Answered step by step

Verified Expert Solution

Question

1 Approved Answer

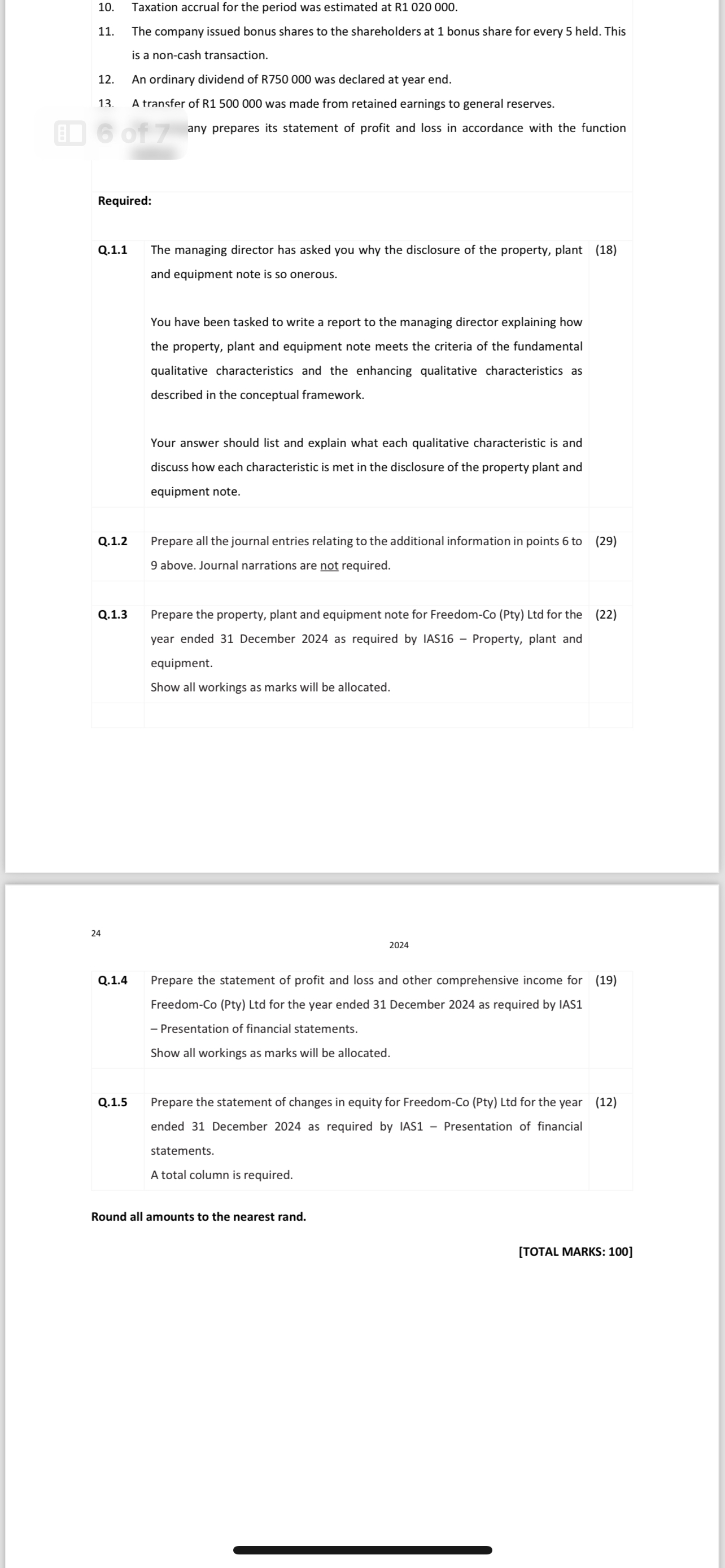

Taxation accrual for the period was estimated at R 1 0 2 0 0 0 0 . The company issued bonus shares to the shareholders

Taxation accrual for the period was estimated at R

The company issued bonus shares to the shareholders at bonus share for every held. This is a noncash transaction.

An ordinary dividend of was declared at year end.

A transfer of R was made from retained earnings to general reserves.

any prepares its statement of profit and loss in accordance with the function Required:

Q The managing director has asked you why the disclosure of the property, plant

and equipment note is so onerous.

You have been tasked to write a report to the managing director explaining how the property, plant and equipment note meets the criteria of the fundamental qualitative characteristics and the enhancing qualitative characteristics as described in the conceptual framework.

Your answer should list and explain what each qualitative characteristic is and discuss how each characteristic is met in the disclosure of the property plant and equipment note.

Q Prepare all the journal entries relating to the additional information in points to

above. Journal narrations are not required.

Q Prepare the property, plant and equipment note for FreedomCo Pty Ltd for the

year ended December as required by IAS Property, plant and equipment.

Show all workings as marks will be allocated.

Q Prepare the statement of profit and loss and other comprehensive income for

FreedomCo Pty Ltd for the year ended December as required by IAS Presentation of financial statements.

Show all workings as marks will be allocated.

Q Prepare the statement of changes in equity for FreedomCo Pty Ltd for the year

ended December as required by IAS Presentation of financial statements.

A total column is required.

Round all amounts to the nearest rand.

TOTAL MARKS:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started