Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Taxpayer receives RSU stock benefits from employer. Here are the facts regarding the employee stock activity in 2 0 2 3 : On 1 /

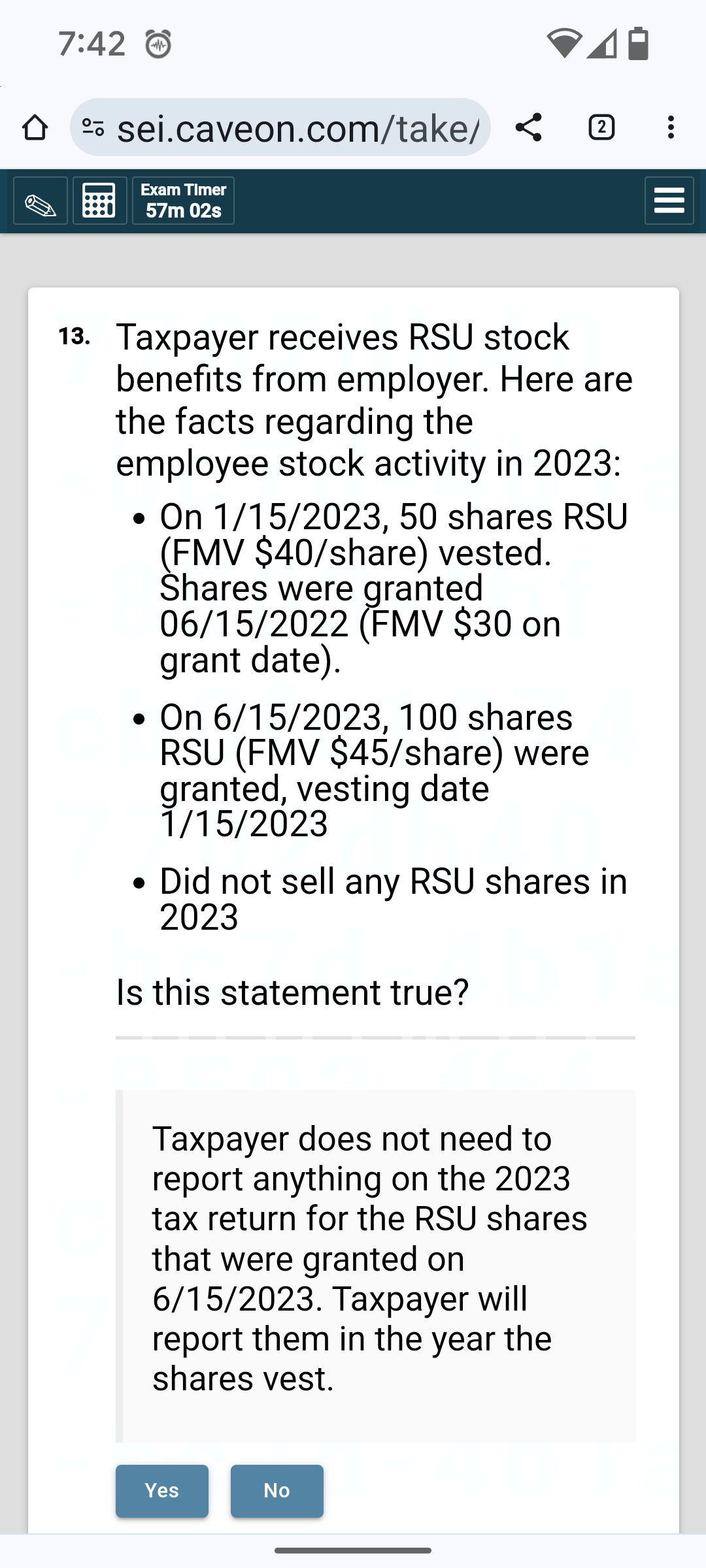

Taxpayer receives RSU stock

benefits from employer. Here are

the facts regarding the

employee stock activity in :

On shares RSU

FMV $share vested.

Shares were granted

FMV $ on

grant date

On shares

RSU FMV $share were

granted, vesting date

Did not sell any RSU shares in

Is this statement true?

Taxpayer does not need to

report anything on the

tax return for the RSU shares

that were granted on

Taxpayer will

report them in the year the

shares vest.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started