taxation

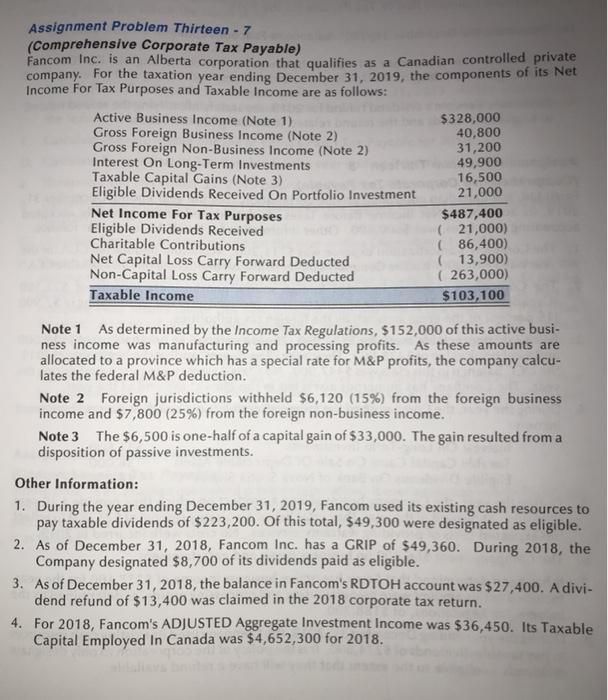

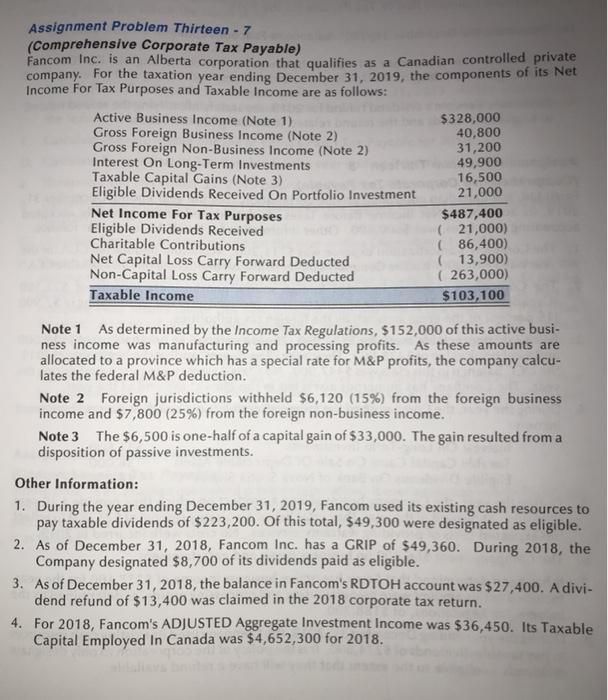

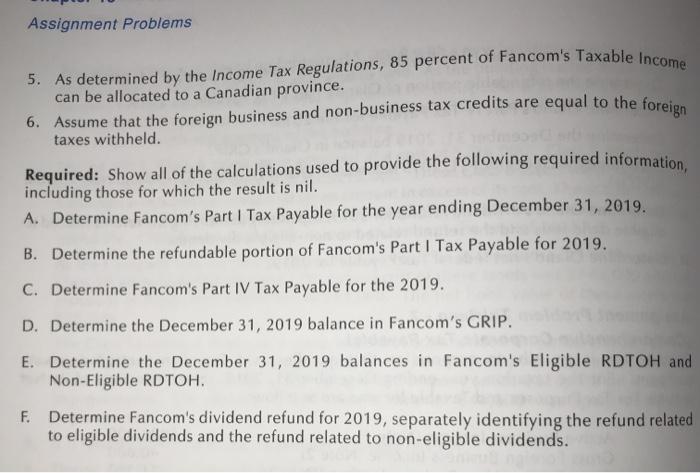

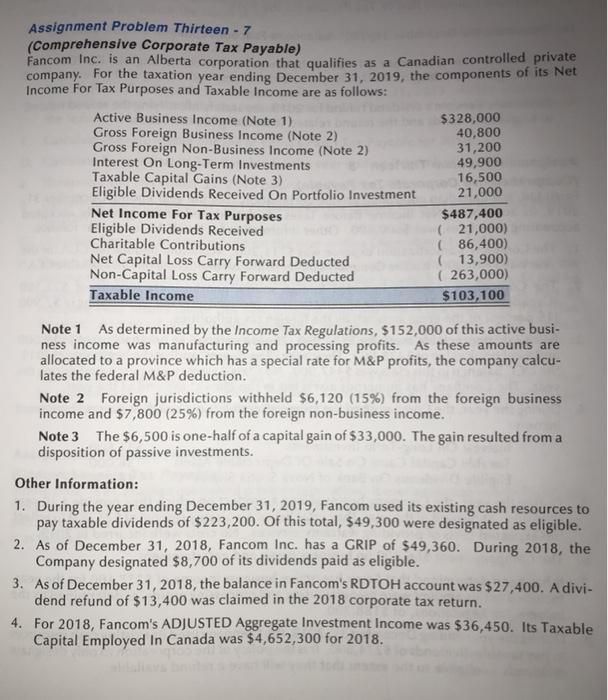

Assignment Problem Thirteen - 7 (Comprehensive Corporate Tax Payable) Fancom Inc. is an Alberta corporation that qualifies as a Canadian controlled private company. For the taxation year ending December 31, 2019, the components of its Net Income For Tax Purposes and Taxable income are as follows: Active Business Income (Note 1) $328,000 Gross Foreign Business Income (Note 2) 40,800 Gross Foreign Non-Business Income (Note 2) 31,200 Interest On Long-Term Investments 49,900 Taxable Capital Gains (Note 3) 16,500 Eligible Dividends Received On Portfolio Investment 21,000 Net Income For Tax Purposes $487,400 Eligible Dividends Received ( 21,000) Charitable Contributions (86,400) Net Capital Loss Carry Forward Deducted (13,900) Non-Capital Loss Carry Forward Deducted ( 263,000) Taxable income $103,100 Note 1 As determined by the Income Tax Regulations, $152,000 of this active busi- ness income was manufacturing and processing profits. As these amounts are allocated to a province which has a special rate for M&P profits, the company calcu- lates the federal M&P deduction. Note 2 Foreign jurisdictions withheld $6,120 (15%) from the foreign business income and $7,800 (25%) from the foreign non-business income. Note 3 The $6,500 is one-half of a capital gain of $33,000. The gain resulted from a disposition of passive investments. Other Information: 1. During the year ending December 31, 2019, Fancom used its existing cash resources to pay taxable dividends of $223,200. Of this total, $49,300 were designated as eligible. 2. As of December 31, 2018, Fancom Inc. has a GRIP of $49,360. During 2018, the Company designated $8,700 of its dividends paid as eligible. 3. As of December 31, 2018, the balance in Fancom's RDTOH account was $27,400. A divi- dend refund of $13,400 was claimed in the 2018 corporate tax return. 4. For 2018, Fancom's ADJUSTED Aggregate Investment Income was $36,450. Its Taxable Capital Employed In Canada was $4,652,300 for 2018. Assignment Problems 5. As determined by the Income Tax Regulations, 85 percent of Fancom's Taxable income can be allocated to a Canadian province. 6. Assume that the foreign business and non-business tax credits are equal to the foreign taxes withheld. Required: Show all of the calculations used to provide the following required information, including those for which the result is nil. A. Determine Fancom's Part 1 Tax Payable for the year ending December 31, 2019. B. Determine the refundable portion of Fancom's Part I Tax Payable for 2019. C. Determine Fancom's Part IV Tax Payable for the 2019. D. Determine the December 31, 2019 balance in Fancom's GRIP. E. Determine the December 31, 2019 balances in Fancom's Eligible RDTOH and Non-Eligible RDTOH F. Determine Fancom's dividend refund for 2019, separately identifying the refund related to eligible dividends and the refund related to non-eligible dividends. Assignment Problem Thirteen - 7 (Comprehensive Corporate Tax Payable) Fancom Inc. is an Alberta corporation that qualifies as a Canadian controlled private company. For the taxation year ending December 31, 2019, the components of its Net Income For Tax Purposes and Taxable income are as follows: Active Business Income (Note 1) $328,000 Gross Foreign Business Income (Note 2) 40,800 Gross Foreign Non-Business Income (Note 2) 31,200 Interest On Long-Term Investments 49,900 Taxable Capital Gains (Note 3) 16,500 Eligible Dividends Received On Portfolio Investment 21,000 Net Income For Tax Purposes $487,400 Eligible Dividends Received ( 21,000) Charitable Contributions (86,400) Net Capital Loss Carry Forward Deducted (13,900) Non-Capital Loss Carry Forward Deducted ( 263,000) Taxable income $103,100 Note 1 As determined by the Income Tax Regulations, $152,000 of this active busi- ness income was manufacturing and processing profits. As these amounts are allocated to a province which has a special rate for M&P profits, the company calcu- lates the federal M&P deduction. Note 2 Foreign jurisdictions withheld $6,120 (15%) from the foreign business income and $7,800 (25%) from the foreign non-business income. Note 3 The $6,500 is one-half of a capital gain of $33,000. The gain resulted from a disposition of passive investments. Other Information: 1. During the year ending December 31, 2019, Fancom used its existing cash resources to pay taxable dividends of $223,200. Of this total, $49,300 were designated as eligible. 2. As of December 31, 2018, Fancom Inc. has a GRIP of $49,360. During 2018, the Company designated $8,700 of its dividends paid as eligible. 3. As of December 31, 2018, the balance in Fancom's RDTOH account was $27,400. A divi- dend refund of $13,400 was claimed in the 2018 corporate tax return. 4. For 2018, Fancom's ADJUSTED Aggregate Investment Income was $36,450. Its Taxable Capital Employed In Canada was $4,652,300 for 2018. Assignment Problems 5. As determined by the Income Tax Regulations, 85 percent of Fancom's Taxable income can be allocated to a Canadian province. 6. Assume that the foreign business and non-business tax credits are equal to the foreign taxes withheld. Required: Show all of the calculations used to provide the following required information, including those for which the result is nil. A. Determine Fancom's Part 1 Tax Payable for the year ending December 31, 2019. B. Determine the refundable portion of Fancom's Part I Tax Payable for 2019. C. Determine Fancom's Part IV Tax Payable for the 2019. D. Determine the December 31, 2019 balance in Fancom's GRIP. E. Determine the December 31, 2019 balances in Fancom's Eligible RDTOH and Non-Eligible RDTOH F. Determine Fancom's dividend refund for 2019, separately identifying the refund related to eligible dividends and the refund related to non-eligible dividends