Taxation

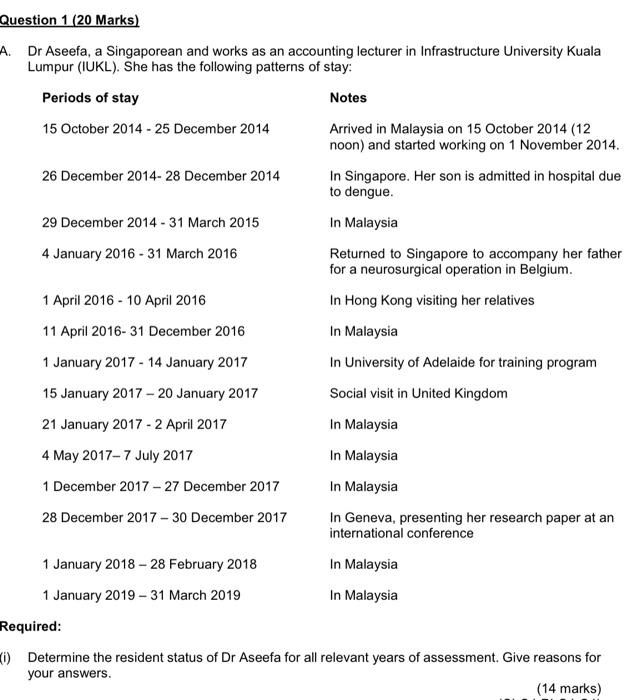

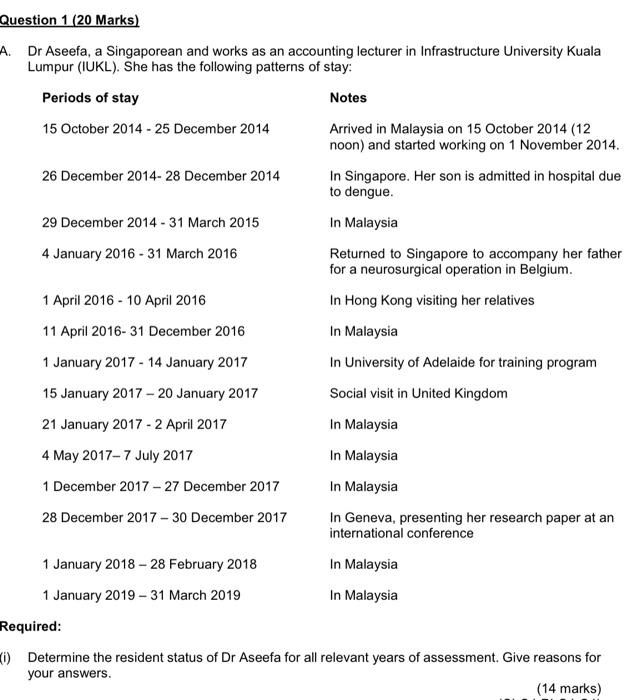

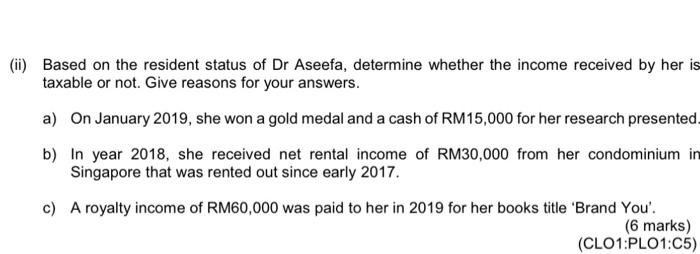

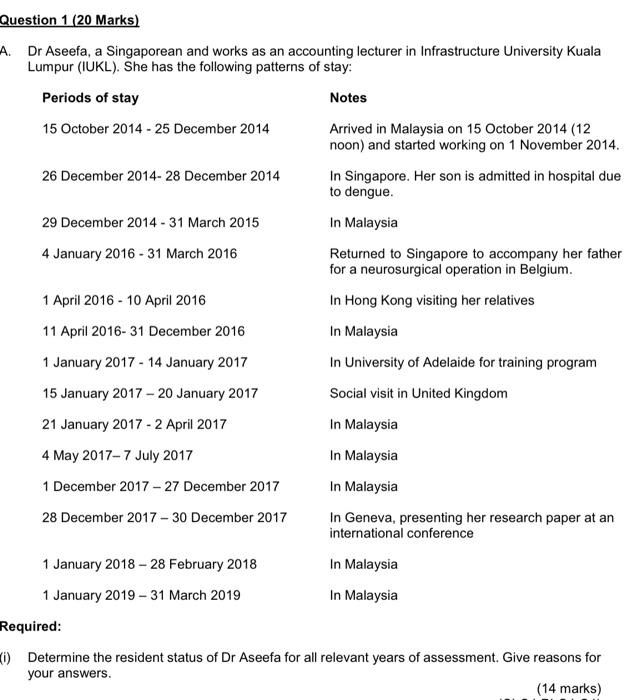

Question 1 (20 Marks) A. Dr Aseefa, a Singaporean and works as an accounting lecturer in Infrastructure University Kuala Lumpur (IUKL). She has the following patterns of stay: Periods of stay Notes 15 October 2014 - 25 December 2014 Arrived in Malaysia on 15 October 2014 (12 noon) and started working on 1 November 2014. 26 December 2014- 28 December 2014 In Singapore. Her son is admitted in hospital due to dengue. 29 December 2014 - 31 March 2015 In Malaysia 4 January 2016 - 31 March 2016 Returned to Singapore to accompany her father for a neurosurgical operation in Belgium. 1 April 2016 - 10 April 2016 In Hong Kong visiting her relatives 11 April 2016- 31 December 2016 In Malaysia 1 January 2017 - 14 January 2017 In University of Adelaide for training program 15 January 2017 - 20 January 2017 Social visit in United Kingdom 21 January 2017 - 2 April 2017 In Malaysia 4 May 2017- 7 July 2017 In Malaysia 1 December 2017 - 27 December 2017 In Malaysia 28 December 2017 - 30 December 2017 In Geneva, presenting her research paper at an international conference 1 January 2018 - 28 February 2018 In Malaysia 1 January 2019 - 31 March 2019 In Malaysia Required: 0) Determine the resident status of Dr Aseefa for all relevant years of assessment. Give reasons for your answers. (14 marks) (ii) Based on the resident status of Dr Aseefa, determine whether the income received by her is taxable or not. Give reasons for your answers. a) On January 2019, she won a gold medal and a cash of RM15,000 for her research presented. b) In year 2018, she received net rental income of RM30,000 from her condominium in Singapore that was rented out since early 2017. c) A royalty income of RM60,000 was paid to her in 2019 for her books title 'Brand You'. (6 marks) (CLO1:PLO1:C5) Question 1 (20 Marks) A. Dr Aseefa, a Singaporean and works as an accounting lecturer in Infrastructure University Kuala Lumpur (IUKL). She has the following patterns of stay: Periods of stay Notes 15 October 2014 - 25 December 2014 Arrived in Malaysia on 15 October 2014 (12 noon) and started working on 1 November 2014. 26 December 2014- 28 December 2014 In Singapore. Her son is admitted in hospital due to dengue. 29 December 2014 - 31 March 2015 In Malaysia 4 January 2016 - 31 March 2016 Returned to Singapore to accompany her father for a neurosurgical operation in Belgium. 1 April 2016 - 10 April 2016 In Hong Kong visiting her relatives 11 April 2016- 31 December 2016 In Malaysia 1 January 2017 - 14 January 2017 In University of Adelaide for training program 15 January 2017 - 20 January 2017 Social visit in United Kingdom 21 January 2017 - 2 April 2017 In Malaysia 4 May 2017- 7 July 2017 In Malaysia 1 December 2017 - 27 December 2017 In Malaysia 28 December 2017 - 30 December 2017 In Geneva, presenting her research paper at an international conference 1 January 2018 - 28 February 2018 In Malaysia 1 January 2019 - 31 March 2019 In Malaysia Required: 0) Determine the resident status of Dr Aseefa for all relevant years of assessment. Give reasons for your answers. (14 marks) (ii) Based on the resident status of Dr Aseefa, determine whether the income received by her is taxable or not. Give reasons for your answers. a) On January 2019, she won a gold medal and a cash of RM15,000 for her research presented. b) In year 2018, she received net rental income of RM30,000 from her condominium in Singapore that was rented out since early 2017. c) A royalty income of RM60,000 was paid to her in 2019 for her books title 'Brand You'. (6 marks) (CLO1:PLO1:C5)