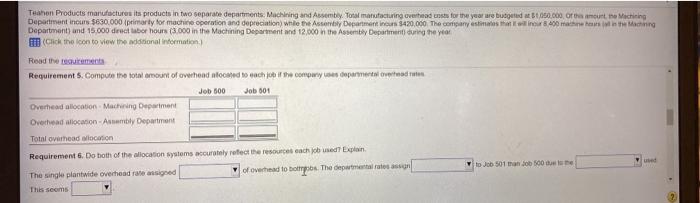

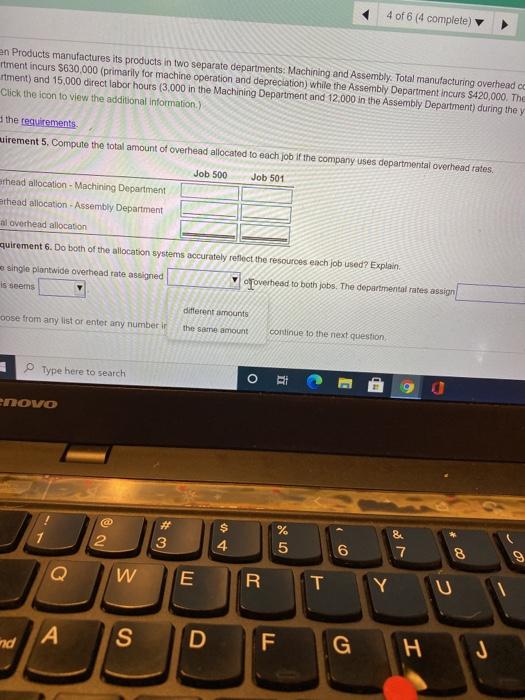

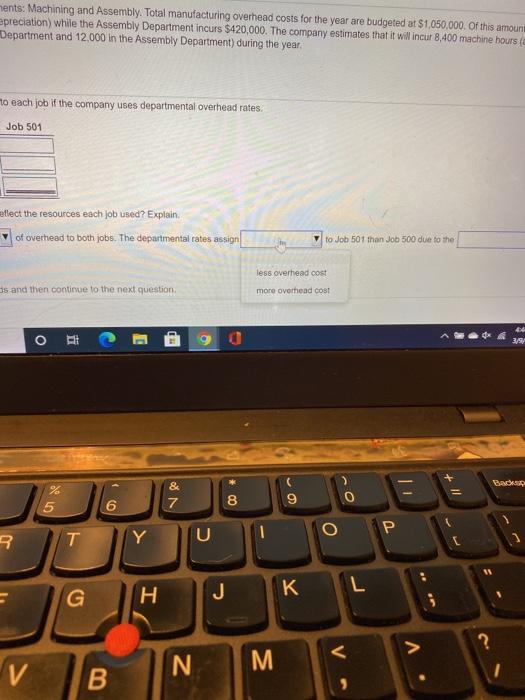

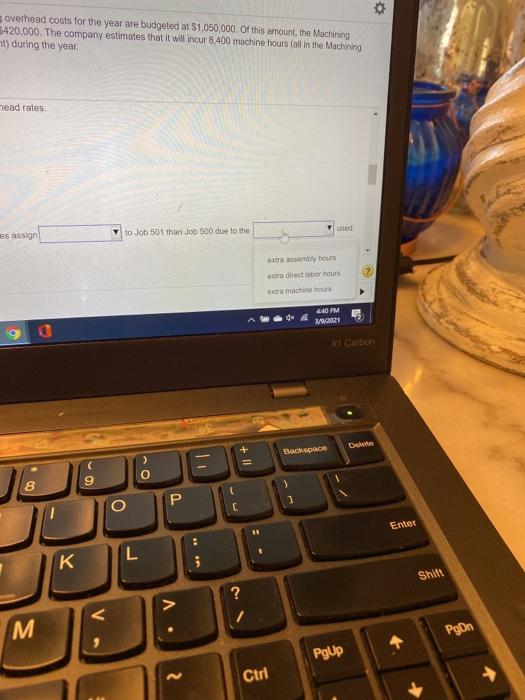

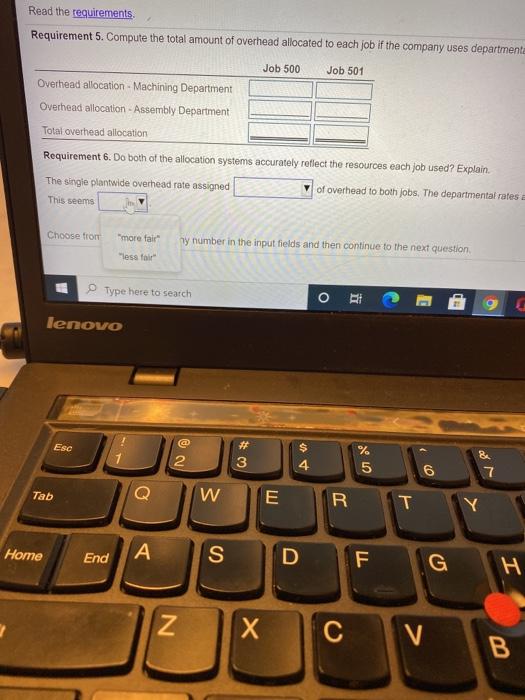

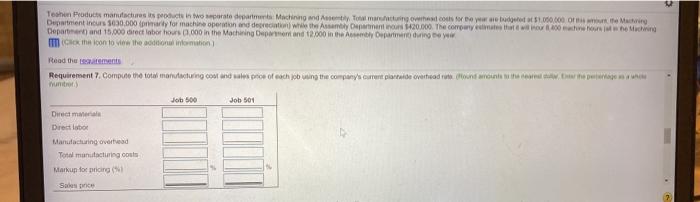

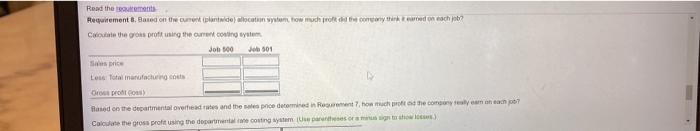

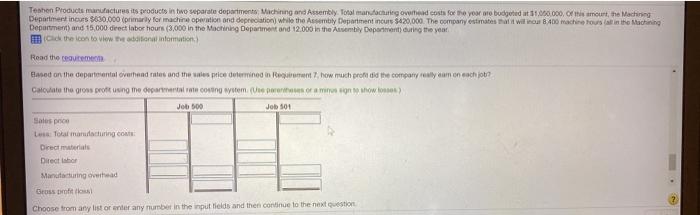

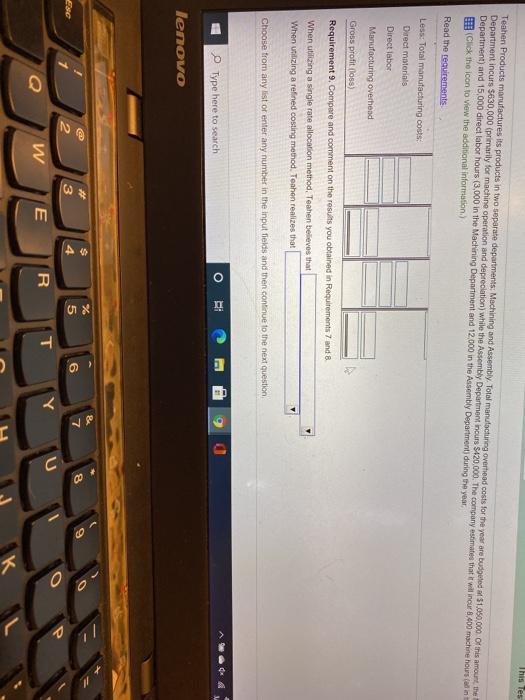

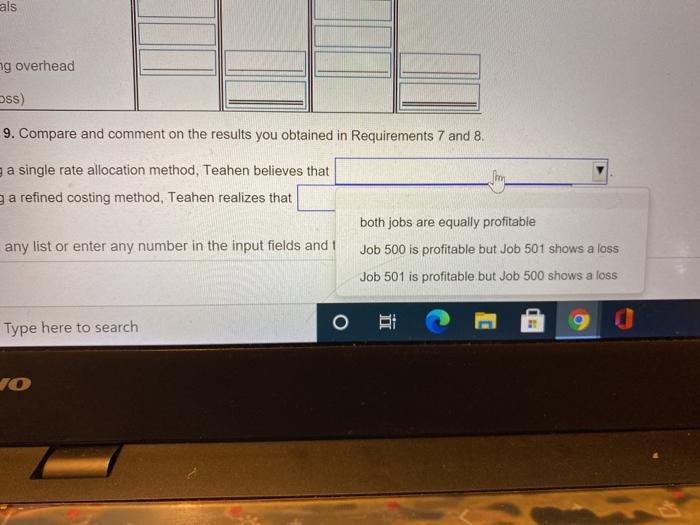

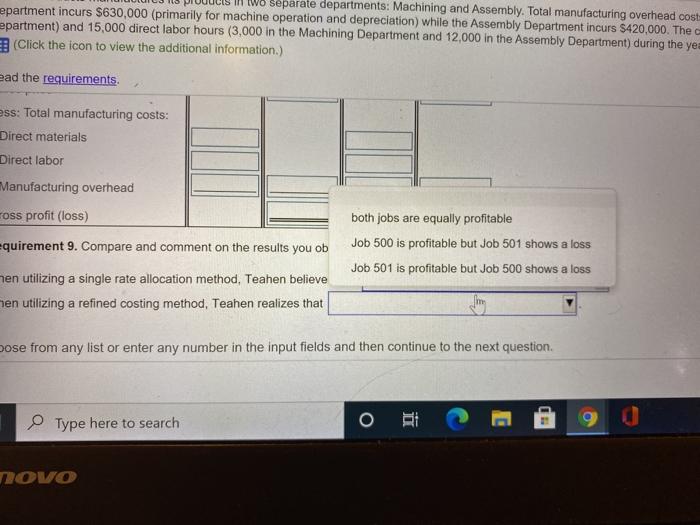

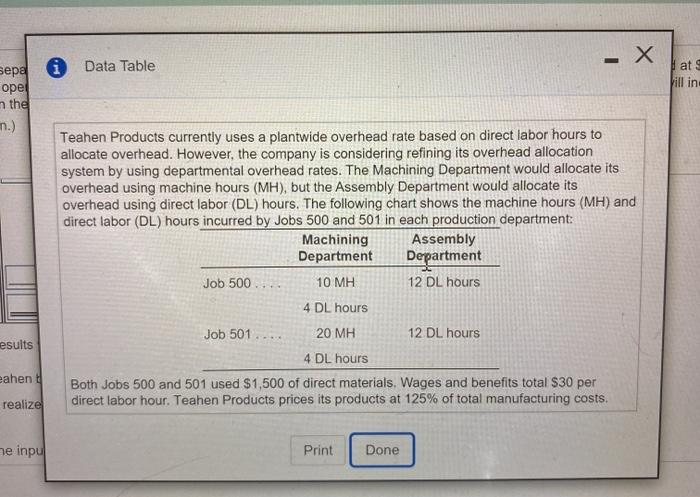

Teahon Products manufactures its products in two separate departments, Machining and Assembly Total manufacturing overhead sts for the year are budget 100.000 or mount the Machining Department inours $630.000 primary for machine operation and depreciation while the Assembly Department no 1420.000 The company estimate 600 mg Department) und 15.000 dead bor hours (3.000 in the Machining Department and 12,000 in the Assembly Department in the year IT (Click the icon to view the doctional information Read the requirements Requirements. Compute the total amount of overhead alocared to each of the compus department des Job 500 Job 501 Overhead allocation Machining Department Overhead allocation Army Department Total overhead Bicarion Requirements. Do both of the allocation systems accurately refect the resources cachoed? Explain ed to Job 501 than 100 de The single plantwide overhead rate assigned of overhead to tots. The departmental raton This scoms 4 of 6 (4 complete) en Products manufactures its products in two separate departments: Machining and Assembly. Total manufacturing overhead cc rtment incurs $630,000 (primarily for machine operation and depreciation) while the Assembly Department incurs $420,000. The rtment) and 15.000 direct labor hours (3.000 in the Machining Department and 12.000 in the Assembly Department) during they Click the icon to view the additional information) the requirements Riirement 5. Compune the total amount of overhead allocated to each job if the company uses departmental overhead tates. Job 500 Job 501 erhead allocation - Machining Department thead allocation - Assembly Department al overhead allocation quirement 6. Do both of the allocation systems accurately reflect the resources each job used? Explain single plantwide overhead rate assigned is seems Toverhead to both jobs. The departmental rates assign different amounts oose from any list or enter any number the same amount continue to the next question Type here to search o ENOVO @ 2 %2 # 3 $ 4 % 5 6 & 7 8 g W E JU T Y C A ind S D F G H J ments: Machining and Assembly. Total manufacturing overhead costs for the year are budgeted at $1,050,000. Of this amour epreciation) while the Assembly Department incurs $420,000. The company estimates that it will incur 8,400 machine hours ( Department and 12,000 in the Assembly Department) during the year to each job if the company uses departmental overhead rates Job 501 eflect the resources each job used? Explain of overhead to both jobs. The departmental rates assign V to Job 501 than Job 500 due to the less overhead cost more overhead cost as and then continue to the next question O E HD Bad % & 7 ogle Il 00 9 6 o U A T LY G J H L . ? N M B overhead costs for the year are budgeted at $1,050,000. Of this amount, the Machining 5420.000. The company estimates that it will incur 8.400 machine hours (all in the Machining ht) during the year head rates used as assign to Job 501 than Job 500 due to the extrembly hours tra direct labor hours er machine bours d 440 PM 3/2021 xi Cubon Dhe Backspace ( 9 O 8 o P ( C Enter ER L K Shift ?