Answered step by step

Verified Expert Solution

Question

1 Approved Answer

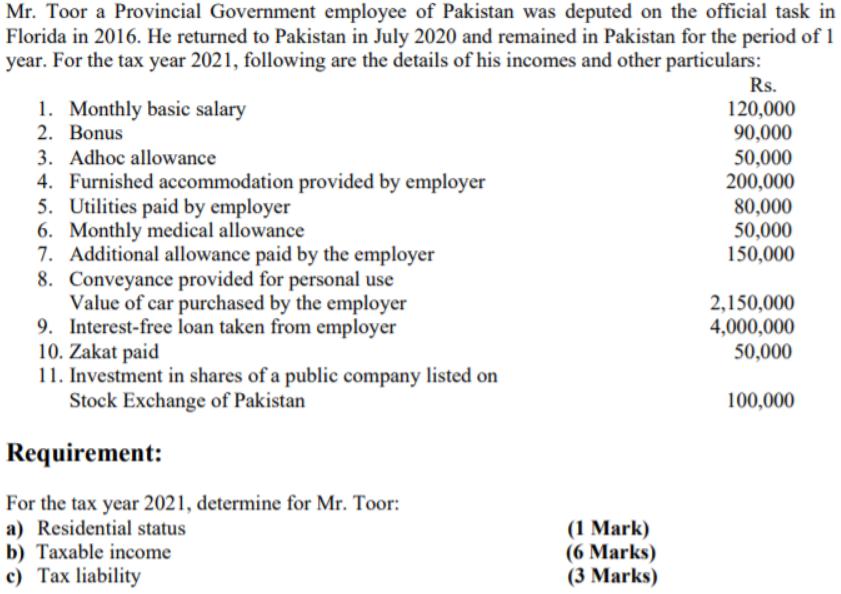

Mr. Toor a Provincial Government employee of Pakistan was deputed on the official task in Florida in 2016. He returned to Pakistan in July

Mr. Toor a Provincial Government employee of Pakistan was deputed on the official task in Florida in 2016. He returned to Pakistan in July 2020 and remained in Pakistan for the period of 1 year. For the tax year 2021, following are the details of his incomes and other particulars: 1. Monthly basic salary 2. Bonus 3. Adhoc allowance 4. Furnished accommodation provided by employer 5. Utilities paid by employer 6. Monthly medical allowance 7. Additional allowance paid by the employer 8. Conveyance provided for personal use Value of car purchased by the employer 9. Interest-free loan taken from employer 10. Zakat paid 11. Investment in shares of a public company listed on Stock Exchange of Pakistan Requirement: For the tax year 2021, determine for Mr. Toor: a) Residential status b) Taxable income c) Tax liability (1 Mark) (6 Marks) (3 Marks) Rs. 120,000 90,000 50,000 200,000 80,000 50,000 150,000 2,150,000 4,000,000 50,000 100,000

Step by Step Solution

★★★★★

3.49 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

a Mr Toors residential status is nonresident for the tax year 2021 b Mr Toors taxable income fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started