Question

Tees R Us , set up as a privately held corporation, operating as a t-shirt retailer, of which 100% of the Common Shares are owned

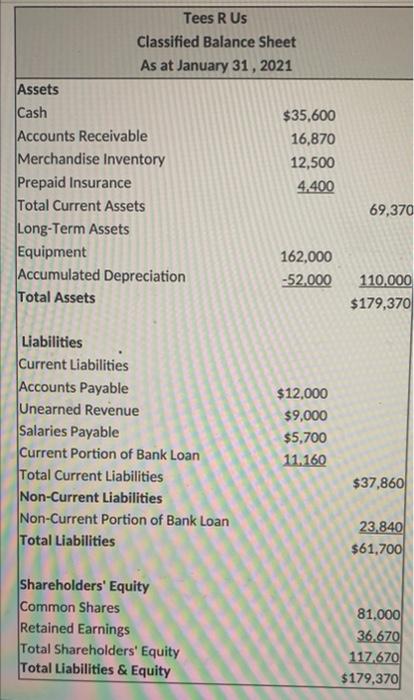

Tees R Us , set up as a privately held corporation, operating as a t-shirt retailer, of which 100% of the Common Shares are owned by Tamara Green. You were hired to account for transactions for the month of February 2021, complete month end processing, prepare the financial statements and perform a financial ratio analysis as of the end of that month. They use perpetual inventory system and use the weigted average method to determine value for the inventory. Its balance sheet as at January 31, 2021, is presented below.

Please do B!!!!!

b) Enter the opening balances of the accounts from the January 31, 2021 Balance Sheet and post the above journal entries to the accounts

c) & &d) Complete the bank reconciliation report and record/post journal entries.

e) Complete the 10-column worksheet (using information for adjustments

f) record the adjestments in the general journal and then post to the general ledger accounts

g) Prepare the multistep income statement, calculation of retained earnings, classified balance sheet

Don't make journal entries, need help with B

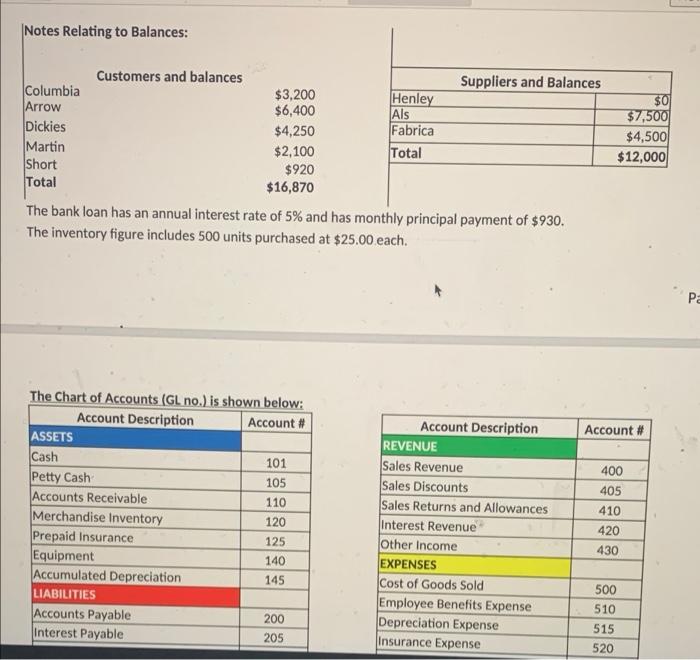

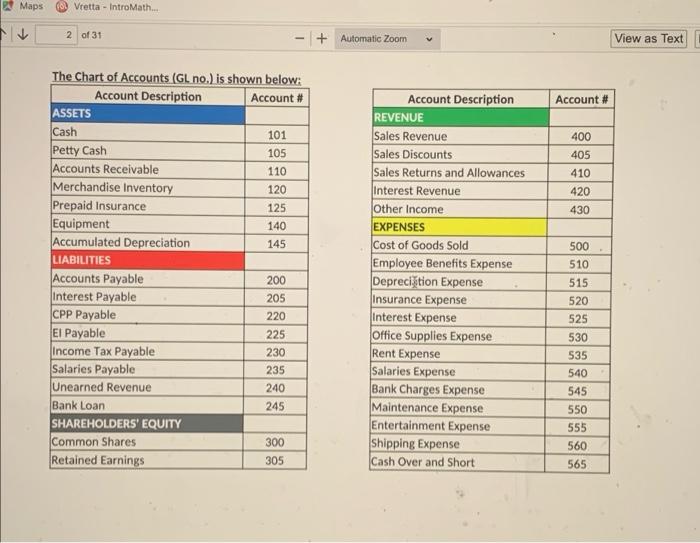

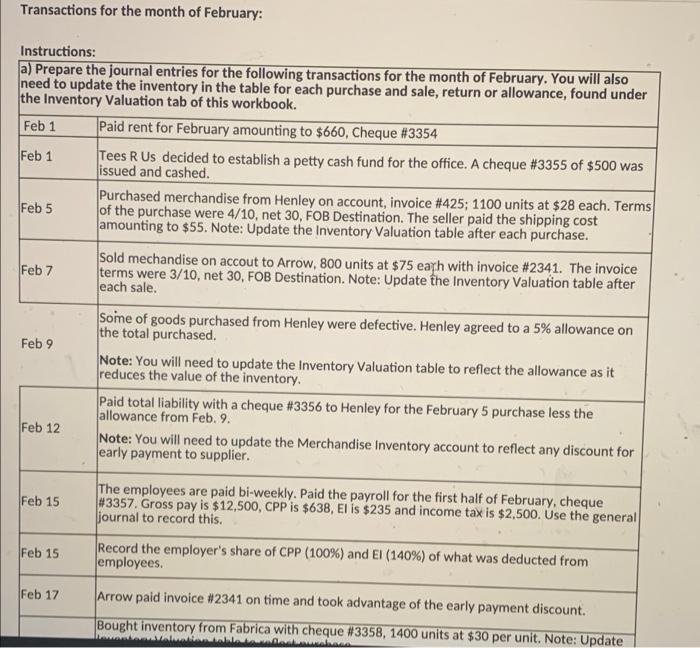

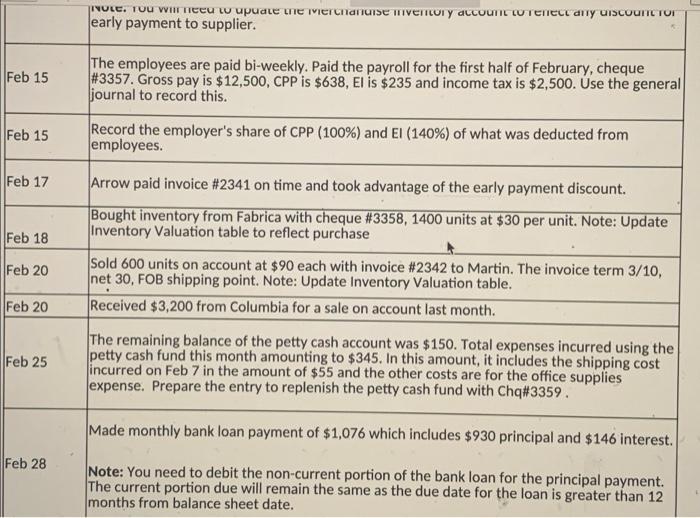

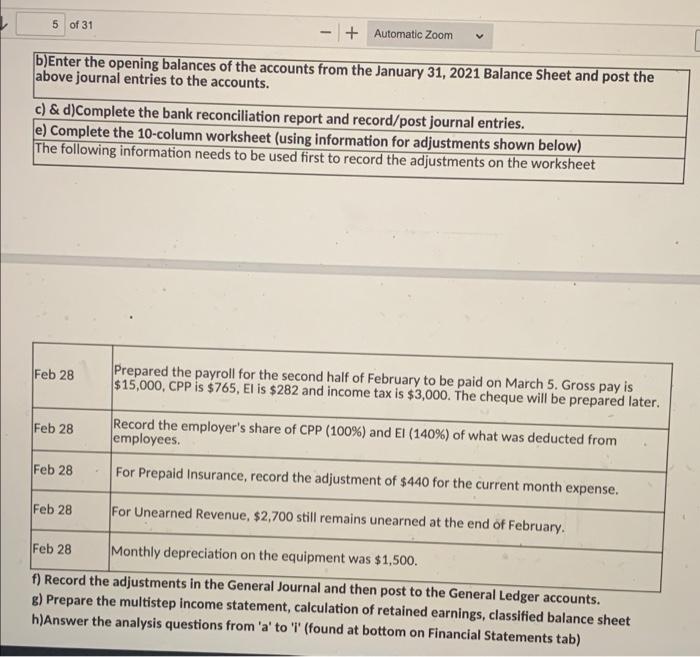

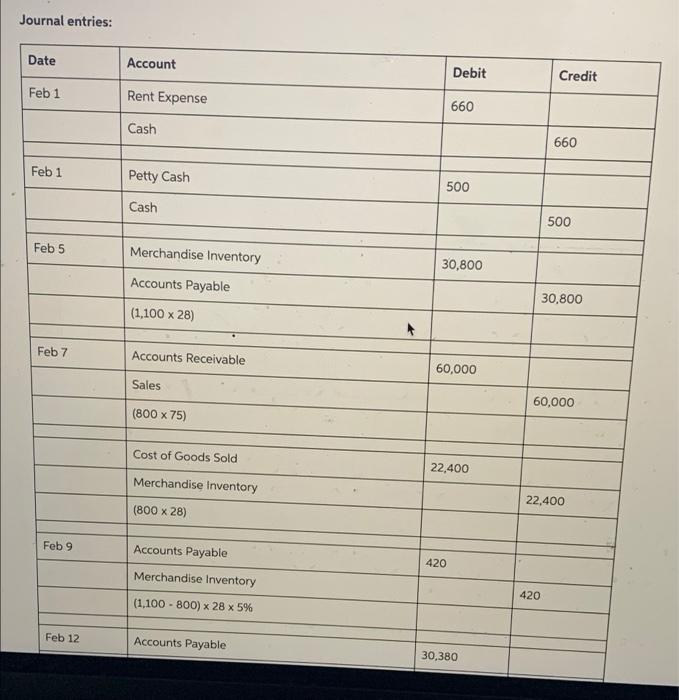

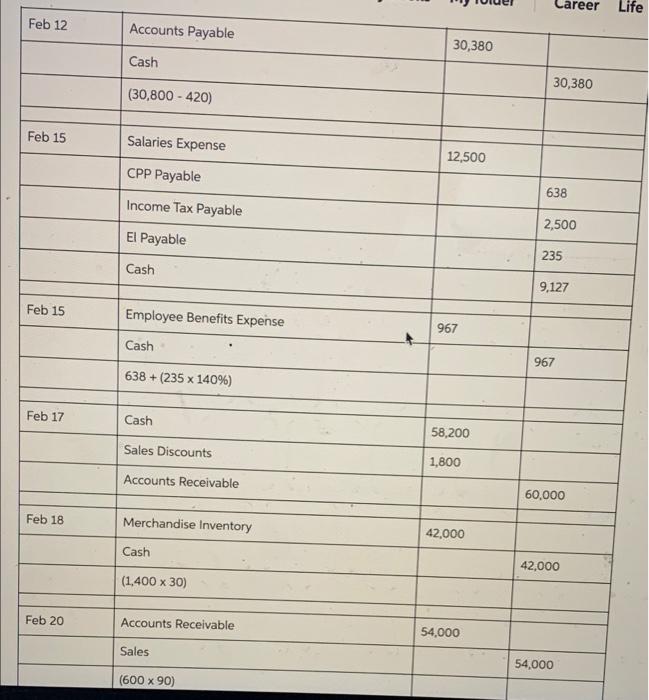

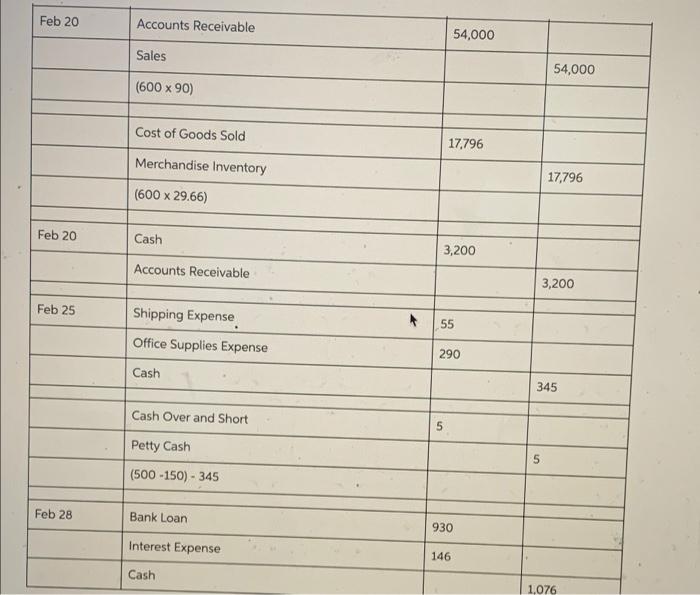

Tees R Us Classified Balance Sheet As at January 31, 2021 Assets Cash $35,600 Accounts Receivable 16,870 Merchandise Inventory 12,500 Prepaid Insurance 4,400 Total Current Assets Long-Term Assets Equipment 162,000 Accumulated Depreciation -52,000 Total Assets 69,370 110.000 $179,370 Liabilities Current Liabilities Accounts Payable Unearned Revenue Salaries Payable Current Portion of Bank Loan Total Current Liabilities Non-Current Liabilities Non-Current Portion of Bank Loan Total Liabilities $12,000 $9,000 $5,700 11.160 $37,860 23.840 $61,700 Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity Total Liabilities & Equity 81,000 36,670 117,670 $179,370 Notes Relating to Balances: Customers and balances Suppliers and Balances Columbia $3,200 Henley Arrow $6,400 Als Dickies $4,250 Fabrica Martin $2,100 Total Short $920 Total $16,870 The bank loan has an annual interest rate of 5% and has monthly principal payment of $930. The inventory figure includes 500 units purchased at $25.00 each. $0 $7,500 $4,500 $12,000 Pa Account # 400 405 The Chart of Accounts (GL no.) is shown below: Account Description Account # ASSETS Cash 101 Petty Cash 105 Accounts Receivable 110 Merchandise Inventory 120 Prepaid Insurance 125 Equipment 140 Accumulated Depreciation 145 LIABILITIES Accounts Payable 200 Interest Payable 205 410 Account Description REVENUE Sales Revenue Sales Discounts Sales Returns and Allowances Interest Revenue Other Income EXPENSES Cost of Goods Sold Employee Benefits Expense Depreciation Expense Insurance Expense 420 430 500 510 515 520 Maps Vretta - IntroMath... 2 of 31 - + Automatic Zoom View as Text Account # 400 405 410 420 430 The Chart of Accounts (GL no.) is shown below: Account Description Account # ASSETS Cash 101 Petty Cash 105 Accounts Receivable 110 Merchandise Inventory 120 Prepaid Insurance 125 Equipment 140 Accumulated Depreciation 145 LIABILITIES Accounts Payable 200 Interest Payable 205 CPP Payable 220 EI Payable 225 Income Tax Payable 230 Salaries Payable 235 Unearned Revenue 240 Bank Loan 245 SHAREHOLDERS' EQUITY Common Shares 300 Retained Earnings 305 Account Description REVENUE Sales Revenue Sales Discounts Sales Returns and Allowances Interest Revenue Other Income EXPENSES Cost of Goods Sold Employee Benefits Expense Deprecition Expense Insurance Expense Interest Expense Office Supplies Expense Rent Expense Salaries Expense Bank Charges Expense Maintenance Expense Entertainment Expense Shipping Expense Cash Over and Short 500 510 515 520 525 530 535 540 545 550 555 560 565 Transactions for the month of February: Instructions: a) Prepare the journal entries for the following transactions for the month of February. You will also need to update the inventory in the table for each purchase and sale, return or allowance, found under the Inventory Valuation tab of this workbook. Feb 1 Paid rent for February amounting to $660, Cheque #3354 Feb 1 Tees R Us decided to establish a petty cash fund for the office. A cheque #3355 of $500 was issued and cashed. Purchased merchandise from Henley on account, invoice #425; 1100 units at $28 each. Terms Feb 5 of the purchase were 4/10, net 30. FOB Destination. The seller paid the shipping cost amounting to $55. Note: Update the Inventory Valuation table after each purchase. Sold mechandise on accout to Arrow, 800 units at $75 earh with invoice #2341. The invoice Feb 7 terms were 3/10, net 30, FOB Destination. Note: Update the Inventory Valuation table after each sale. Some of goods purchased from Henley were defective. Henley agreed to a 5% allowance on the total purchased. Feb 9 Note: You will need to update the Inventory Valuation table to reflect the allowance as it reduces the value of the inventory. Paid total liability with a cheque #3356 to Henley for the February 5 purchase less the allowance from Feb. 9. Feb 12 Note: You will need to update the Merchandise Inventory account to reflect any discount for early payment to supplier. Feb 15 The employees are paid bi-weekly. Paid the payroll for the first half of February, cheque #3357. Gross pay is $12,500, CPP is $638, El is $235 and income tax is $2,500. Use the general journal to record this. Record the employer's share of CPP (100%) and El (140%) of what was deducted from employees Feb 15 Feb 17 Arrow paid invoice #2341 on time and took advantage of the early payment discount. Bought inventory from Fabrica with cheque #3358, 1400 units at $30 per unit. Note: Update wVM role. TOU WITTCcu w upuate the merchandise miercury account to Tenect any UISCOUILTON early payment to supplier. Feb 15 The employees are paid bi-weekly. Paid the payroll for the first half of February, cheque #3357. Gross pay is $12,500, CPP is $638, El is $235 and income tax is $2,500. Use the general journal to record this. Record the employer's share of CPP (100%) and El (140%) of what was deducted from employees. Feb 15 Feb 17 Feb 18 Feb 20 Arrow paid invoice #2341 on time and took advantage of the early payment discount. Bought inventory from Fabrica with cheque #3358, 1400 units at $30 per unit. Note: Update Inventory Valuation table to reflect purchase Sold 600 units on account at $90 each with invoice #2342 to Martin. The invoice term 3/10, net 30, FOB shipping point. Note: Update Inventory Valuation table. Received $3,200 from Columbia for a sale on account last month. The remaining balance of the petty cash account was $150. Total expenses incurred using the petty cash fund this month amounting to $345. In this amount, it includes the shipping cost incurred on Feb 7 in the amount of $55 and the other costs are for the office supplies expense. Prepare the entry to replenish the petty cash fund with Chq#3359. Feb 20 Feb 25 Made monthly bank loan payment of $1,076 which includes $930 principal and $146 interest. Feb 28 Note: You need to debit the non-current portion of the bank loan for the principal payment. The current portion due will remain the same as the due date for the loan is greater than 12 months from balance sheet date. 5 of 31 - + Automatic Zoom b)Enter the opening balances of the accounts from the January 31, 2021 Balance Sheet and post the above journal entries to the accounts. c) & d)Complete the bank reconciliation report and record/post journal entries. e) Complete the 10-column worksheet (using information for adjustments shown below) The following information needs to be used first to record the adjustments on the worksheet Feb 28 Prepared the payroll for the second half of February to be paid on March 5. Gross pay is $15,000, CPP is $765, El is $282 and income tax is $3,000. The cheque will be prepared later. Feb 28 Record the employer's share of CPP (100%) and El (140%) of what was deducted from employees. Feb 28 For Prepaid Insurance, record the adjustment of $440 for the current month expense. Feb 28 For Unearned Revenue, $2,700 still remains unearned at the end of February Feb 28 Monthly depreciation on the equipment was $1,500. f) Record the adjustments in the General Journal and then post to the General Ledger accounts. g) Prepare the multistep income statement, calculation of retained earnings, classified balance sheet h)Answer the analysis questions from 'a' to 'I' (found at bottom on Financial Statements tab) Journal entries: Date Account Debit Credit Feb 1 Rent Expense 660 Cash 660 Feb 1 Petty Cash 500 Cash 500 Feb 5 Merchandise Inventory 30,800 Accounts Payable 30,800 (1,100 x 28) Feb 7 Accounts Receivable 60,000 Sales 60,000 (800 x 75) Cost of Goods Sold 22,400 Merchandise Inventory 22,400 (800 x 28) Feb 9 Accounts Payable 420 Merchandise Inventory 420 (1,100 - 800) x 28 x 5% Feb 12 Accounts Payable 30,380 Career Life Feb 12 Accounts Payable 30,380 Cash 30,380 (30,800 - 420) Feb 15 Salaries Expense 12,500 CPP Payable 638 Income Tax Payable 2,500 El Payable 235 Cash 9,127 Feb 15 Employee Benefits Expense 967 Cash 967 638 +(235 x 140%) Feb 17 Cash 58,200 Sales Discounts 1,800 Accounts Receivable 60,000 Feb 18 Merchandise Inventory 42,000 Cash 42,000 (1.400 x 30) Feb 20 Accounts Receivable 54,000 Sales 54,000 (600 x 90) Feb 20 Accounts Receivable 54,000 Sales 54,000 (600 x 90) Cost of Goods Sold 17,796 Merchandise Inventory 17,796 (600 x 29.66) Feb 20 Cash 3,200 Accounts Receivable 3,200 Feb 25 Shipping Expense Office Supplies Expense 55 290 Cash 345 Cash Over and Short 5 Petty Cash 5 (500-150) - 345 Feb 28 Bank Loan 930 Interest Expense 146 Cash 1,076Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started