Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that owners of the restaurant have registered the business as a corporation. ? temporary accounts, and prepare post-closing trial balance. At the end,

Assume that owners of the restaurant have registered the business as a corporation.

?

?

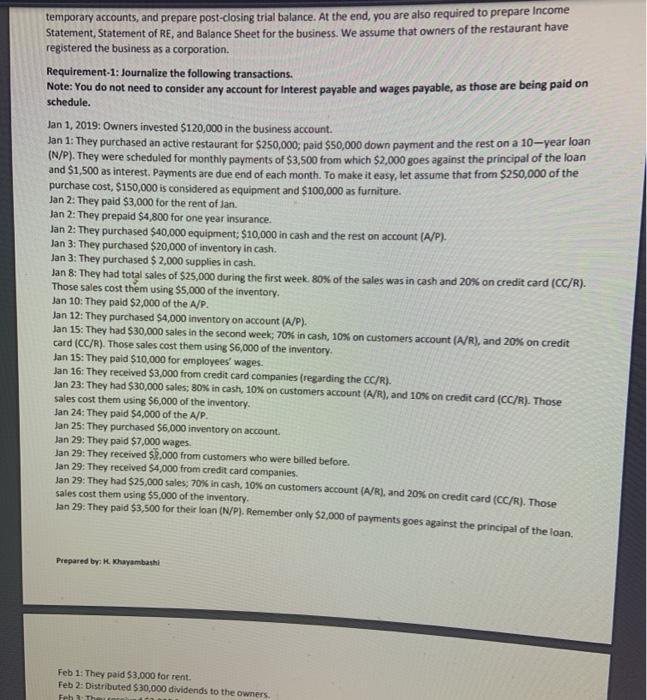

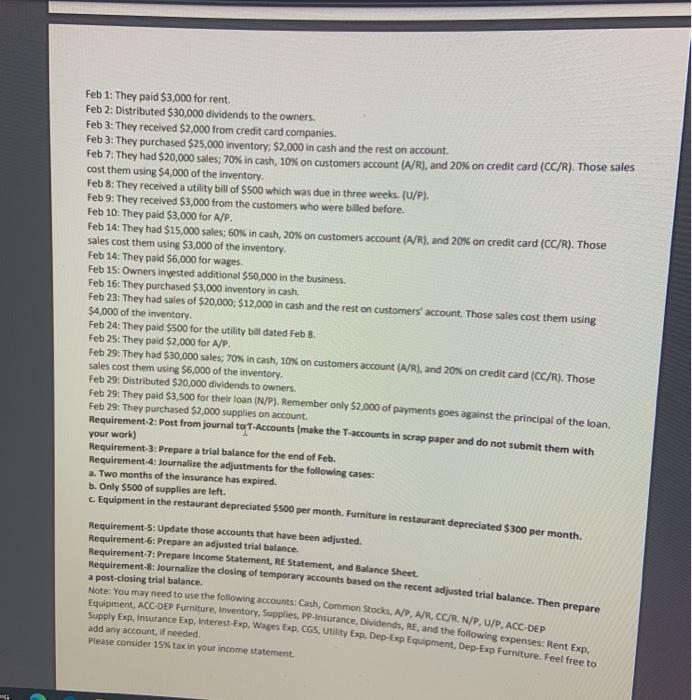

temporary accounts, and prepare post-closing trial balance. At the end, you are also required to prepare Income Statement, Statement of RE, and Balance Sheet for the business. We assume that owners of the restaurant have registered the business as a corporation. Requirement-1: Journalize the following transactions. Note: You do not need to consider any account for Interest payable and wages payable, as those are being paid on schedule. Jan 1, 2019: Owners invested $120,000 in the business account. Jan 1: They purchased an active restaurant for $250,000; paid $50,000 down payment and the rest on a 10-year loan (N/P). They were scheduled for monthly payments of $3,500 from which $2,000 goes against the principal of the loan and $1,500 as interest. Payments are due end of each month. To make it easy, let assume that from $250,000 of the purchase cost, $150,000 is considered as equipment and $100,000 as furniture. Jan 2: They paid $3,000 for the rent of Jan. Jan 2: They prepaid $4,800 for one year insurance. Jan 2: They purchased $40,000 equipment; $10,000 in cash and the rest on account (A/P). Jan 3: They purchased $20,000 of inventory in cash. Jan 3: They purchased $2,000 supplies in cash. Jan 8: They had total sales of $25,000 during the first week. 80% of the sales was in cash and 20% on credit card (CC/R). Those sales cost them using $5,000 of the inventory. Jan 10: They paid $2,000 of the A/P. Jan 12: They purchased $4,000 inventory on account (A/P). Jan 15: They had $30,000 sales in the second week; 70% in cash, 10% on customers account (A/R), and 20% on credit card (CC/R). Those sales cost them using $6,000 of the inventory. Jan 15: They paid $10,000 for employees' wages. Jan 16: They received $3,000 from credit card companies (regarding the CC/R). Jan 23: They had $30,000 sales; 80% in cash, 10% on customers account (A/R), and 10% on credit card (CC/R). Those sales cost them using $6,000 of the inventory. Jan 24: They paid $4,000 of the A/P. Jan 25: They purchased $6,000 inventory on account. Jan 29: They paid $7,000 wages. Jan 29: They received $2.000 from customers who were billed before. Jan 29: They received $4,000 from credit card companies. Jan 29: They had $25,000 sales; 70% in cash, 10% on customers account (A/R), and 20% on credit card (CC/R). Those sales cost them using $5,000 of the inventory. Jan 29: They paid $3,500 for their loan (N/P). Remember only $2,000 of payments goes against the principal of the loan. Prepared by: H. Khayambashi Feb 1: They paid $3,000 for rent. Feb 2: Distributed $30,000 dividends to the owners. Feb 3:Th

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

in light of the chegg policy a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started