TAXATION

NOTES:

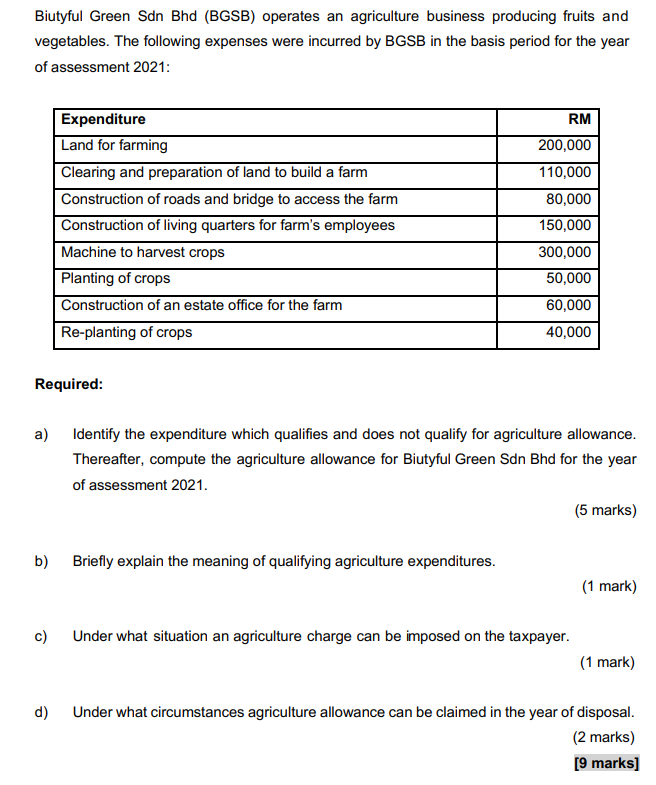

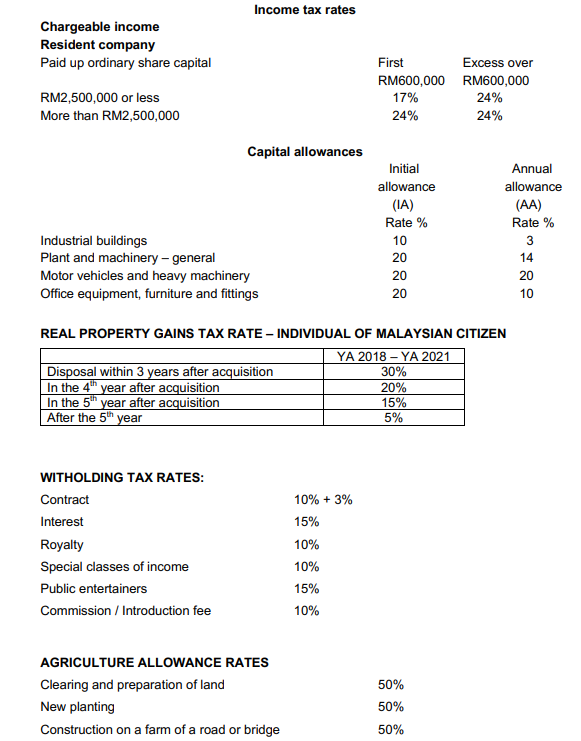

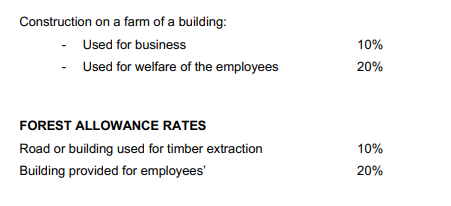

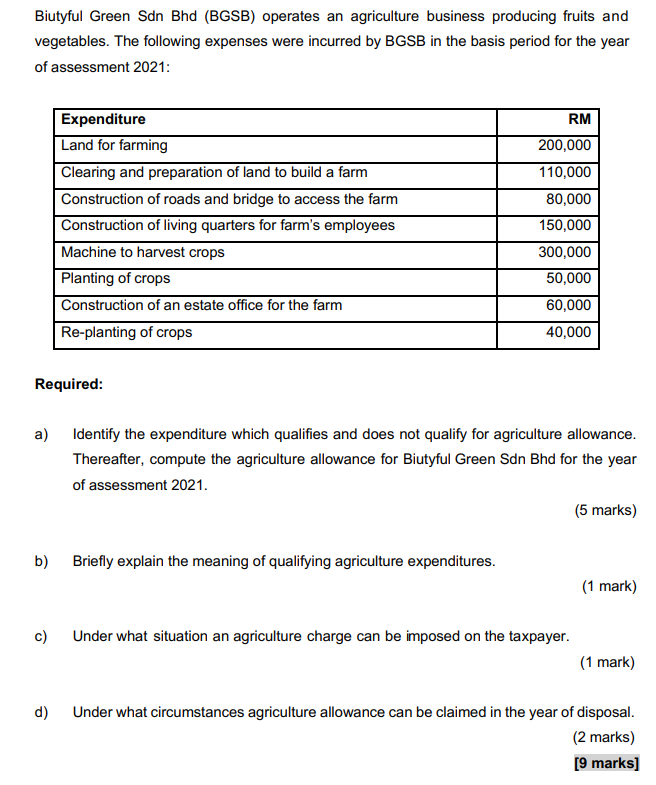

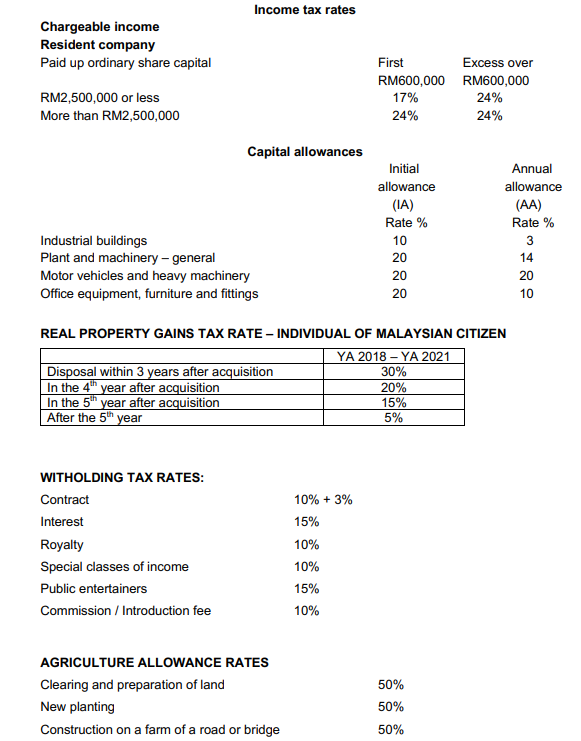

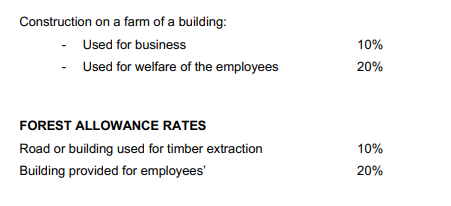

Biutyful Green Sdn Bhd (BGSB) operates an agriculture business producing fruits and vegetables. The following expenses were incurred by BGSB in the basis period for the year of assessment 2021: Expenditure Land for farming Clearing and preparation of land to build a farm Construction of roads and bridge to access the farm Construction of living quarters for farm's employees Machine to harvest crops Planting of crops Construction of an estate office for the farm Re-planting of crops RM 200,000 110,000 80,000 150,000 300,000 50,000 60,000 40,000 Required: a) Identify the expenditure which qualifies and does not qualify for agriculture allowance. Thereafter, compute the agriculture allowance for Biutyful Green Sdn Bhd for the year of assessment 2021. (5 marks) b) Briefly explain the meaning of qualifying agriculture expenditures. (1 mark) c) Under what situation an agriculture charge can be imposed on the taxpayer. (1 mark) d) Under what circumstances agriculture allowance can be claimed in the year of disposal. (2 marks) [9 marks] Income tax rates Chargeable income Resident company Paid up ordinary share capital RM2,500,000 or less More than RM2,500,000 First Excess over RM600,000 RM600,000 17% 24% 24% 24% Capital allowances Initial allowance (IA) Rate % 10 20 20 Annual allowance (AA) Rate % 3 14 20 10 Industrial buildings Plant and machinery - general Motor vehicles and heavy machinery Office equipment, furniture and fittings 20 REAL PROPERTY GAINS TAX RATE - INDIVIDUAL OF MALAYSIAN CITIZEN YA 2018 - YA 2021 Disposal within 3 years after acquisition 30% In the 4th year after acquisition 20% In the 5 year after acquisition 15% After the 5th year 5% WITHOLDING TAX RATES: Contract Interest Royalty Special classes of income Public entertainers Commission / Introduction fee 10% + 3% 15% 10% 10% 15% 10% AGRICULTURE ALLOWANCE RATES Clearing and preparation of land New planting Construction on a farm of a road or bridge 50% 50% 50% Construction on a farm of a building: Used for business - Used for welfare of the employees 10% 20% FOREST ALLOWANCE RATES Road or building used for timber extraction Building provided for employees' 10% 20%