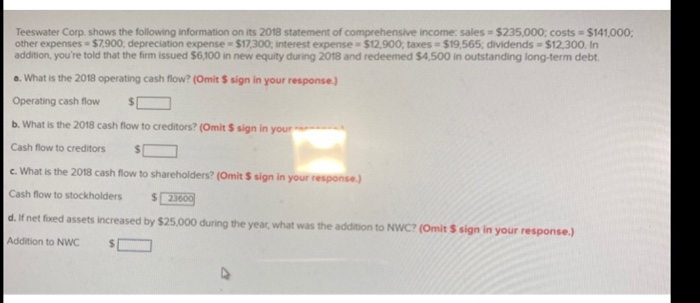

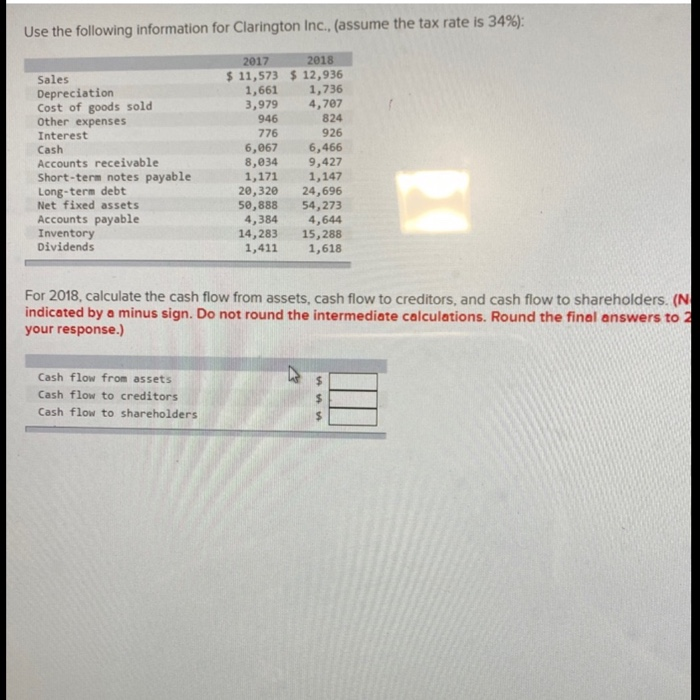

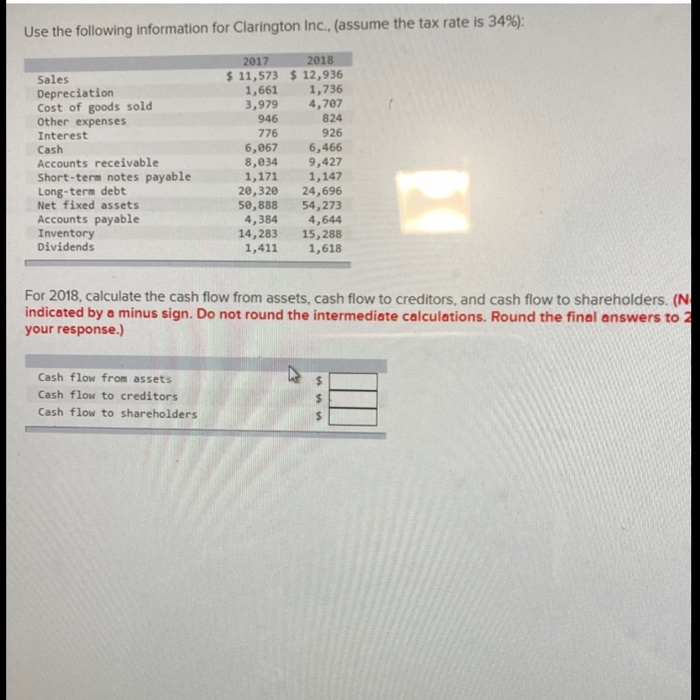

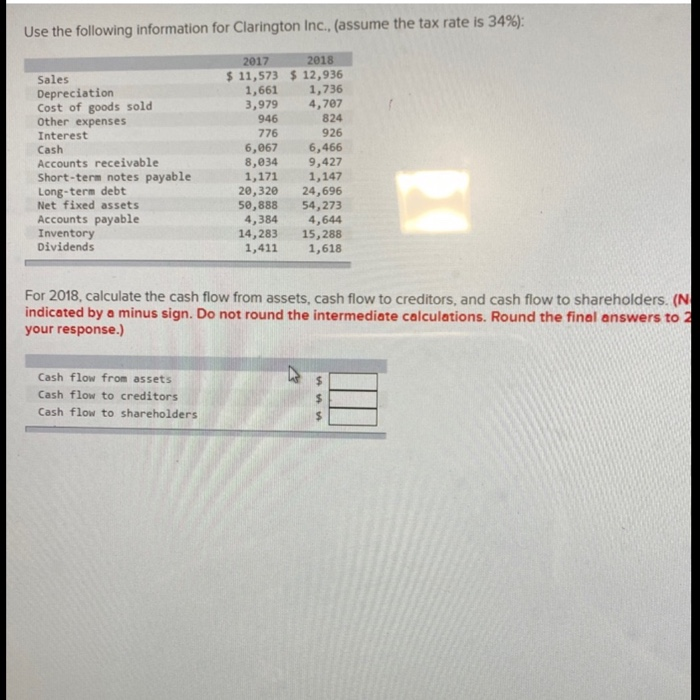

Teeswater Corp. shows the following information on its 2018 statement of comprehensive income sales = $235.000, costs = $141,000 other expenses - $7.900, depreciation expense = $17,300; interest expense = $12.900, taxes = $19,565, dividends = $12,300. In addition, you're told that the firm issued $6,100 in new equity during 2018 and redeemed $4,500 in outstanding long-term debt. .. What is the 2018 operating cash flow? (Omit sign in your response.) Operating cash flow SC b. What is the 2018 cash flow to creditors? (Omit S sign in your Cash flow to creditors c. What is the 2018 cash flow to shareholders? (Omit S sign in your response.) Cash flow to stockholders $23600 d. If net fixed assets increased by $25,000 during the year, what was the addition to NWC? (Omit S sign in your response.) Addition to NWC SC Use the following information for Clarington Inc., (assume the tax rate is 34%): Sales Depreciation Cost of goods sold Other expenses Interest Cash Accounts receivable Short-term notes payable Long-term debt Net fixed assets Accounts payable Inventory Dividends 2017 2018 $ 11,573 $ 12,936 1,661 1,736 3,979 4,707 946 824 776 926 6,067 6,466 8,034 9,427 1,171 1,147 20,320 24,696 50,888 54,273 4,384 4,644 14,283 15,288 1,411 1,618 For 2018, calculate the cash flow from assets, cash flow to creditors, and cash flow to shareholders. (N indicated by a minus sign. Do not round the intermediate calculations. Round the final answers to 2 your response.) Cash flow from assets Cash flow to creditors Cash flow to shareholders Use the following information for Clarington Inc., (assume the tax rate is 34%): Sales Depreciation Cost of goods sold Other expenses Interest Cash Accounts receivable Short-term notes payable Long-term debt Net fixed assets Accounts payable Inventory Dividends 2017 2018 $ 11,573 $ 12,936 1,661 1,736 3,979 4,707 946 824 776 926 6,067 6,466 8,034 9,427 1,171 1,147 20,320 24,696 50,888 54,273 4,384 4,644 14,283 15,288 1,411 1,618 For 2018, calculate the cash flow from assets, cash flow to creditors, and cash flow to shareholders. (N indicated by a minus sign. Do not round the intermediate calculations. Round the final answers to 2 your response.) Cash flow from assets Cash flow to creditors Cash flow to shareholders