Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tenggiri Bhd (TB) began business at the start of the current year and maintains its accounting records on an absorption-cost basis. The following selected

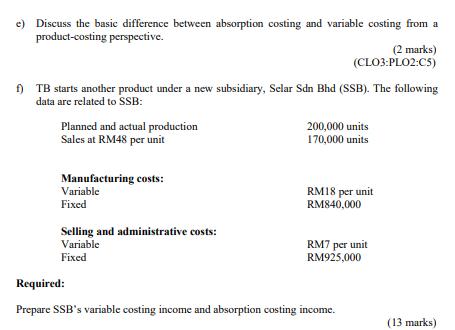

Tenggiri Bhd (TB) began business at the start of the current year and maintains its accounting records on an absorption-cost basis. The following selected information appeared on the company's profit or loss statement and end-of-year statement of financial position: Profit or Loss Data: Sales revenues (35,000 units @ RM24) Gross Margin Total sales and administrative expenses RM 840,000 210,000 160,000 Financial Position Data: Ending finished-goods inventory (12,000 units) 216,0000 There is no beginning finished-goods inventory. TB achieved its planned production level for the year. The company's fixed manufacturing overhead totaled RM188,000, and the firm paid a 10% commission based on gross sales (RM) to its sales force. Required: a) Compute the number of units that TB planned to produce during the year. (2 marks) (CLO3:PLO2:C2) b) Compute the fixed manufacturing overhead per unit for TB. (2 marks) (CLO3:PLO2:C2) c) Compute TB's cost of goods sold using absorption costing. (3 marks) (CLO3:PLO2:C2) d) Compute the variable cost per unit for TB using absorption costing. (3 marks) (CLO3:PLO2:C2) e) Discuss the basic difference between absorption costing and variable costing from a product-costing perspective. (2 marks) (CLO3:PLO2:CS) ) TB starts another product under a new subsidiary, Sclar Sdn Bhd (SSB). The following data are related to sSB: Planned and actual production Sales at RM48 per unit 200,000 units 170,000 units Manufacturing costs: Variable RM18 per unit RM840,000 Fixed Selling and administrative costs: Variable RM7 per unit RM925,000 Fixed Required: Prepare SSB's variable costing income and absorption costing income. (13 marks)

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Step 1 Given that Tenggiri Bhd started business in the current year There is no beginning fin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started