Answered step by step

Verified Expert Solution

Question

1 Approved Answer

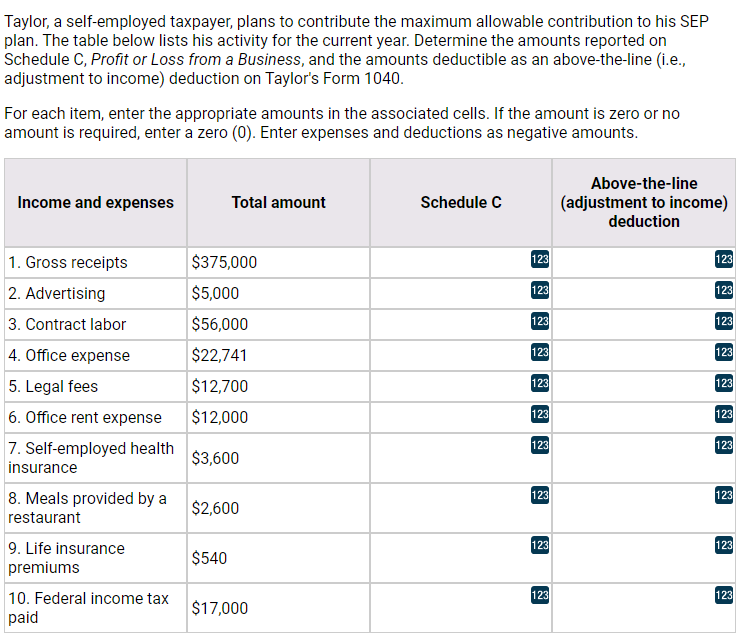

Taylor, a self-employed taxpayer, plans to contribute the maximum allowable contribution to his SEP plan. The table below lists his activity for the current

Taylor, a self-employed taxpayer, plans to contribute the maximum allowable contribution to his SEP plan. The table below lists his activity for the current year. Determine the amounts reported on Schedule C, Profit or Loss from a Business, and the amounts deductible as an above-the-line (i.e., adjustment to income) deduction on Taylor's Form 1040. For each item, enter the appropriate amounts in the associated cells. If the amount is zero or no amount is required, enter a zero (0). Enter expenses and deductions as negative amounts. Income and expenses Total amount Schedule C Above-the-line (adjustment to income) deduction 1. Gross receipts $375,000 123 123 2. Advertising $5,000 123 123 3. Contract labor $56,000 123 123 4. Office expense $22,741 123 123 5. Legal fees $12,700 123 123 6. Office rent expense $12,000 123 123 7. Self-employed health 123 123 $3,600 insurance 8. Meals provided by a 123 123 $2,600 restaurant 123 123 9. Life insurance $540 premiums 10. Federal income tax 123 123 $17,000 paid

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started