Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ted Field owns 1,000 shares of Greener Pastures Ltd. He purchased these shares on the stock exchange in 2003 for a total of $1,000.

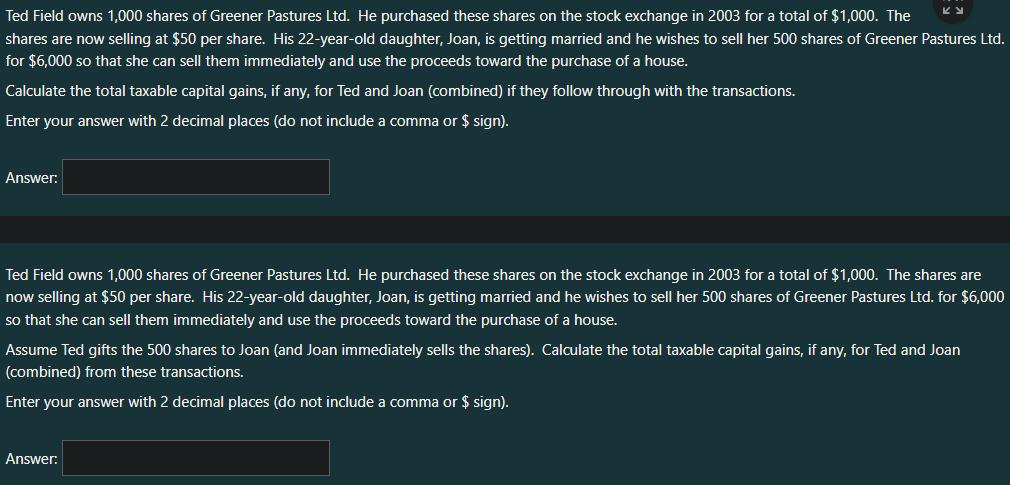

Ted Field owns 1,000 shares of Greener Pastures Ltd. He purchased these shares on the stock exchange in 2003 for a total of $1,000. The shares are now selling at $50 per share. His 22-year-old daughter, Joan, is getting married and he wishes to sell her 500 shares of Greener Pastures Ltd. for $6,000 so that she can sell them immediately and use the proceeds toward the purchase of a house. Calculate the total taxable capital gains, if any, for Ted and Joan (combined) if they follow through with the transactions. Enter your answer with 2 decimal places (do not include a comma or $ sign). Answer: KE Ted Field owns 1,000 shares of Greener Pastures Ltd. He purchased these shares on the stock exchange in 2003 for a total of $1,000. The shares are now selling at $50 per share. His 22-year-old daughter, Joan, is getting married and he wishes to sell her 500 shares of Greener Pastures Ltd. for $6,000 so that she can sell them immediately and use the proceeds toward the purchase of a house. Assume Ted gifts the 500 shares to Joan (and Joan immediately sells the shares). Calculate the total taxable capital gains, if any, for Ted and Joan (combined) from these transactions. Enter your answer with 2 decimal places (do not include a comma or $ sign). Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the total taxable capital gains for Ted and Joan combined we need to consider the capit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started