tell me why Harvey, Illinois municipal bonds might not be the best investment to hold in your portfolio. Use some ratios.

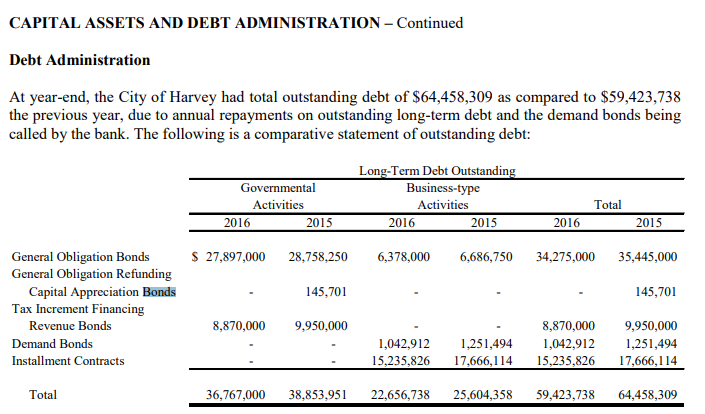

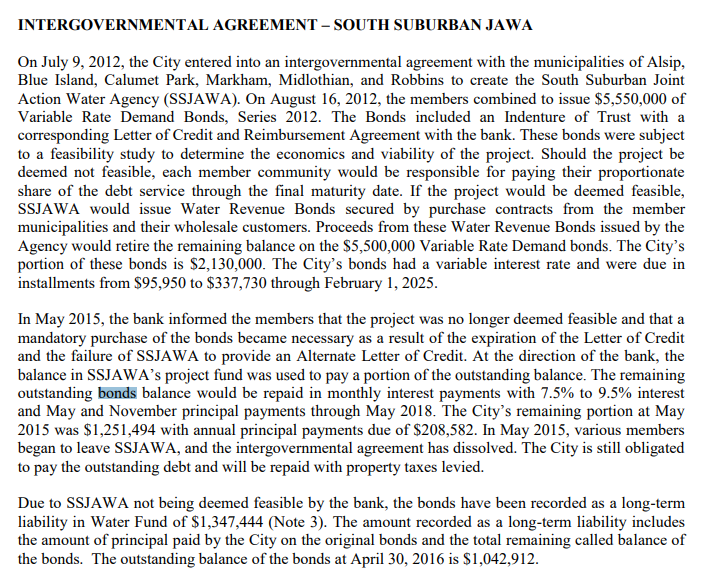

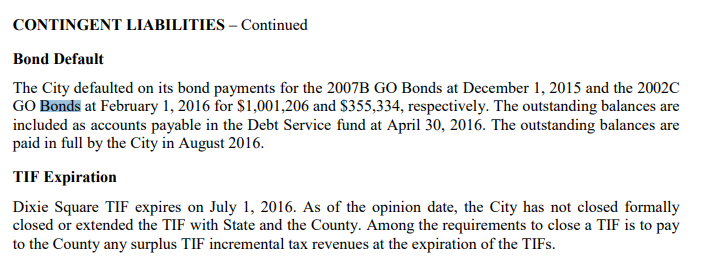

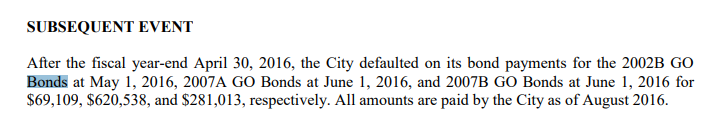

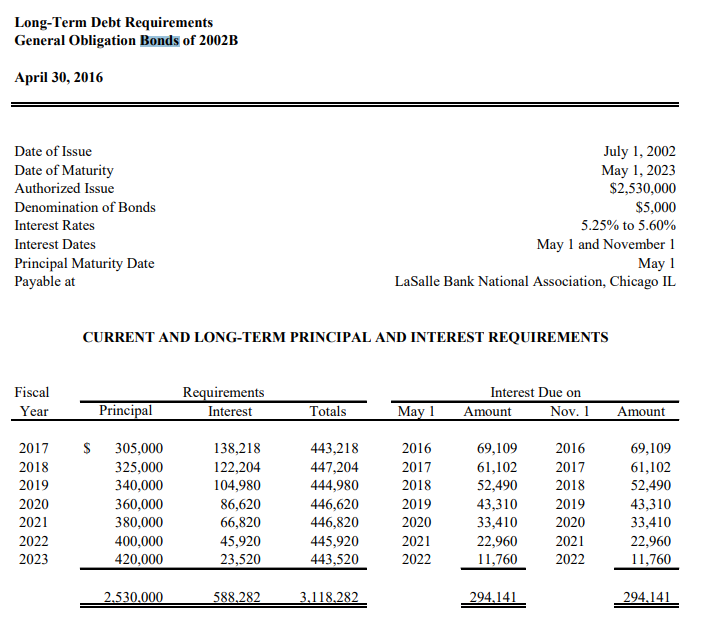

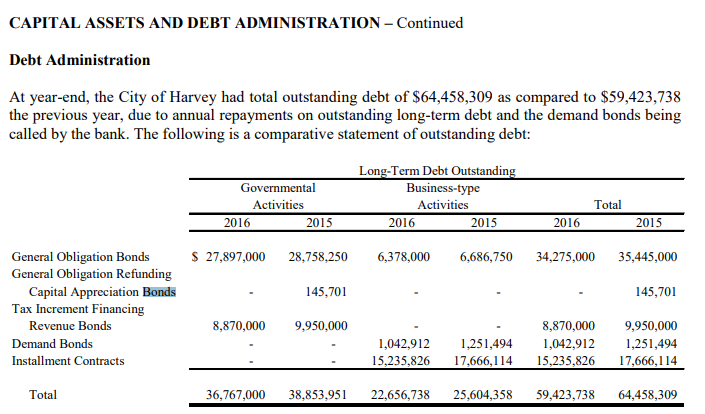

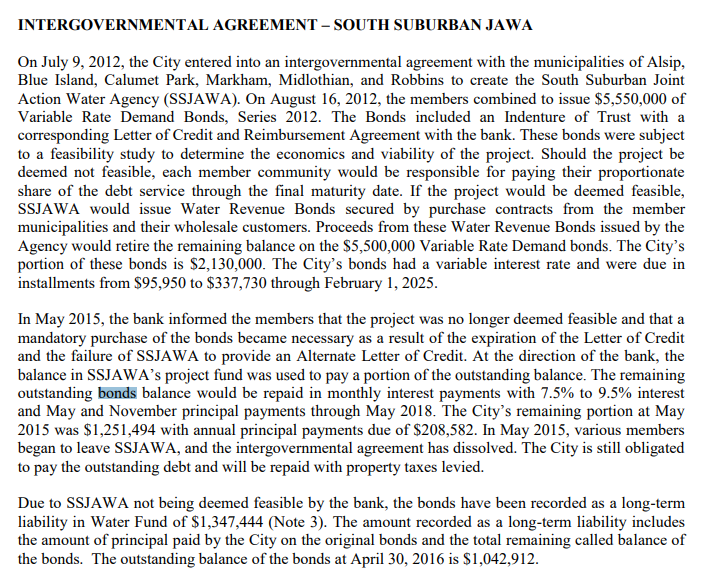

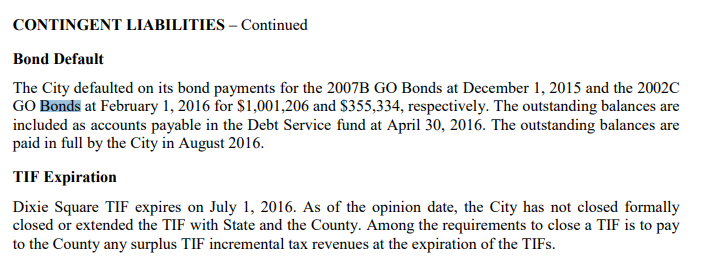

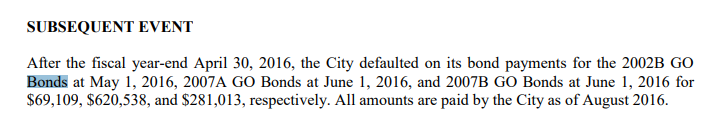

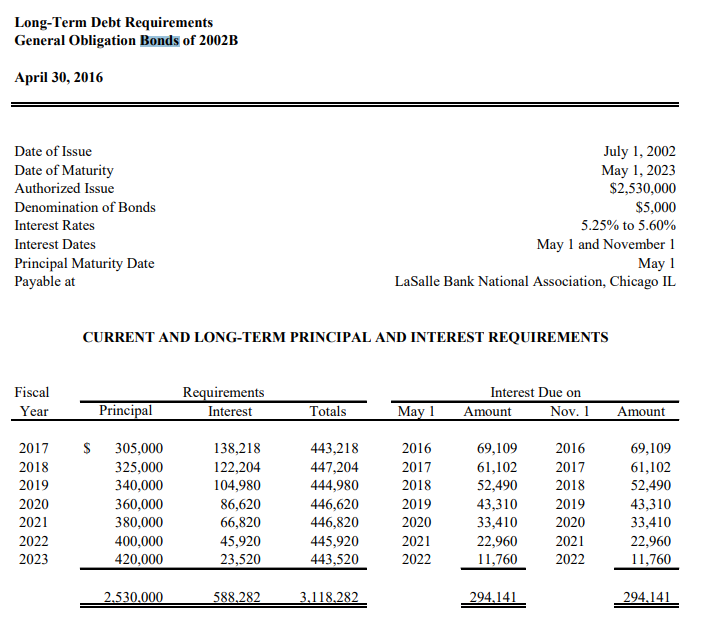

CAPITAL ASSETS AND DEBT ADMINISTRATION - Continued Debt Administration At year-end, the City of Harvey had total outstanding debt of $64,458,309 as compared to $59,423,738 the previous year, due to annual repayments on outstanding long-term debt and the demand bonds being called by the bank. The following is a comparative statement of outstanding debt: Long-Term Debt Outstanding Governmental Business-type Activities Activities Total 2016 2015 2016 2015 2016 2015 $ 27,897,000 28,758,250 6,378,000 6,686,750 34,275,000 35,445,000 145,701 145,701 General Obligation Bonds General Obligation Refunding Capital Appreciation Bonds Tax Increment Financing Revenue Bonds Demand Bonds Installment Contracts 8,870,000 9,950,000 1,042,912 15,235,826 1,251,494 17,666,114 8,870,000 1,042,912 15,235,826 9,950,000 1,251,494 17,666,114 Total 36,767,000 38,853,951 22,656,738 25,604,358 59,423,738 64,458,309 INTERGOVERNMENTAL AGREEMENT - SOUTH SUBURBAN JAWA On July 9, 2012, the City entered into an intergovernmental agreement with the municipalities of Alsip, Blue Island, Calumet Park, Markham, Midlothian, and Robbins to create the South Suburban Joint Action Water Agency (SSJAWA). On August 16, 2012, the members combined to issue $5,550,000 of Variable Rate Demand Bonds, Series 2012. The Bonds included an Indenture of Trust with a corresponding Letter of Credit and Reimbursement Agreement with the bank. These bonds were subject to a feasibility study to determine the economics and viability of the project. Should the project be deemed not feasible, each member community would be responsible for paying their proportionate share of the debt service through the final maturity date. If the project would be deemed feasible, SSJAWA would issue Water Revenue Bonds secured by purchase contracts from the member municipalities and their wholesale customers. Proceeds from these Water Revenue Bonds issued by the Agency would retire the remaining balance on the $5,500,000 Variable Rate Demand bonds. The City's portion of these bonds is $2,130,000. The City's bonds had a variable interest rate and were due in installments from $95,950 to $337,730 through February 1, 2025. In May 2015, the bank informed the members that the project was no longer deemed feasible and that a mandatory purchase of the bonds became necessary as a result of the expiration of the Letter of Credit and the failure of SSJAWA to provide an Alternate Letter of Credit. At the direction of the bank, the balance in SSJAWA's project fund was used to pay a portion of the outstanding balance. The remaining outstanding bonds balance would be repaid in monthly interest payments with 7.5% to 9.5% interest and May and November principal payments through May 2018. The City's remaining portion at May 2015 was $1,251,494 with annual principal payments due of $208,582. In May 2015, various members began to leave SSJAWA, and the intergovernmental agreement has dissolved. The City is still obligated to pay the outstanding debt and will be repaid with property taxes levied. Due to SSJAWA not being deemed feasible by the bank, the bonds have been recorded as a long-term liability in Water Fund of $1,347,444 (Note 3). The amount recorded as a long-term liability includes the amount of principal paid by the City on the original bonds and the total remaining called balance of the bonds. The outstanding balance of the bonds at April 30, 2016 is $1,042,912. CONTINGENT LIABILITIES - Continued Bond Default The City defaulted on its bond payments for the 2007B GO Bonds at December 1, 2015 and the 2002C GO Bonds at February 1, 2016 for $1,001,206 and $355,334, respectively. The outstanding balances are included as accounts payable in the Debt Service fund at April 30, 2016. The outstanding balances are paid in full by the City in August 2016. TIF Expiration Dixie Square TIF expires on July 1, 2016. As of the opinion date, the City has not closed formally closed or extended the TIF with State and the County. Among the requirements to close a TIF is to pay to the County any surplus TIF incremental tax revenues at the expiration of the TIFs. SUBSEQUENT EVENT After the fiscal year-end April 30, 2016, the City defaulted on its bond payments for the 2002B GO Bonds at May 1, 2016, 2007A GO Bonds at June 1, 2016, and 2007B GO Bonds at June 1, 2016 for $69,109, $620,538, and $281,013, respectively. All amounts are paid by the City as of August 2016. Long-Term Debt Requirements General Obligation Bonds of 2002B April 30, 2016 Date of Issue Date of Maturity Authorized Issue Denomination of Bonds Interest Rates Interest Dates Principal Maturity Date Payable at July 1, 2002 May 1, 2023 $2,530,000 $5,000 5.25% to 5.60% May 1 and November 1 May 1 LaSalle Bank National Association, Chicago IL CURRENT AND LONG-TERM PRINCIPAL AND INTEREST REQUIREMENTS Fiscal Year Principal Requirements Interest Interest Due on Amount Nov. 1 Totals May 1 Amount $ 2017 2018 2019 2020 2021 2022 2023 305,000 325,000 340,000 360,000 380,000 400,000 420,000 138,218 122,204 104,980 86,620 66,820 45,920 23,520 443,218 447,204 444,980 446,620 446,820 445,920 443,520 2016 2017 2018 2019 2020 2021 69,109 61,102 52,490 43,310 33,410 22,960 11,760 2016 2017 2018 2019 2020 2021 2022 69,109 61,102 52,490 43,310 33,410 22,960 11,760 2022 2.530.000 588,282 3,118.282 294,141 294,141 CAPITAL ASSETS AND DEBT ADMINISTRATION - Continued Debt Administration At year-end, the City of Harvey had total outstanding debt of $64,458,309 as compared to $59,423,738 the previous year, due to annual repayments on outstanding long-term debt and the demand bonds being called by the bank. The following is a comparative statement of outstanding debt: Long-Term Debt Outstanding Governmental Business-type Activities Activities Total 2016 2015 2016 2015 2016 2015 $ 27,897,000 28,758,250 6,378,000 6,686,750 34,275,000 35,445,000 145,701 145,701 General Obligation Bonds General Obligation Refunding Capital Appreciation Bonds Tax Increment Financing Revenue Bonds Demand Bonds Installment Contracts 8,870,000 9,950,000 1,042,912 15,235,826 1,251,494 17,666,114 8,870,000 1,042,912 15,235,826 9,950,000 1,251,494 17,666,114 Total 36,767,000 38,853,951 22,656,738 25,604,358 59,423,738 64,458,309 INTERGOVERNMENTAL AGREEMENT - SOUTH SUBURBAN JAWA On July 9, 2012, the City entered into an intergovernmental agreement with the municipalities of Alsip, Blue Island, Calumet Park, Markham, Midlothian, and Robbins to create the South Suburban Joint Action Water Agency (SSJAWA). On August 16, 2012, the members combined to issue $5,550,000 of Variable Rate Demand Bonds, Series 2012. The Bonds included an Indenture of Trust with a corresponding Letter of Credit and Reimbursement Agreement with the bank. These bonds were subject to a feasibility study to determine the economics and viability of the project. Should the project be deemed not feasible, each member community would be responsible for paying their proportionate share of the debt service through the final maturity date. If the project would be deemed feasible, SSJAWA would issue Water Revenue Bonds secured by purchase contracts from the member municipalities and their wholesale customers. Proceeds from these Water Revenue Bonds issued by the Agency would retire the remaining balance on the $5,500,000 Variable Rate Demand bonds. The City's portion of these bonds is $2,130,000. The City's bonds had a variable interest rate and were due in installments from $95,950 to $337,730 through February 1, 2025. In May 2015, the bank informed the members that the project was no longer deemed feasible and that a mandatory purchase of the bonds became necessary as a result of the expiration of the Letter of Credit and the failure of SSJAWA to provide an Alternate Letter of Credit. At the direction of the bank, the balance in SSJAWA's project fund was used to pay a portion of the outstanding balance. The remaining outstanding bonds balance would be repaid in monthly interest payments with 7.5% to 9.5% interest and May and November principal payments through May 2018. The City's remaining portion at May 2015 was $1,251,494 with annual principal payments due of $208,582. In May 2015, various members began to leave SSJAWA, and the intergovernmental agreement has dissolved. The City is still obligated to pay the outstanding debt and will be repaid with property taxes levied. Due to SSJAWA not being deemed feasible by the bank, the bonds have been recorded as a long-term liability in Water Fund of $1,347,444 (Note 3). The amount recorded as a long-term liability includes the amount of principal paid by the City on the original bonds and the total remaining called balance of the bonds. The outstanding balance of the bonds at April 30, 2016 is $1,042,912. CONTINGENT LIABILITIES - Continued Bond Default The City defaulted on its bond payments for the 2007B GO Bonds at December 1, 2015 and the 2002C GO Bonds at February 1, 2016 for $1,001,206 and $355,334, respectively. The outstanding balances are included as accounts payable in the Debt Service fund at April 30, 2016. The outstanding balances are paid in full by the City in August 2016. TIF Expiration Dixie Square TIF expires on July 1, 2016. As of the opinion date, the City has not closed formally closed or extended the TIF with State and the County. Among the requirements to close a TIF is to pay to the County any surplus TIF incremental tax revenues at the expiration of the TIFs. SUBSEQUENT EVENT After the fiscal year-end April 30, 2016, the City defaulted on its bond payments for the 2002B GO Bonds at May 1, 2016, 2007A GO Bonds at June 1, 2016, and 2007B GO Bonds at June 1, 2016 for $69,109, $620,538, and $281,013, respectively. All amounts are paid by the City as of August 2016. Long-Term Debt Requirements General Obligation Bonds of 2002B April 30, 2016 Date of Issue Date of Maturity Authorized Issue Denomination of Bonds Interest Rates Interest Dates Principal Maturity Date Payable at July 1, 2002 May 1, 2023 $2,530,000 $5,000 5.25% to 5.60% May 1 and November 1 May 1 LaSalle Bank National Association, Chicago IL CURRENT AND LONG-TERM PRINCIPAL AND INTEREST REQUIREMENTS Fiscal Year Principal Requirements Interest Interest Due on Amount Nov. 1 Totals May 1 Amount $ 2017 2018 2019 2020 2021 2022 2023 305,000 325,000 340,000 360,000 380,000 400,000 420,000 138,218 122,204 104,980 86,620 66,820 45,920 23,520 443,218 447,204 444,980 446,620 446,820 445,920 443,520 2016 2017 2018 2019 2020 2021 69,109 61,102 52,490 43,310 33,410 22,960 11,760 2016 2017 2018 2019 2020 2021 2022 69,109 61,102 52,490 43,310 33,410 22,960 11,760 2022 2.530.000 588,282 3,118.282 294,141 294,141