Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Taxation - Question 1 & 2 Question 2 (15 marks) Tilly (41), a South African resident, was seconded to Radio Cool in India, where she

Taxation - Question 1 & 2

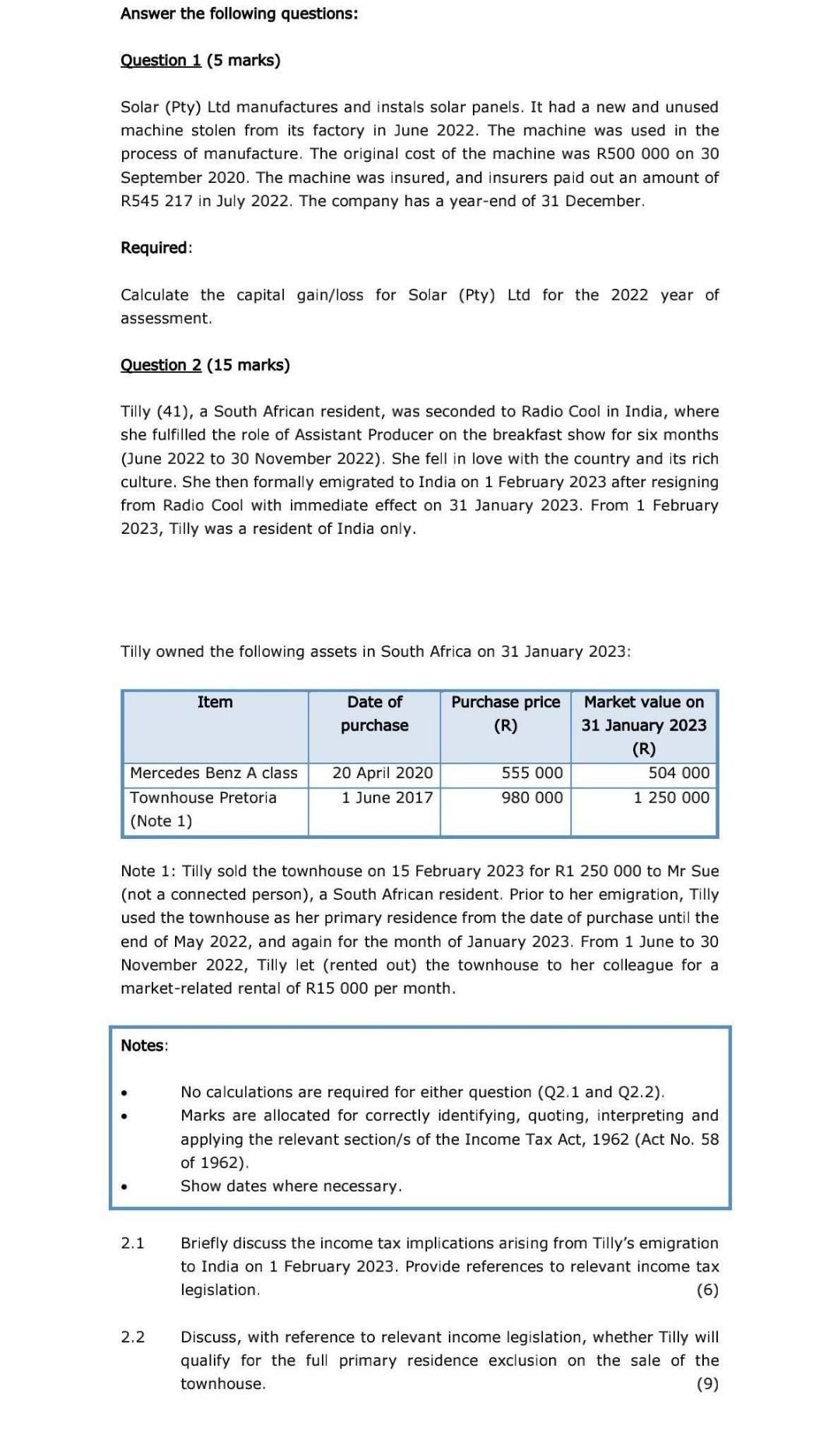

Question 2 (15 marks) Tilly (41), a South African resident, was seconded to Radio Cool in India, where she fulfilled the role of Assistant Producer on the breakfast show for six months (June 2022 to 30 November 2022). She fell in love with the country and its rich culture. She then formally emigrated to India on 1 February 2023 after resigning from Radio Cool with immediate effect on 31 January 2023. From 1 February 2023, Tilly was a resident of India only. Tilly owned the following assets in South Africa on 31 January 2023: Note 1: Tilly sold the townhouse on 15 February 2023 for R1 250000 to Mr Sue (not a connected person), a South African resident. Prior to her emigration, Tilly used the townhouse as her primary residence from the date of purchase until the end of May 2022, and again for the month of January 2023. From 1 June to 30 November 2022, Tilly let (rented out) the townhouse to her colleague for a market-related rental of R15 000 per month. Notes: - \\( \\quad \\) No calculations are required for either question (Q2.1 and Q2.2). - Marks are allocated for correctly identifying, quoting, interpreting and applying the relevant section/s of the Income Tax Act, 1962 (Act No. 58 of 1962). Show dates where necessary. 2.1 Briefly discuss the income tax implications arising from Tilly's emigration to India on 1 February 2023. Provide references to relevant income tax legislation. (6) 2.2 Discuss, with reference to relevant income legislation, whether Tilly will qualify for the full primary residence exclusion on the sale of the townhouse. (9)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started