Answered step by step

Verified Expert Solution

Question

1 Approved Answer

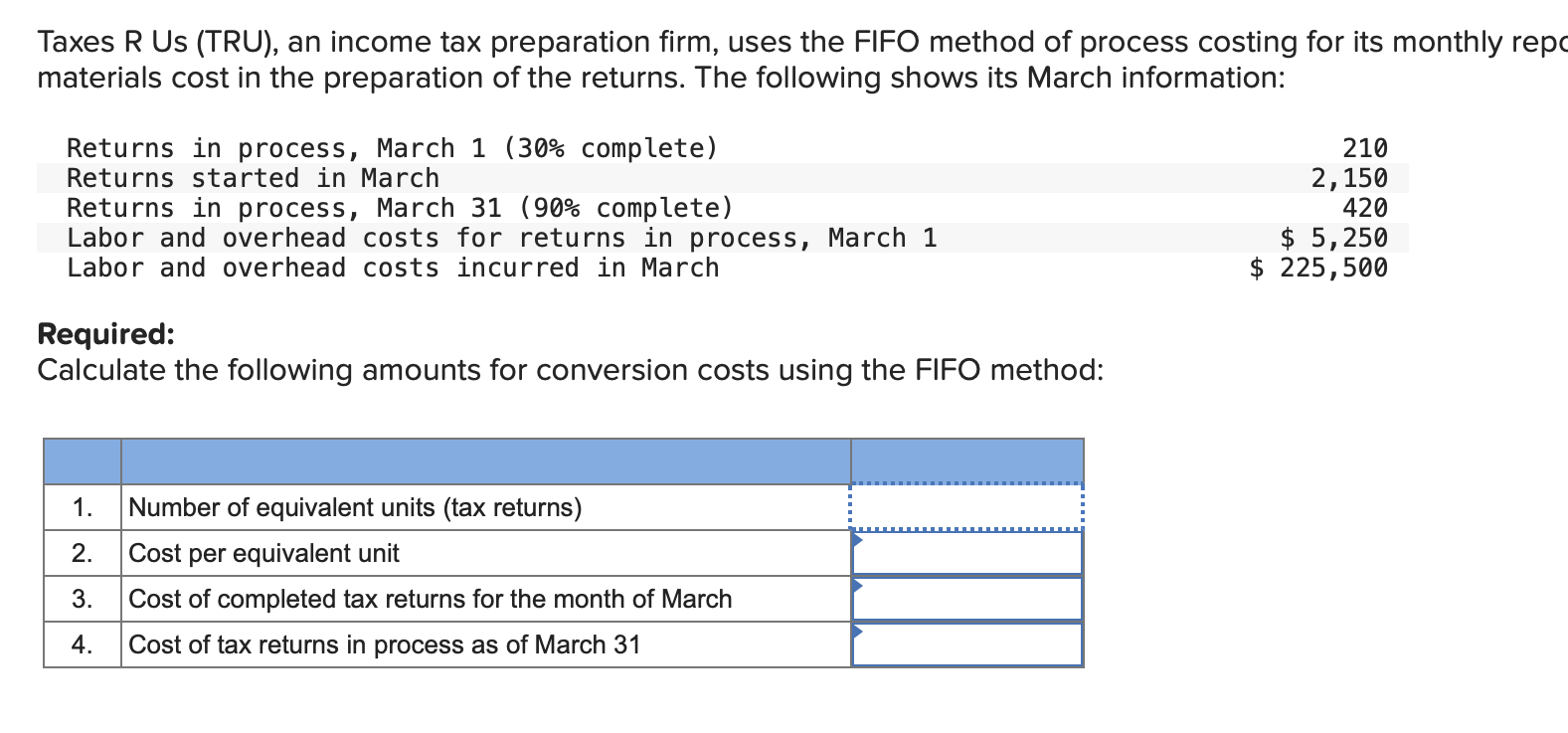

Taxes R Us (TRU), an income tax preparation firm, uses the FIFO method of process costing for its monthly repo materials cost in the

Taxes R Us (TRU), an income tax preparation firm, uses the FIFO method of process costing for its monthly repo materials cost in the preparation of the returns. The following shows its March information: Returns in process, March 1 (30% complete) Returns started in March Returns in process, March 31 (90% complete) Labor and overhead costs for returns in process, March 1 Labor and overhead costs incurred in March Required: Calculate the following amounts for conversion costs using the FIFO method: 1. Number of equivalent units (tax returns) 2. Cost per equivalent unit 3. Cost of completed tax returns for the month of March 4. Cost of tax returns in process as of March 31 210 2,150 420 $ 5,250 $ 225,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the required amounts for conversion costs using the FIFO method well follow these steps ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started