Answered step by step

Verified Expert Solution

Question

1 Approved Answer

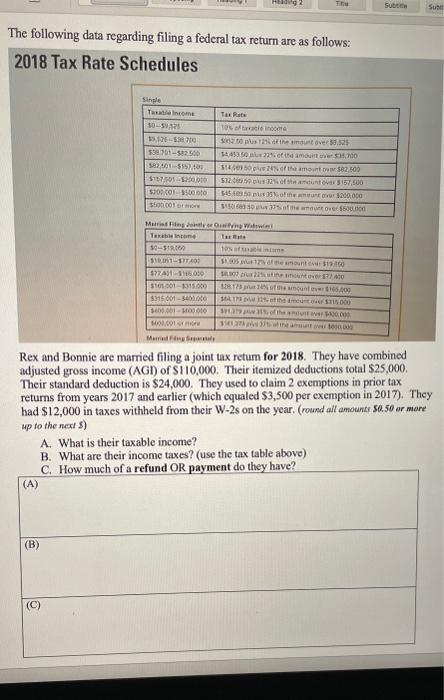

TE Sub Sub The following data regarding filing a federal tax return are as follows: 2018 Tax Rate Schedules 10% of taxable incoma Single

TE Sub Sub The following data regarding filing a federal tax return are as follows: 2018 Tax Rate Schedules 10% of taxable incoma Single Taxable Income Tax Rate 50-59525 $5,125-538700 $38701-$82.500 $82,501-$557,400 $157,501-$200,000 $200.001-$500.000 $500.001 or mo $12.50 plus 12% of the amount over $3.525 34453.50 a 22% of the amount over $35.700 314603 50 pive 24% of the amount over $82,500 $32.00 ou 32% of the amount over $157,500 $45400 50 plus 35% of the amirunt $200,000 $1506031037% of the amount over $600,000 Married Filing Jointly or Qualifying Walow Tax $0-$10,000 10% of $100-$77,400 tintame $77401-516000 $1.005 12% of the amount over $19.00 307 px 22% fine mount over $7400 $105.001-$315.000 828173 pat 24% of the amount $105,000 $315,001-$400.000 $400.001-000000 1000001 Married Filing Separately 1417 12% of the amount o$15000 SH379 31% of the amount a 0.000 354127 p 37% of the aunt me t000,000 Rex and Bonnie are married filing a joint tax retum for 2018. They have combined adjusted gross income (AGI) of $110,000. Their itemized deductions total $25,000. Their standard deduction is $24,000. They used to claim 2 exemptions in prior tax returns from years 2017 and earlier (which equaled $3,500 per exemption in 2017). They had $12,000 in taxes withheld from their W-2s on the year. (round all amounts $0.50 or more up to the next 5) (A) A. What is their taxable income? B. What are their income taxes? (use the tax table above) C. How much of a refund OR payment do they have? (B) (C)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started