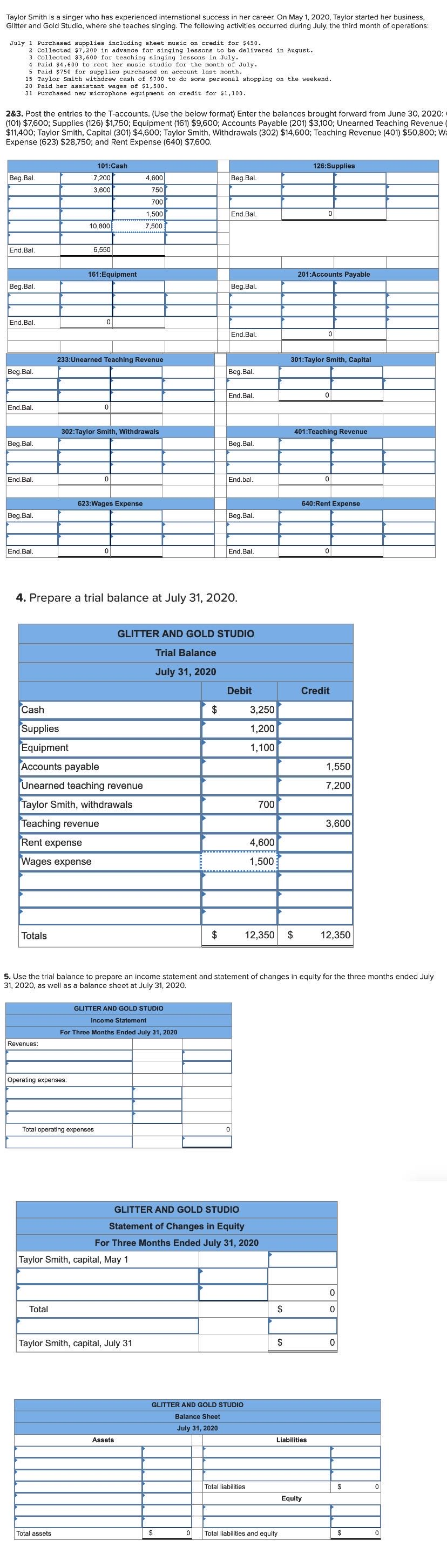

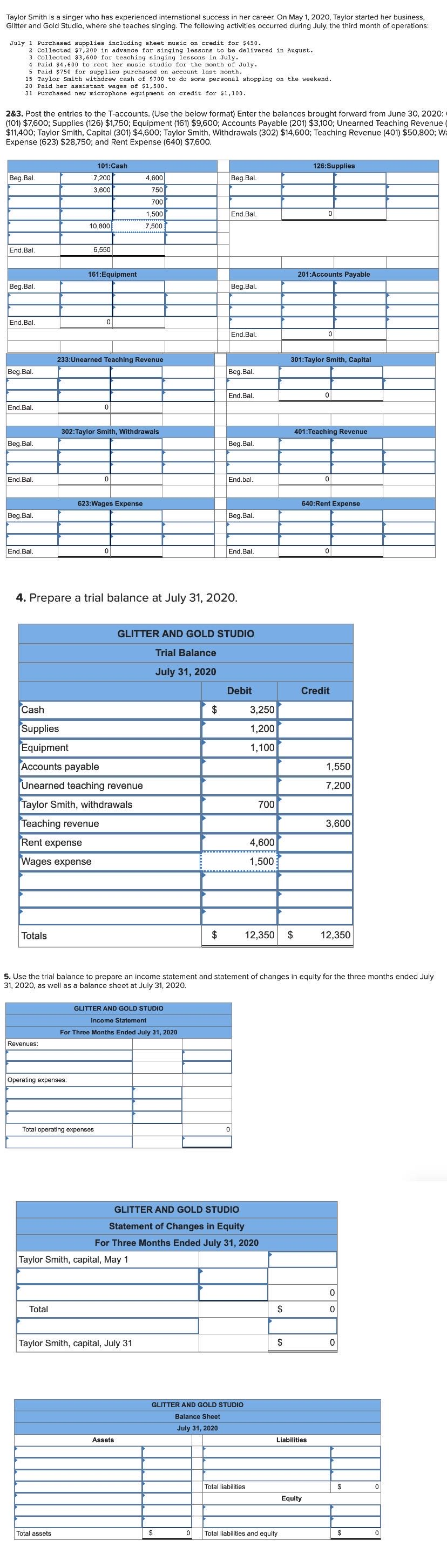

Taylor Smith is a singer who has experienced international success in her career. On May 1, 2020, Taylor started her business, Glitter and Gold Studio, where she teaches singing. The following activities occurred during July, the third month of operations: July 1 Purchased supplies including sheet music on credit for $450. 2 Collected $7,200 in advance for singing lessons to be delivered in August. 3 Collected $3,600 for teaching singing lessons in July. 4 Paid $4,600 to rent her music studio for the month of July. 5 Paid $750 for supplies purchased on account last month. 15 Taylor Smith withdrew cash of $700 to do some personal shopping on the weekend. 20 Paid her assistant wages of $1,500. 31 Purchased new microphone equipment on credit for $1,100. 2&3. Post the entries to the T-accounts. (Use the below format) Enter the balances brought forward from June 30, 2020: (101) $7,600; Supplies (126) $1,750; Equipment (161) $9,600; Accounts Payable (201) $3,100; Unearned Teaching Revenue $11,400; Taylor Smith, Capital (301) $4,600; Taylor Smith, Withdrawals (302) $14,600; Teaching Revenue (401) $50,800; W Expense (623) $28,750; and Rent Expense (640) $7,600. 101:Cash 126:Supplies Beg.Bal. 7,200 4,600 Beg.Bal. 3,600 750 700 1,500 7,500 End.Bal 01 10,800 End.Bal. 6,550 161:Equipment 201:Accounts Payable Beg.Bal. Beg.Bal. End.Bal 0 End.Bal. 0 233:Unearned Teaching Revenue 301:Taylor Smith, Capital Beg.Bal. Beg.Bal. End.Bal. 0 End.Bal. 0 302:Taylor Smith, Withdrawals 401:Teaching Revenue Beg.Bal. Beg.Bal. End.Bal. 0 End.bal. 0 623:Wages Expense 640:Rent Expense Beg.Bal. Beg.Bal. End.Bal. 0 End. Bal 0 4. Prepare a trial balance at July 31, 2020. GLITTER AND GOLD STUDIO Trial Balance July 31, 2020 Debit Credit Cash $ 3,250 1,200 1,100 1,550 Supplies Equipment Accounts payable Unearned teaching revenue Taylor Smith, withdrawals Teaching revenue 7,200 700 3,600 Rent expense 4,600 Wages expense 1,500 Totals $ 12,350 $ 12,350 5. Use the trial balance to prepare an income statement and statement of changes in equity for the three months ended July 31, 2020, as well as a balance sheet at July 31, 2020. GLITTER AND GOLD STUDIO Income Statement For Three Months Ended July 31, 2020 Revenues: Operating expenses: Total operating expenses 0 GLITTER AND GOLD STUDIO Statement of Changes in Equity For Three Months Ended July 31, 2020 Taylor Smith, capital, May 1 0 Total $ 0 Taylor Smith, capital, July 31 $ 0 GLITTER AND GOLD STUDIO Balance Sheet July 31, 2020 Assets Liabilities Total liabilities $ 0 Equity Total assets 0 Total liabilities and equity $ 0