Answered step by step

Verified Expert Solution

Question

1 Approved Answer

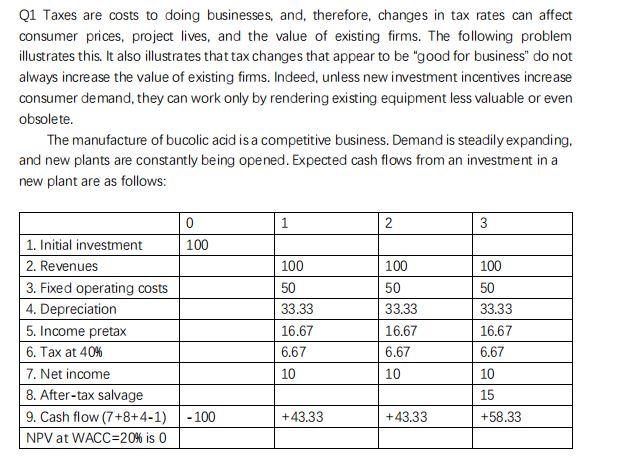

Taxes are costs to doing businesses, and, therefore, changes in tax rates can affect consumer prices, project lives, and the value of existing firms. The

Taxes are costs to doing businesses, and, therefore, changes in tax rates can affect

consumer prices, project lives, and the value of existing firms. The following problem

illustrates this. It also illustrates that tax changes that appear to be good for business do not

always increase the value of existing firms. Indeed, unless new investment incentives increase

consumer demand, they can work only by rendering existing equipment less valuable or even

obsolete.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started