Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Taxpayer T earned a salary of $100,000 in 2021. In 2021 T also received $5,000 of interest income and $2,000 income from a passive

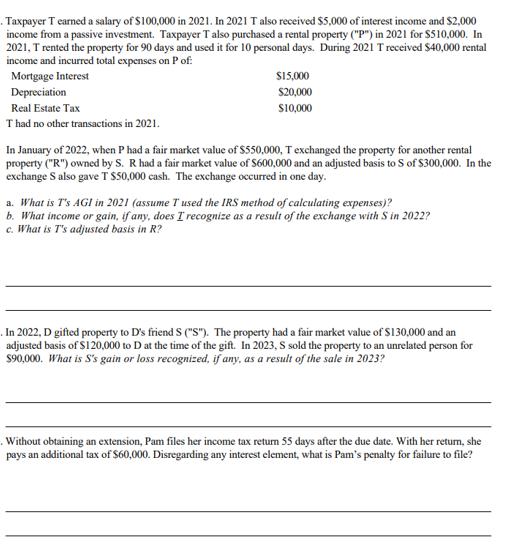

Taxpayer T earned a salary of $100,000 in 2021. In 2021 T also received $5,000 of interest income and $2,000 income from a passive investment. Taxpayer T also purchased a rental property ("P") in 2021 for $510,000. In 2021, T rented the property for 90 days and used it for 10 personal days. During 2021 T received $40,000 rental income and incurred total expenses on P of: Mortgage Interest Depreciation Real Estate Tax T had no other transactions in 2021. $15,000 $20,000 $10,000 In January of 2022, when P had a fair market value of $550,000, T exchanged the property for another rental property ("R") owned by S. R had a fair market value of $600,000 and an adjusted basis to S of $300,000. In the exchange S also gave T $50,000 cash. The exchange occurred in one day. a. What is I's AGI in 2021 (assume T used the IRS method of calculating expenses)? b. What income or gain, if any, does I recognize as a result of the exchange with S in 20227 c. What is I's adjusted basis in R? In 2022, D gifted property to D's friend S ("S"). The property had a fair market value of $130,000 and an adjusted basis of $120,000 to D at the time of the gift. In 2023, S sold the property to an unrelated person for $90,000. What is S's gain or loss recognized, if any, as a result of the sale in 2023? Without obtaining an extension, Pam files her income tax return 55 days after the due date. With her return, she pays an additional tax of $60,000. Disregarding any interest element, what is Pam's penalty for failure to file?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Taxpayer Ts Situation a AGI in 2021 Salary 100000 Interest income 5000 Passive investment income 200...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started