Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As the audit manager of Causeway Bay Ltd., CPAs, you are in charge of the annual audit of AAA Ltd (AAA) for the year

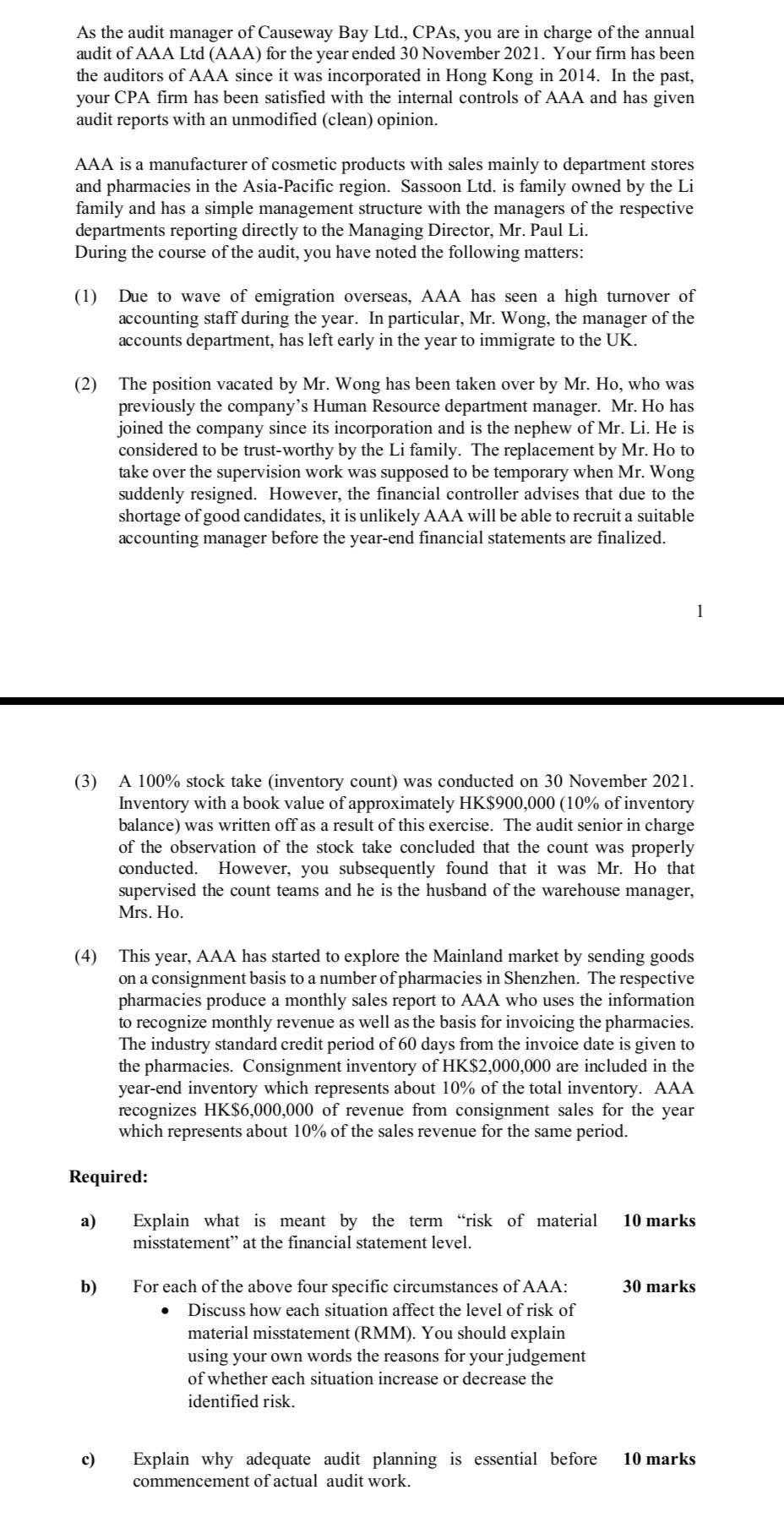

As the audit manager of Causeway Bay Ltd., CPAs, you are in charge of the annual audit of AAA Ltd (AAA) for the year ended 30 November 2021. Your firm has been the auditors of AAA since it was incorporated in Hong Kong in 2014. In the past, your CPA firm has been satisfied with the internal controls of AAA and has given audit reports with an unmodified (clean) opinion. AAA is a manufacturer of cosmetic products with sales mainly to department stores and pharmacies in the Asia-Pacific region. Sassoon Ltd. is family owned by the Li family and has a simple management structure with the managers of the respective departments reporting directly to the Managing Director, Mr. Paul Li. During the course of the audit, you have noted the following matters: (1) Due to wave of emigration overseas, AAA has seen a high turnover of accounting staff during the year. In particular, Mr. Wong, the manager of the accounts department, has left early in the year to immigrate to the UK. (2) (3) A 100% stock take (inventory count) was conducted on 30 November 2021. Inventory with a book value of approximately HK$900,000 (10% of inventory balance) was written off as a result of this exercise. The audit senior in charge of the observation of the stock take concluded that the count was properly conducted. However, you subsequently found that it was Mr. Ho that supervised the count teams and he is the husband of the warehouse manager, Mrs. Ho. (4) This year, AAA has started to explore the Mainland market by sending goods on a consignment basis to a number of pharmacies in Shenzhen. The respective pharmacies produce a monthly sales report to AAA who uses the information to recognize monthly revenue as well as the basis for invoicing the pharmacies. The industry standard credit period of 60 days from the invoice date is given to the pharmacies. Consignment inventory of HK$2,000,000 are included in the year-end inventory which represents about 10% of the total inventory. AAA recognizes HK$6,000,000 of revenue from consignment sales for the year which represents about 10% of the sales revenue for the same period. The position vacated by Mr. Wong has been taken over by Mr. Ho, who was previously the company's Human Resource department manager. Mr. Ho has joined the company since its incorporation and is the nephew of Mr. Li. He is considered to be trust-worthy by the Li family. The replacement by Mr. Ho to take over the supervision work was supposed to be temporary when Mr. Wong suddenly resigned. However, the financial controller advises that due to the shortage of good candidates, it is unlikely AAA will be able to recruit a suitable accounting manager before the year-end financial statements are finalized. Required: a) b) c) Explain what is meant by the term "risk of material misstatement" at the financial statement level. 1 For each of the above four specific circumstances of AAA: Discuss how each situation affect the level of risk of material misstatement (RMM). You should explain using your own words the reasons for your judgement of whether each situation increase or decrease the identified risk. 10 marks 30 marks Explain why adequate audit planning is essential before 10 marks commencement of actual audit work.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Step ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started