Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alaia Docherty is a single resident taxpayer who is employed as a tour guide by Ocean World. Alaia also holds investments including shares and

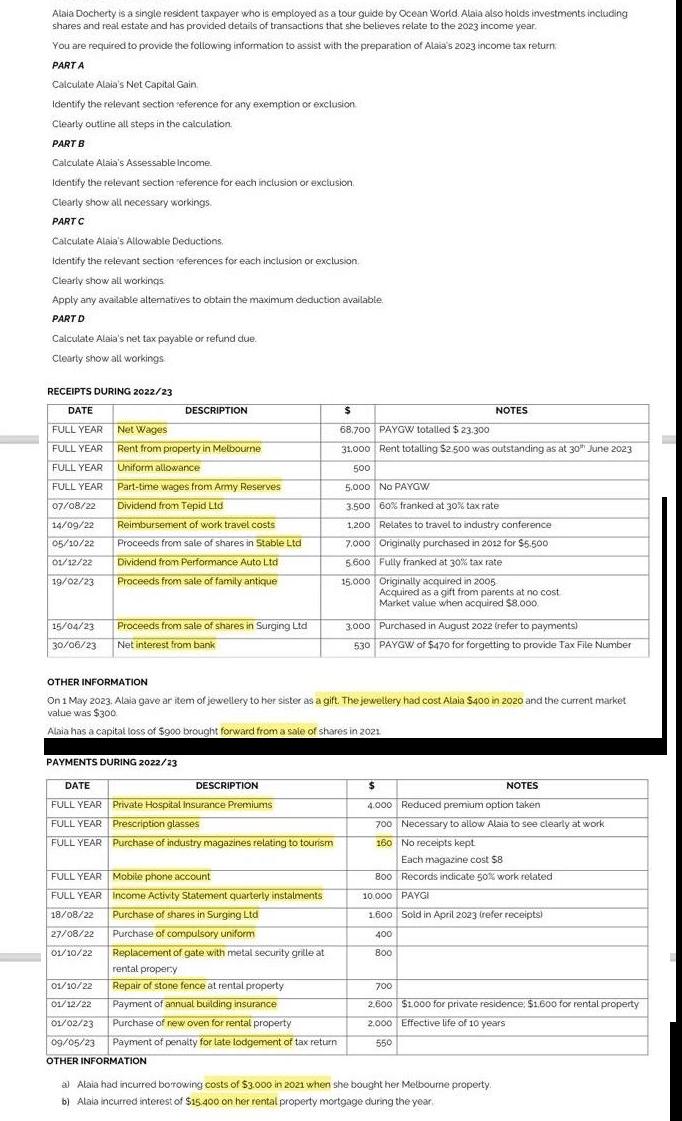

Alaia Docherty is a single resident taxpayer who is employed as a tour guide by Ocean World. Alaia also holds investments including shares and real estate and has provided details of transactions that she believes relate to the 2023 income year. You are required to provide the following information to assist with the preparation of Alaia's 2023 income tax return PART A Calculate Alaia's Net Capital Gain Identify the relevant section reference for any exemption or exclusion Clearly outline all steps in the calculation. PART B Calculate Alaia's Assessable income. Identify the relevant section reference for each inclusion or exclusion Clearly show all necessary workings. PART C Calculate Alaia's Allowable Deductions. Identify the relevant section references for each inclusion or exclusion. Clearly show all workings Apply any available alternatives to obtain the maximum deduction available PART D Calculate Alaia's net tax payable or refund due Clearly show all workings RECEIPTS DURING 2022/23 DATE DESCRIPTION $ NOTES FULL YEAR Net Wages FULL YEAR FULL YEAR FULL YEAR 07/08/22 14/09/22 05/10/22 01/12/22 Reimbursement of work travel costs Proceeds from sale of shares in Stable Ltd Dividend from Performance Auto Ltd Rent from property in Melbourne Uniform allowance Part-time wages from Army Reserves Dividend from Tepid Ltd 68.700 PAYGW totalled $ 23.300 31.000 Rent totalling $2.500 was outstanding as at 30th June 2023 500 5.000 No PAYGW 3.500 60% franked at 30% tax rate 1,200 Relates to travel to industry conference 7.000 Originally purchased in 2012 for $5.500 5.600 Fully franked at 30% tax rate 19/02/23 Proceeds from sale of family antique 15,000 Originally acquired in 2005 Acquired as a gift from parents at no cost Market value when acquired $8,000 15/04/23 30/06/23 Proceeds from sale of shares in Surging Ltd Net interest from bank OTHER INFORMATION On 1 May 2023. Alaia gave ar item of jewellery to her sister as a gift. The jewellery had cost Alaia $400 in 2020 and the current market value was $300 Alaia has a capital loss of $goo brought forward from a sale of shares in 2021 3,000 Purchased in August 2022 (refer to payments) 530 PAYGW of $470 for forgetting to provide Tax File Number PAYMENTS DURING 2022/23 DATE DESCRIPTION FULL YEAR Private Hospital Insurance Premiums FULL YEAR Prescription glasses FULL YEAR Purchase of industry magazines relating to tourism $ NOTES 4.000 Reduced premium option taken 700 Necessary to allow Alaia to see clearly at work 160 No receipts kept Each magazine cost $8 800 Records indicate 50% work related 10.000 PAYGI FULL YEAR Mobile phone account FULL YEAR Income Activity Statement quarterly instalments 18/08/22 Purchase of shares in Surging Ltd 1.600 Sold in April 2023 (refer receipts) 27/08/22 Purchase of compulsory uniform 400 01/10/22 Replacement of gate with metal security grille at 800 rental property 01/10/22 Repair of stone fence at rental property 01/12/22 Payment of annual building insurance 01/02/23 09/05/23 Purchase of new oven for rental property 700 2,600 $1,000 for private residence: $1,600 for rental property 2.000 Effective life of 10 years Payment of penalty for late lodgement of tax return 550 OTHER INFORMATION a) Alaia had incurred borrowing costs of $3.000 in 2021 when she bought her Melbourne property. b) Alaia incurred interest of $15.400 on her rental property mortgage during the year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

PART A Net Capital Gain Sales proceeds Stable Ltd shares 3500 Cost base Nil purchased after 21999 Ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started