Answered step by step

Verified Expert Solution

Question

1 Approved Answer

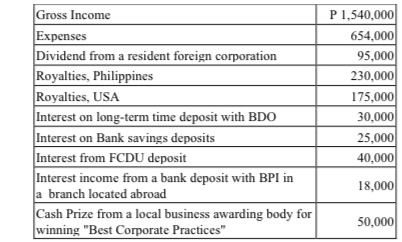

TDG Corp is a domestic corporation. They have the following income during the year. How much is the total final with holding tax due?

TDG Corp is a domestic corporation. They have the following income during the year. How much is the total final with holding tax due? a. 73,000 b. 57,000 c. 63,000 d. 67,000

Gross Income Expenses Dividend from a resident foreign corporation Royalties, Philippines Royalties, USA Interest on long-term time deposit with BDO Interest on Bank savings deposits Interest from FCDU deposit Interest income from a bank deposit with BPI in a branch located abroad Cash Prize from a local business awarding body for winning "Best Corporate Practices" P 1,540,000 654,000 95,000 230,000 175,000 30,000 25,000 40,000 18,000 50,000 Gross Income Expenses Dividend from a resident foreign corporation Royalties, Philippines Royalties, USA Interest on long-term time deposit with BDO Interest on Bank savings deposits Interest from FCDU deposit Interest income from a bank deposit with BPI in a branch located abroad Cash Prize from a local business awarding body for winning "Best Corporate Practices" P 1,540,000 654,000 95,000 230,000 175,000 30,000 25,000 40,000 18,000 50,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

TDG Corps Final Withholding Tax Calculation Heres a breakdown of TDG Corps final withholding tax lia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started