Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ted McKay has just bought the common stock of Ryland Corp. The company expects to grow at the following rates for the next three

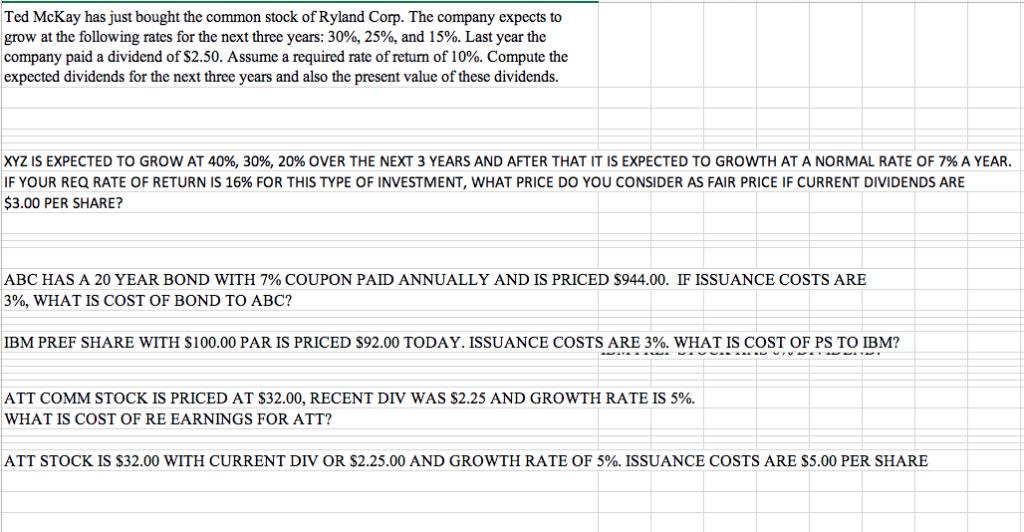

Ted McKay has just bought the common stock of Ryland Corp. The company expects to grow at the following rates for the next three years: 30%, 25%, and 15%. Last year the company paid a dividend of $2.50. Assume a required rate of return of 10%. Compute the expected dividends for the next three years and also the present value of these dividends. XYZ IS EXPECTED TO GROW AT 40%, 30%, 20% OVER THE NEXT 3 YEARS AND AFTER THAT IT IS EXPECTED TO GROWTH AT A NORMAL RATE OF 7% A YEAR. IF YOUR REQ RATE OF RETURN IS 16% FOR THIS TYPE OF INVESTMENT, WHAT PRICE DO YOU CONSIDER AS FAIR PRICE IF CURRENT DIVIDENDS ARE $3.00 PER SHARE? ABC HAS A 20 YEAR BOND WITH 7% COUPON PAID ANNUALLY AND IS PRICED $944.00. IF ISSUANCE COSTS ARE 3%, WHAT IS COST OF BOND TO ABC? IBM PREF SHARE WITH $100.00 PAR IS PRICED $92.00 TODAY. ISSUANCE COSTS ARE 3%. WHAT IS COST OF PS TO IBM? AFTALE ATT COMM STOCK IS PRICED AT $32.00, RECENT DIV WAS $2.25 AND GROWTH RATE IS 5%. WHAT IS COST OF RE EARNINGS FOR ATT? WA* *** * ATT STOCK IS $32.00 WITH CURRENT DIV OR $2.25.00 AND GROWTH RATE OF 5%. ISSUANCE COSTS ARE $5.00 PER SHARE

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution solution Given that Ted mekay has just boug...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started