Answered step by step

Verified Expert Solution

Question

1 Approved Answer

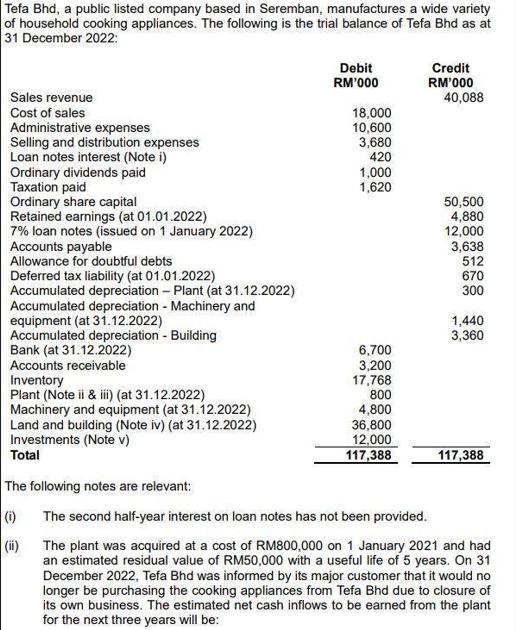

Tefa Bhd, a public listed company based in Seremban, manufactures a wide variety of household cooking appliances. The following is the trial balance of

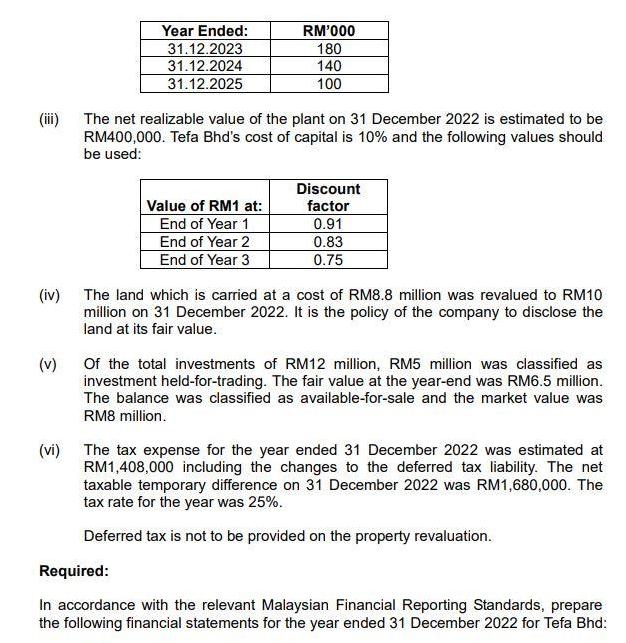

Tefa Bhd, a public listed company based in Seremban, manufactures a wide variety of household cooking appliances. The following is the trial balance of Tefa Bhd as at 31 December 2022: Sales revenue Cost of sales Administrative expenses Selling and distribution expenses Loan notes interest (Note i) Ordinary dividends paid Taxation paid Ordinary share capital Retained earnings (at 01.01.2022) 7% loan notes (issued on 1 January 2022) Accounts payable Allowance for doubtful debts Deferred tax liability (at 01.01.2022) Accumulated depreciation - Plant (at 31.12.2022) Accumulated depreciation - Machinery and equipment (at 31.12.2022) Accumulated depreciation - Building Bank (at 31.12.2022) Accounts receivable Inventory Plant (Note ii & iii) (at 31.12.2022) Machinery and equipment (at 31.12.2022) Land and building (Note iv) (at 31.12.2022) Investments (Note v) Total Debit RM'000 18,000 10,600 3,680 420 1,000 1,620 6,700 3,200 17,768 800 4,800 36,800 12,000 117,388 Credit RM'000 40,088 50,500 4,880 12,000 3,638 512 670 300 1,440 3,360 117,388 The following notes are relevant: (1) The second half-year interest on loan notes has not been provided. (ii) The plant was acquired at a cost of RM800,000 on 1 January 2021 and had an estimated residual value of RM50,000 with a useful life of 5 years. On 31 December 2022, Tefa Bhd was informed by its major customer that it would no longer be purchasing the cooking appliances from Tefa Bhd due to closure of its own business. The estimated net cash inflows to be earned from the plant for the next three years will be: (iii) (iv) (v) Year Ended: 31.12.2023 31.12.2024 31.12.2025 RM'000 180 140 100 The net realizable value of the plant on 31 December 2022 is estimated to be RM400,000. Tefa Bhd's cost of capital is 10% and the following values should be used: Value of RM1 at: End of Year 1 End of Year 2 End of Year 3 Discount factor 0.91 0.83 0.75 The land which is carried at a cost of RM8.8 million was revalued to RM10 million on 31 December 2022. It is the policy of the company to disclose the land at its fair value. Of the total investments of RM12 million, RM5 million was classified as investment held-for-trading. The fair value at the year-end was RM6.5 million. The balance was classified as available-for-sale and the market value was RM8 million. (vi) The tax expense for the year ended 31 December 2022 was estimated at RM1,408,000 including the changes to the deferred tax liability. The net taxable temporary difference on 31 December 2022 was RM1,680,000. The tax rate for the year was 25%. Deferred tax is not to be provided on the property revaluation. Required: In accordance with the relevant Malaysian Financial Reporting Standards, prepare the following financial statements for the year ended 31 December 2022 for Tefa Bhd:

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started