Answered step by step

Verified Expert Solution

Question

1 Approved Answer

taxation question is as presented, there is no other info provided in textbook. AP 10-4 (RRSPs and Tax Planning) After being married for eight years,

taxation

question is as presented, there is no other info provided in textbook.

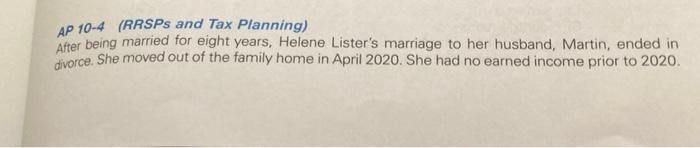

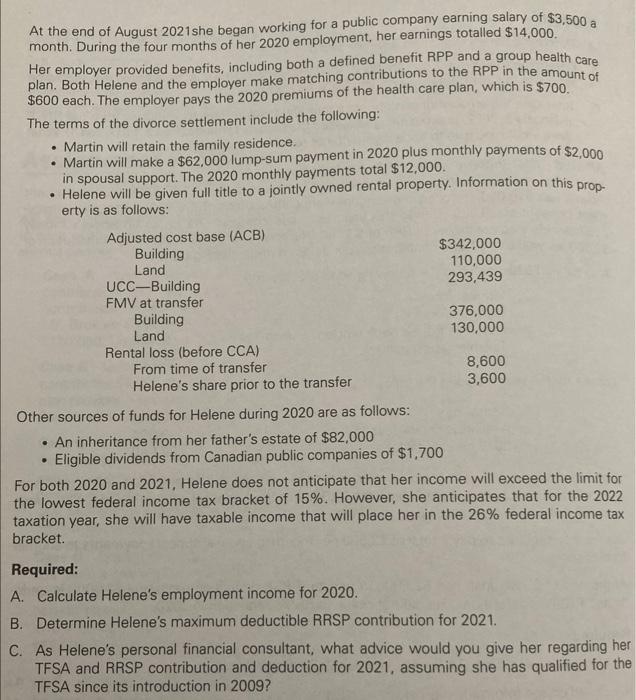

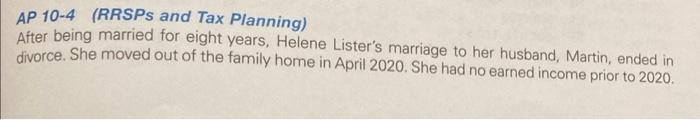

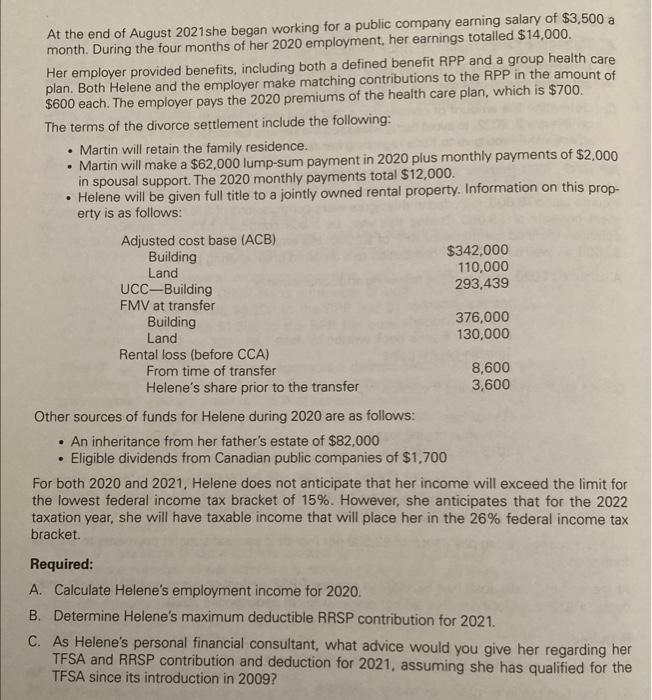

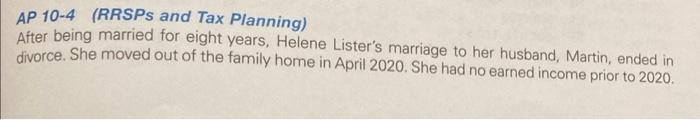

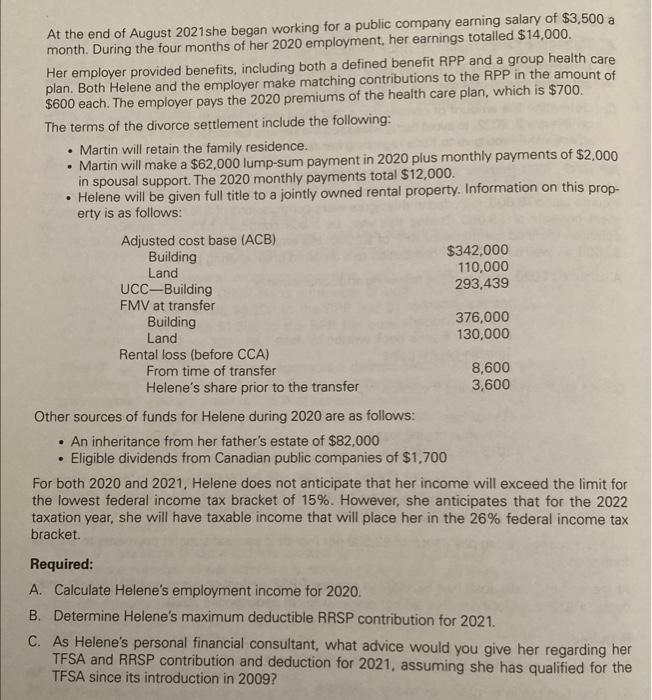

AP 10-4 (RRSPs and Tax Planning) After being married for eight years, Helene Lister's marriage to her husband, Martin, ended in divorce. She moved out of the family home in April 2020. She had no earned income prior to 2020. At the end of August 2021 she began working for a public company earning salary of $3,500 a month. During the four months of her 2020 employment, her earnings totalled $14,000. Her employer provided benefits, including both a defined benefit RPP and a group health care plan. Both Helene and the employer make matching contributions to the RPP in the amount of $600 each. The employer pays the 2020 premiums of the health care plan, which is $700. The terms of the divorce settlement include the following: - Martin will retain the family residence. - Martin will make a $62,000 lump-sum payment in 2020 plus monthly payments of $2,000 in spousal support. The 2020 monthly payments total $12,000. - Helene will be given full title to a jointly owned rental property. Information on this property is as follows: Other sources of funds for Helene during 2020 are as follows: - An inheritance from her father's estate of $82,000 - Eligible dividends from Canadian public companies of $1,700 For both 2020 and 2021. Helene does not anticipate that her income will exceed the limit for the lowest federal income tax bracket of 15%. However, she anticipates that for the 2022 taxation year, she will have taxable income that will place her in the 26% federal income tax bracket. Required: A. Calculate Helene's employment income for 2020. B. Determine Helene's maximum deductible RRSP contribution for 2021. C. As Helene's personal financial consultant, what advice would you give her regarding he TFSA and RRSP contribution and deduction for 2021, assuming she has qualified for the TFSA since its introduction in 2009? AP 10-4 (RRSPs and Tax Planning) After being married for eight years, Helene Lister's marriage to her husband, Martin, ended in divorce. She moved out of the family home in April 2020. She had no earned income prior to 2020. At the end of August 2021 she began working for a public company earning salary of $3,500 a month. During the four months of her 2020 employment, her earnings totalled $14,000. Her employer provided benefits, including both a defined benefit RPP and a group health care plan. Both Helene and the employer make matching contributions to the RPP in the amount of $600 each. The employer pays the 2020 premiums of the health care plan, which is $700. The terms of the divorce settlement include the following: - Martin will retain the family residence. - Martin will make a $62,000 lump-sum payment in 2020 plus monthly payments of $2,000 in spousal support. The 2020 monthly payments total $12,000. - Helene will be given full title to a jointly owned rental property. Information on this property is as follows: Other sources of funds for Helene during 2020 are as follows: - An inheritance from her father's estate of $82,000 - Eligible dividends from Canadian public companies of $1,700 For both 2020 and 2021, Helene does not anticipate that her income will exceed the limit for the lowest federal income tax bracket of 15%. However, she anticipates that for the 2022 taxation year, she will have taxable income that will place her in the 26% federal income tax bracket. Required: A. Calculate Helene's employment income for 2020. B. Determine Helene's maximum deductible RRSP contribution for 2021. C. As Helene's personal financial consultant, what advice would you give her regarding her TFSA and RRSP contribution and deduction for 2021, assuming she has qualified for the TFSA since its introduction in 2009 ? AP 10-4 (RRSPs and Tax Planning) After being married for eight years, Helene Lister's marriage to her husband, Martin, ended in divorce. She moved out of the family home in April 2020. She had no earned income prior to 2020. At the end of August 2021 she began working for a public company earning salary of $3,500 a month. During the four months of her 2020 employment, her earnings totalled $14,000. Her employer provided benefits, including both a defined benefit RPP and a group health care plan. Both Helene and the employer make matching contributions to the RPP in the amount of $600 each. The employer pays the 2020 premiums of the health care plan, which is $700. The terms of the divorce settlement include the following: - Martin will retain the family residence. - Martin will make a $62,000 lump-sum payment in 2020 plus monthly payments of $2,000 in spousal support. The 2020 monthly payments total $12,000. - Helene will be given full title to a jointly owned rental property. Information on this property is as follows: Other sources of funds for Helene during 2020 are as follows: - An inheritance from her father's estate of $82,000 - Eligible dividends from Canadian public companies of $1,700 For both 2020 and 2021. Helene does not anticipate that her income will exceed the limit for the lowest federal income tax bracket of 15%. However, she anticipates that for the 2022 taxation year, she will have taxable income that will place her in the 26% federal income tax bracket. Required: A. Calculate Helene's employment income for 2020. B. Determine Helene's maximum deductible RRSP contribution for 2021. C. As Helene's personal financial consultant, what advice would you give her regarding he TFSA and RRSP contribution and deduction for 2021, assuming she has qualified for the TFSA since its introduction in 2009? AP 10-4 (RRSPs and Tax Planning) After being married for eight years, Helene Lister's marriage to her husband, Martin, ended in divorce. She moved out of the family home in April 2020. She had no earned income prior to 2020. At the end of August 2021 she began working for a public company earning salary of $3,500 a month. During the four months of her 2020 employment, her earnings totalled $14,000. Her employer provided benefits, including both a defined benefit RPP and a group health care plan. Both Helene and the employer make matching contributions to the RPP in the amount of $600 each. The employer pays the 2020 premiums of the health care plan, which is $700. The terms of the divorce settlement include the following: - Martin will retain the family residence. - Martin will make a $62,000 lump-sum payment in 2020 plus monthly payments of $2,000 in spousal support. The 2020 monthly payments total $12,000. - Helene will be given full title to a jointly owned rental property. Information on this property is as follows: Other sources of funds for Helene during 2020 are as follows: - An inheritance from her father's estate of $82,000 - Eligible dividends from Canadian public companies of $1,700 For both 2020 and 2021, Helene does not anticipate that her income will exceed the limit for the lowest federal income tax bracket of 15%. However, she anticipates that for the 2022 taxation year, she will have taxable income that will place her in the 26% federal income tax bracket. Required: A. Calculate Helene's employment income for 2020. B. Determine Helene's maximum deductible RRSP contribution for 2021. C. As Helene's personal financial consultant, what advice would you give her regarding her TFSA and RRSP contribution and deduction for 2021, assuming she has qualified for the TFSA since its introduction in 2009

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started