51 52 3 4 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started