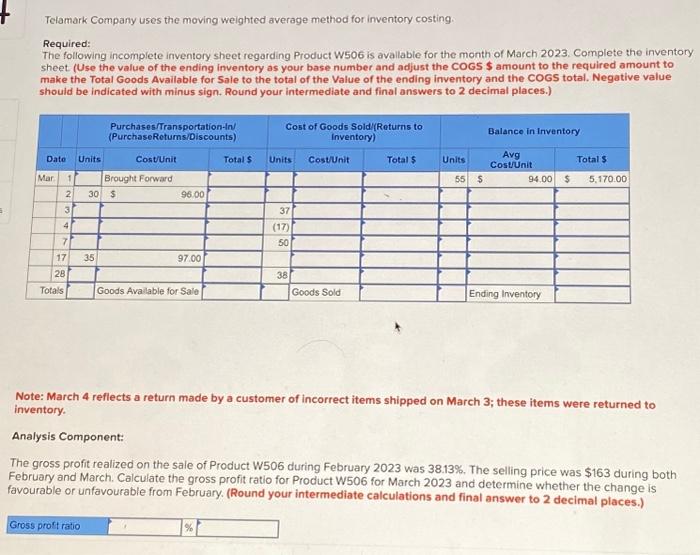

Telamark Company uses the moving weighted average method for inventory costing. Required: The following incomplete inventory sheet regarding Product W506 is avallable for the month of March 2023, Complete the inventon sheet (Use the value of the ending inventory as your base number and adjust the COGS $ amount to the required amount to make the Total Goods Available for Sale to the total of the Value of the ending inventory and the COGS total. Negative value should be indicated with minus sign. Round your intermediate and final answers to 2 decimal places.) Note: March 4 reflects a return made by a customer of incorrect items shipped on March 3 ; these items were returned to inventory. Analysis Component: The gross profit realized on the sale of Product W506 during February 2023 was 38.13%. The selling price was $163 during both February and March. Calculate the gross profit ratio for Product W506 for March 2023 and determine whether the change is favourable or unfavourable from February. (Round your intermediate calculations and final answer to 2 decimal places.) Telamark Company uses the moving weighted average method for inventory costing. Required: The following incomplete inventory sheet regarding Product W506 is avallable for the month of March 2023, Complete the inventon sheet (Use the value of the ending inventory as your base number and adjust the COGS $ amount to the required amount to make the Total Goods Available for Sale to the total of the Value of the ending inventory and the COGS total. Negative value should be indicated with minus sign. Round your intermediate and final answers to 2 decimal places.) Note: March 4 reflects a return made by a customer of incorrect items shipped on March 3 ; these items were returned to inventory. Analysis Component: The gross profit realized on the sale of Product W506 during February 2023 was 38.13%. The selling price was $163 during both February and March. Calculate the gross profit ratio for Product W506 for March 2023 and determine whether the change is favourable or unfavourable from February. (Round your intermediate calculations and final answer to 2 decimal places.)