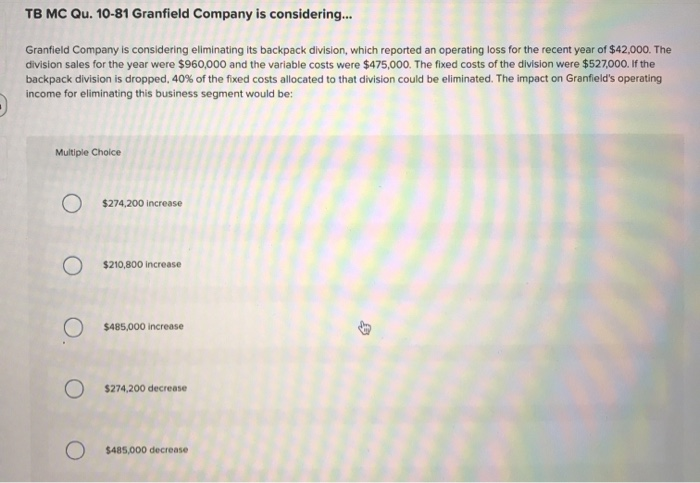

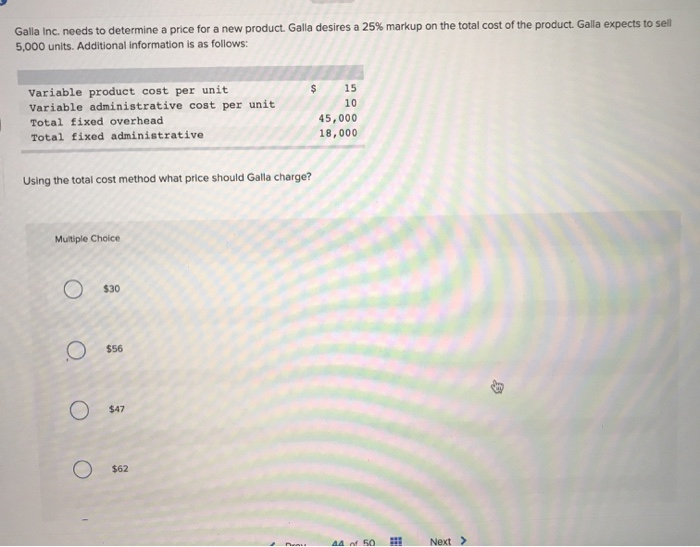

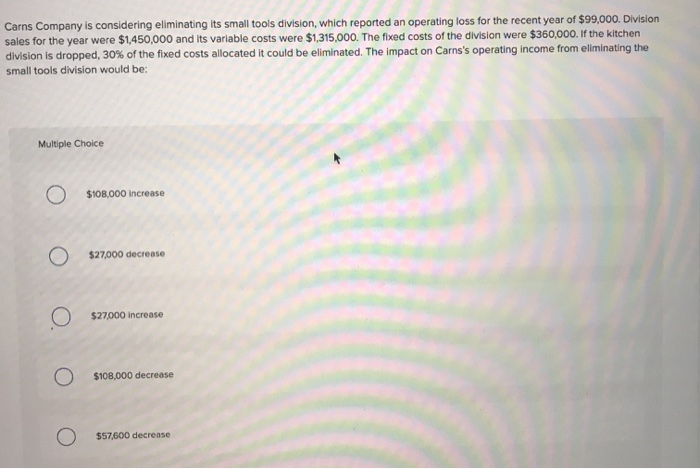

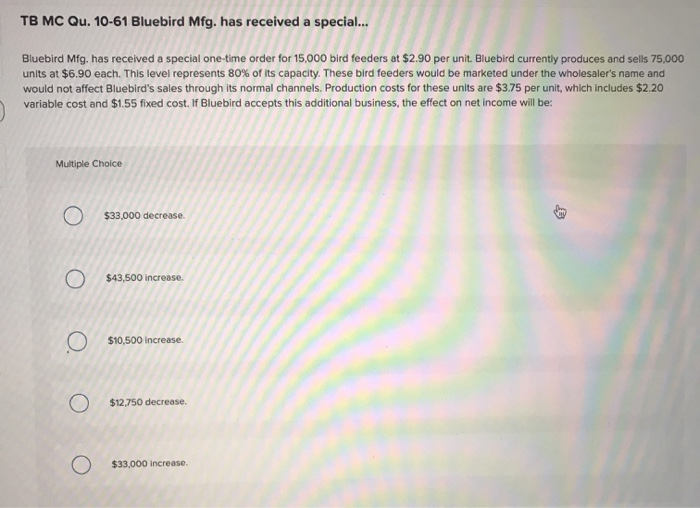

TB MC Qu. 10-81 Granfield Company is considering... Granfield Company is considering eliminating its backpack division, which reported an operating loss for the recent year of $42,000. The division sales for the year were $960,000 and the variable costs were $475,000. The fixed costs of the division were $527,000. If the backpack division is dropped, 40% of the fixed costs allocated to that division could be eliminated. The impact on Granfield's operating income for eliminating this business segment would be: Multiple Choice O $274,200 increase O $210,800 increase $485,000 increase O $274,200 decrease O $485,000 decrease Galla Inc. needs to determine a price for a new product. Galla desires a 25% markup on the total cost of the product. Galla expects to sell 5,000 units. Additional information is as follows: Variable product cost per unit Variable administrative cost per unit Total fixed overhead Total fixed administrative $ 15 10 45,000 18,000 Using the total cost method what price should Galla charge? Multiple Choice $30 $56 O. $47 $62 44 of 50 Next > Carns Company is considering eliminating its small tools division, which reported an operating loss for the recent year of $99,000. Division sales for the year were $1,450,000 and its variable costs were $1,315,000. The fixed costs of the division were $360,000. If the kitchen division is dropped, 30% of the fixed costs allocated it could be eliminated. The impact on Carns's operating income from eliminating the small tools division would be: Multiple Choice $108,000 Increase O $27,000 decrease O $27,000 increase O $108,000 decrease $57,600 decrease TB MC Qu. 10-61 Bluebird Mfg. has received a special... Bluebird Mfg. has received a special one-time order for 15,000 bird feeders at $2.90 per unit. Bluebird currently produces and sells 75,000 units at $6.90 each. This level represents 80% of its capacity. These bird feeders would be marketed under the wholesaler's name and would not affect Bluebird's sales through its normal channels. Production costs for these units are $3.75 per unit, which includes $2.20 variable cost and $1.55 fixed cost. If Bluebird accepts this additional business, the effect on net income will be: Multiple Choice $33.000 decrease. $43,500 increase $10.500 Increase $12,750 decrease O $33,000 increase