Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fine Furnishings Canada Inc. (FFC) is a Canadian Controlled Private Corporation and manufacturer of luxury hand-crafted wooden furniture. The company operates out of Markham,

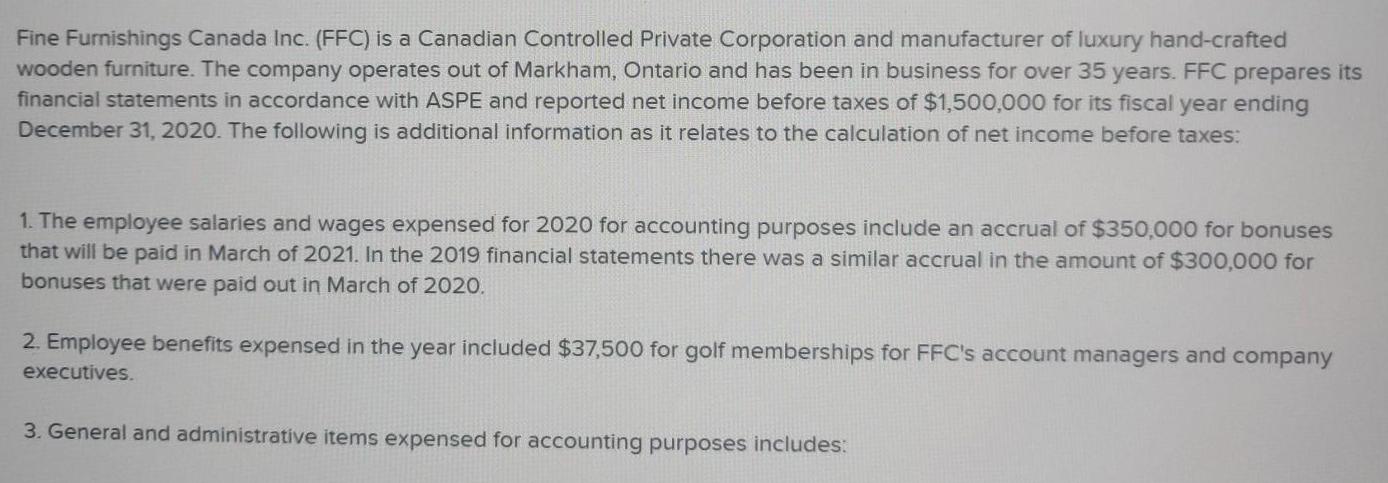

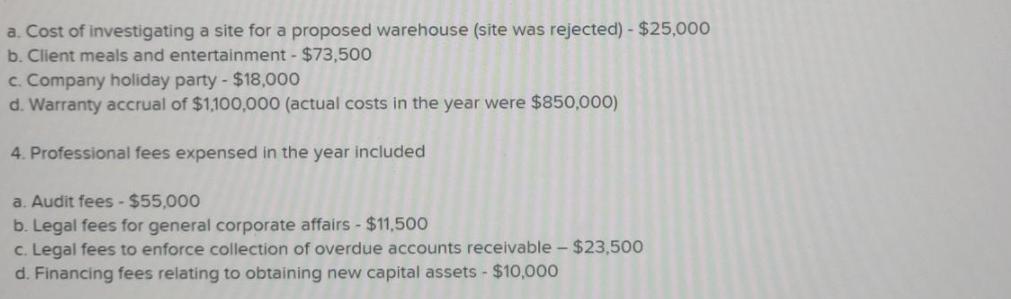

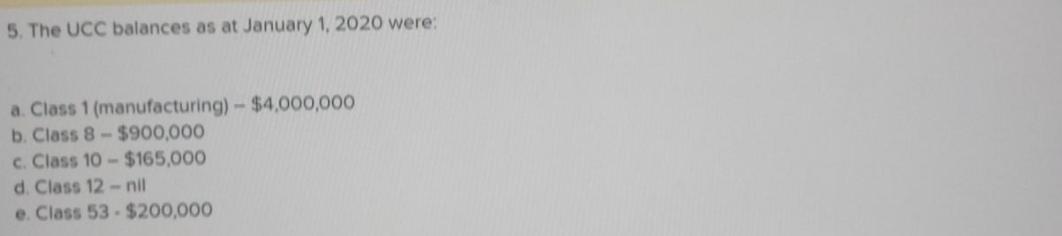

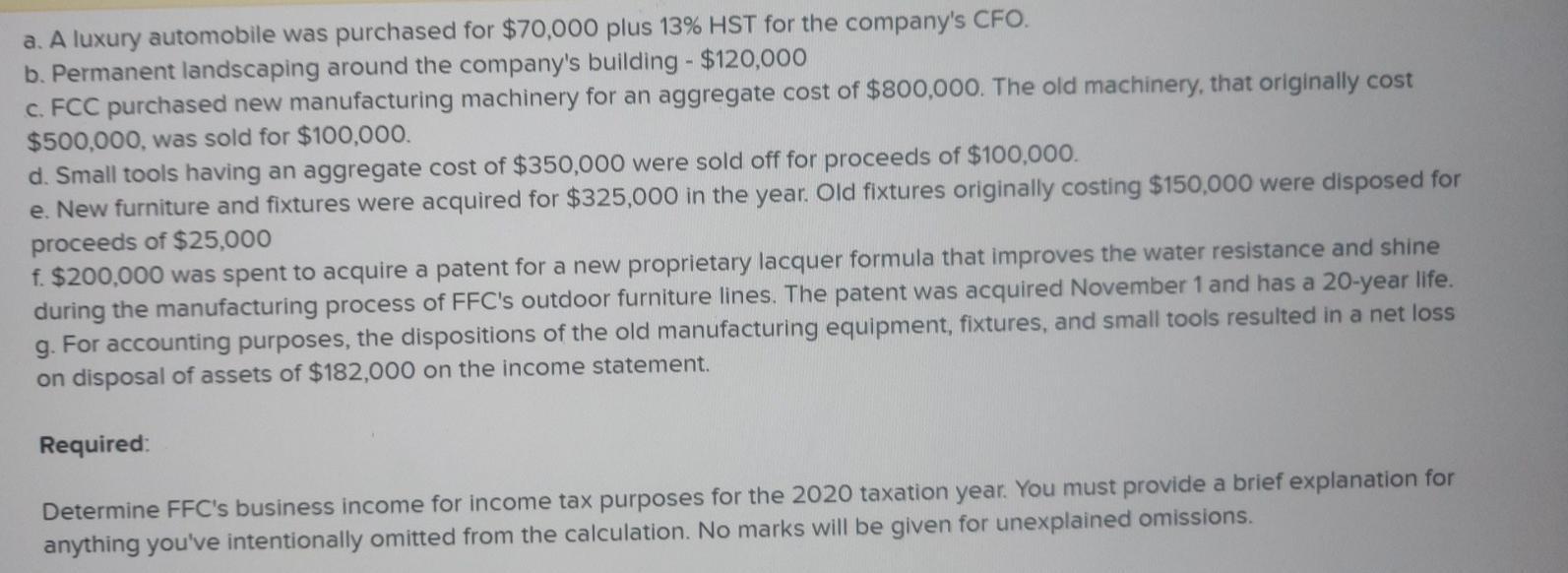

Fine Furnishings Canada Inc. (FFC) is a Canadian Controlled Private Corporation and manufacturer of luxury hand-crafted wooden furniture. The company operates out of Markham, Ontario and has been in business for over 35 years. FFC prepares its financial statements in accordance with ASPE and reported net income before taxes of $1,500,000 for its fiscal year ending December 31, 2020. The following is additional information as it relates to the calculation of net income before taxes: 1. The employee salaries and wages expensed for 2020 for accounting purposes include an accrual of $350,000 for bonuses that will be paid in March of 2021. In the 2019 financial statements there was a similar accrual in the amount of $300,000 for bonuses that were paid out in March of 2020. 2. Employee benefits expensed in the year included $37,500 for golf memberships for FFC's account managers and company executives. 3. General and administrative items expensed for accounting purposes includes: a. Cost of investigating a site for a proposed warehouse (site was rejected) - $25,000 b. Client meals and entertainment - $73,500 c. Company holiday party - $18,000 d. Warranty accrual of $1.100,000 (actual costs in the year were $850,000) 4. Professional fees expensed in the year included a. Audit fees - $55,000 b. Legal fees for general corporate affairs - $11,500 c. Legal fees to enforce collection of overdue accounts receivable - $23,500 d. Financing fees relating to obtaining new capital assets $10,000 5. The UCC balances as at January 1, 2020 were: a. Class 1 (manufacturing)-$4,000,000 b. Class 8-$900,000 c. Class 10- $165,000 d. Class 12- nil e. Class 53-$200,000 a. A luxury automobile was purchased for $70,000 plus 13% HST for the company's CFO. b. Permanent landscaping around the company's building - $120,000 c. FCC purchased new manufacturing machinery for an aggregate cost of $800,000. The old machinery, that originally cost $500,000, was sold for $100,000. d. Small tools having an aggregate cost of $350,000 were sold off for proceeds of $100,000. e. New furniture and fixtures were acquired for $325,000 in the year. Old fixtures originally costing $150,000 were disposed for proceeds of $25,000 f. $200,000 was spent to acquire a patent for a new proprietary lacquer formula that improves the water resistance and shine during the manufacturing process of FFC's outdoor furniture lines. The patent was acquired November 1 and has a 20-year life. g. For accounting purposes, the dispositions of the old manufacturing equipment, fixtures, and small tools resulted in a net loss on disposal of assets of $182,000 on the income statement. Required: Determine FFC's business income for income tax purposes for the 2020 taxation year. You must provide a brief explanation for anything you've intentionally omitted from the calculation. No marks will be given for unexplained omissions.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started