Answered step by step

Verified Expert Solution

Question

1 Approved Answer

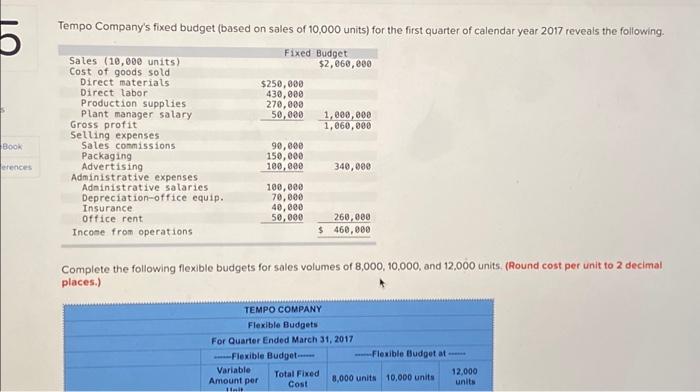

Tempo Company's fixed budget (based on sales of 10,000 units) for the first quarter of calendar year 2017 reveals the following. Fixed Budget Sales (10,000

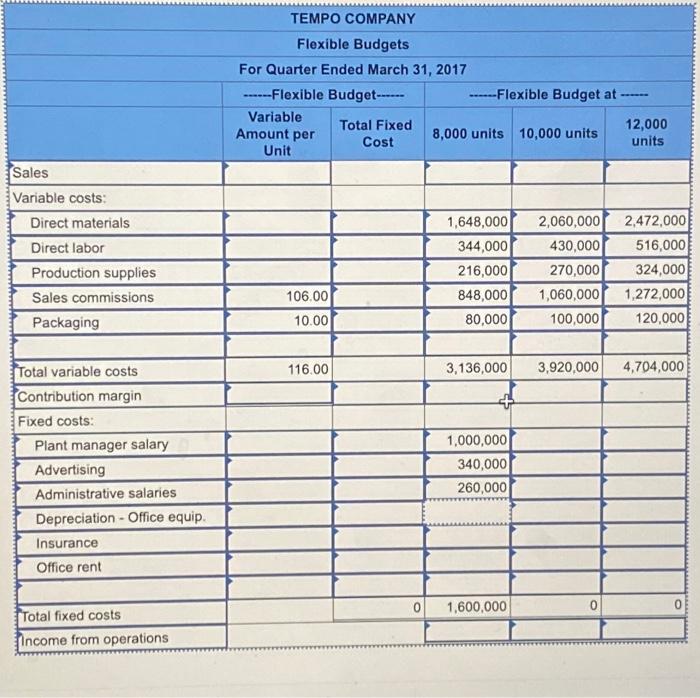

Tempo Company's fixed budget (based on sales of 10,000 units) for the first quarter of calendar year 2017 reveals the following. Fixed Budget Sales (10,000 units) Cost of goods sold Direct materials Direct labor Production supplies Plant manager salary Gross profit Selling expenses Sales commissions Packaging Advertising Administrative expenses Administrative salaries Depreciation-office equip. Insurance Office rent Income from operations $250,000 430,000 270,000 50,000 90,000 150,000 100,000 100,000 70,000 40,000 50,000 Unit ------Flexible Budget------ Variable Amount per $2,060,000 $ 1,000,000 1,060,000 Complete the following flexible budgets for sales volumes of 8,000, 10,000, and 12,000 units. (Round cost per unit to 2 decimal places.) Total Fixed Cost 340,000 TEMPO COMPANY Flexible Budgets For Quarter Ended March 31, 2017 260,000 460,000 ------Flexible Budget at 8,000 units 10,000 units 12,000 units.

Please disregard numbers in the table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started