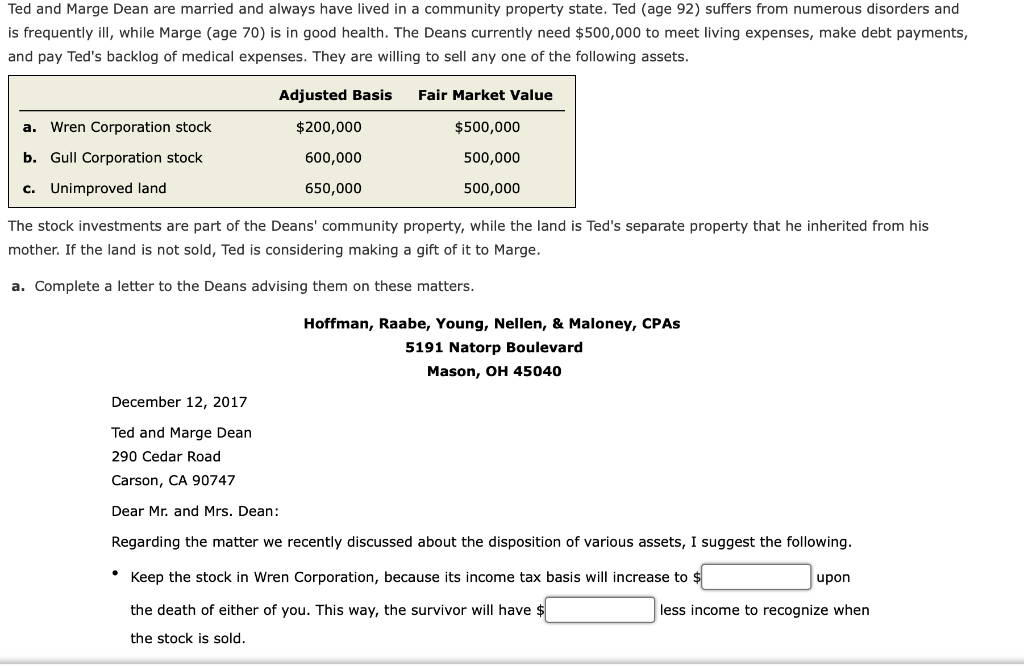

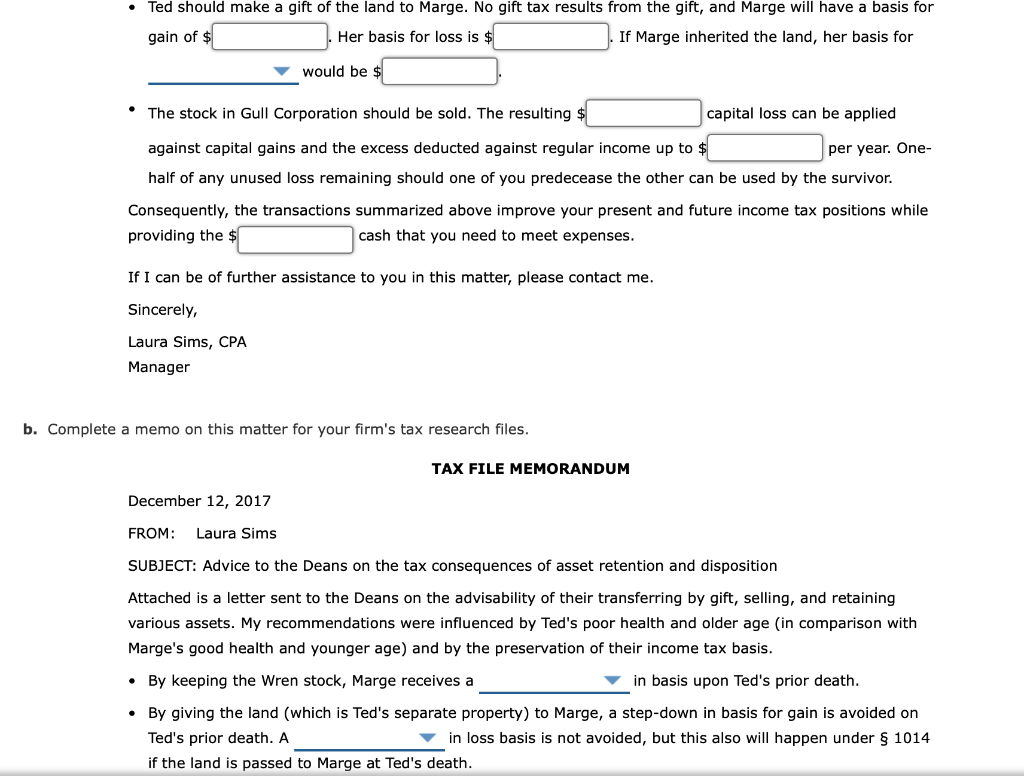

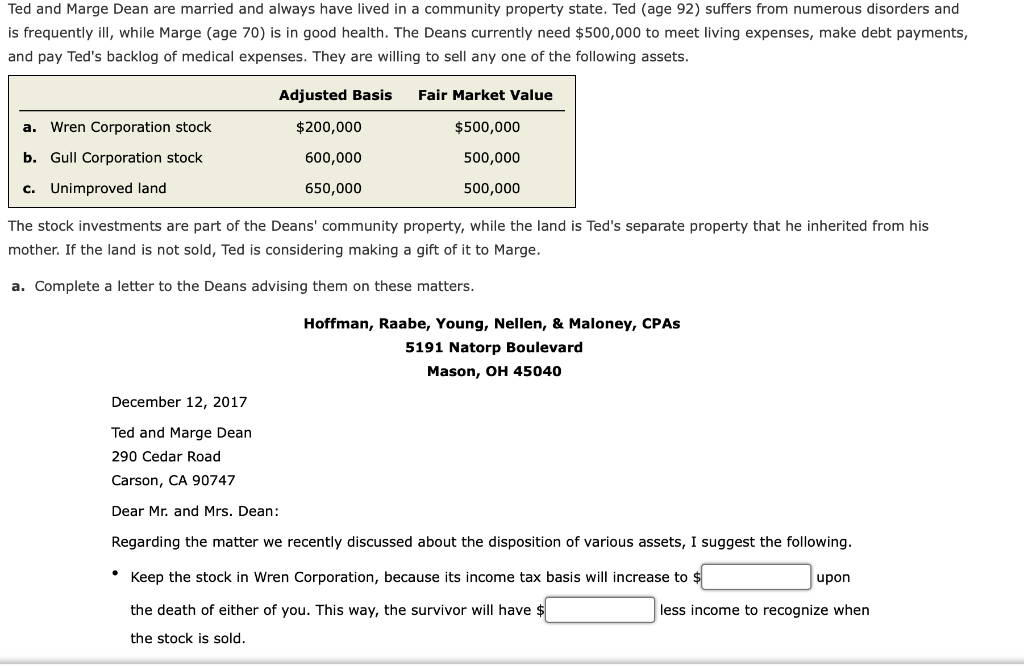

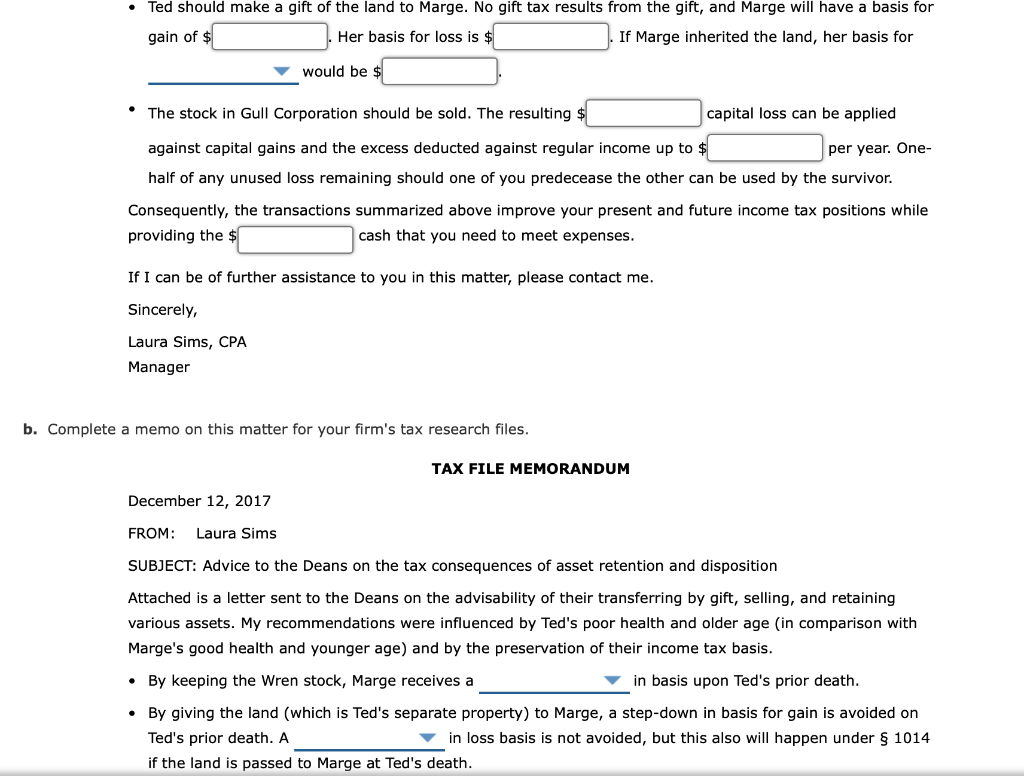

Ted and Marge Dean are married and always have lived in a community property state. Ted (age 92) suffers from numerous disorders and is frequently ill, while Marge (age 70) is in good health. The Deans currently need $500,000 to meet living expenses, make debt payments, and pay Ted's backlog of medical expenses. They are willing to sell any one of the following assets. Adjusted Basis Fair Market Value $200,000 $500,000 a. Wren Corporation stock b. Gull Corporation stock 600,000 500,000 c. Unimproved land 650,000 500,000 The stock investments are part of the Deans' community property, while the land is Ted's separate property that he inherited from his mother. If the land is not sold, Ted is considering making a gift of it to Marge. a. Complete a letter to the Deans advising them on these matters. Hoffman, Raabe, Young, Nellen, & Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 December 12, 2017 Ted and Marge Dean 290 Cedar Road Carson, CA 90747 Dear Mr. and Mrs. Dean: Regarding the matter we recently discussed about the disposition of various assets, I suggest the following. Keep the stock in Wren Corporation, because its income tax basis will increase to $ upon less income to recognize when the death of either of you. This way, the survivor will have $ the stock is sold. Ted should make a gift of the land to Marge. No gift tax results from the gift, and Marge will have a basis for gain of $ Her basis for loss is $ If Marge inherited the land, her basis for would be $ The stock in Gull Corporation should be sold. The resulting capital loss can be applied against capital gains and the excess deducted against regular income up to $ per year. One- half of any unused loss remaining should one of you predecease the other can be used by the survivor. Consequently, the transactions summarized above improve your present and future income tax positions while providing the $ cash that you need to meet expenses. If I can be of further assistance to you in this matter, please contact me. Sincerely, Laura Sims, CPA Manager b. Complete a memo on this matter for your firm's tax research files. TAX FILE MEMORANDUM December 12, 2017 FROM: Laura Sims SUBJECT: Advice to the Deans on the tax consequences of asset retention and disposition Attached is a letter sent to the Deans on the advisability of their transferring by gift, selling, and retaining various assets. My recommendations were influenced by Ted's poor health and older age (in comparison with Marge's good health and younger age) and by the preservation of their income tax basis. By keeping the Wren stock, Marge receives a in basis upon Ted's prior death. By giving the land (which is Ted's separate property) to Marge, a step-down in basis for gain is avoided on Ted's prior death. A in loss basis is not avoided, but this also will happen under $ 1014 if the land is passed to Marge at Ted's death