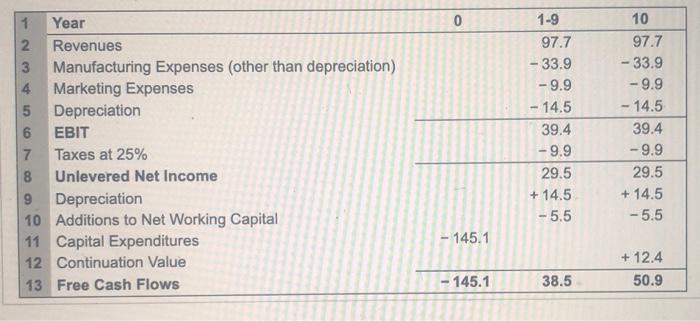

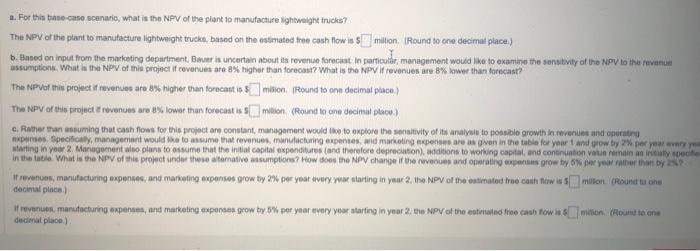

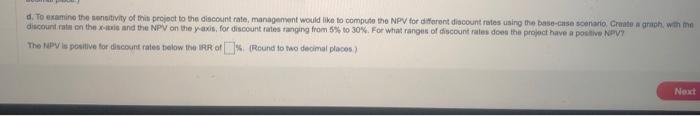

Tent is currently evaluating a proposal to buld a plant that wil manulacture ighitioight trucks. Bavuer plans to use a cost of captal of 12 is b. Based on input from the marketing department, Anver is tancertain abture lightweight trucks? e. Ruper than assuming that cash flow for this project are constant management What is the NPV if revenues are 8% lower than forecash? \begin{tabular}{|llrrr|} \hline 1 & Year & 0 & 19 & 10 \\ 2 & Revenues & & 97.7 & 97.7 \\ 3 & Manufacturing Expenses (other than depreciation) & & -33.9 & -33.9 \\ 4 & Marketing Expenses & & -9.9 & -9.9 \\ 5 & Depreciation & & -14.5 & -14.5 \\ 6 & EBIT & & 39.4 & 39.4 \\ 7 & Taxes at 25\% & & -9.9 & -9.9 \\ 8 & Unlevered Net Income & & 29.5 & 29.5 \\ 9 & Depreciation & & +14.5 & +14.5 \\ 10 & Additions to Net Working Capital & -5.5 & -5.5 \\ 11 & Capital Expenditures & -145.1 & & \\ 12 & Continuation Value & & & +12.4 \\ 13 & Free Cash Flows & -145.1 & 38.5 & 50.9 \\ \hline \end{tabular} a. For this bane-case ecenario, what is the NPV of the piant to manufacture Ightwoight trucks? The NPV of the plant to manufacture lightweight trucks, based on the estimated free cash flow is \& million. (Round to one decimad place.) b. Hnsed on input from the marketing department, Baver is uncertain about its revenue forecast in particulde, management would like to examine the sensitily of the Npy to the fevanue assumptions. What is the NPV of thin project if covenues are 8% higher than forecast? What is the NPV if revenues are 8% lower than forecast? The NPvof this project if revenues are 8 higher than forecast is s millon. (Round to one decimal place.) The NPV of this project if revenues are aN, lower than forecast is 5 milion (Round to one decimat place.) If revenues, manufacturing expenses, and marketing eupenses grow by 2% per year avery year starting in year 2. the NPV of the eatrratad frae cash flow is I decimal place.) If revenues, marstacturing expenses, and markeling exponses grow by 5\% per year every yoer atarting in ynar 2, the NPV of the eatimaled froe cash fow in s. decimal place.) The fapy Is positive tor discourd rates below the IRR of 14. (Reund to tao decimat places? Tent is currently evaluating a proposal to buld a plant that wil manulacture ighitioight trucks. Bavuer plans to use a cost of captal of 12 is b. Based on input from the marketing department, Anver is tancertain abture lightweight trucks? e. Ruper than assuming that cash flow for this project are constant management What is the NPV if revenues are 8% lower than forecash? \begin{tabular}{|llrrr|} \hline 1 & Year & 0 & 19 & 10 \\ 2 & Revenues & & 97.7 & 97.7 \\ 3 & Manufacturing Expenses (other than depreciation) & & -33.9 & -33.9 \\ 4 & Marketing Expenses & & -9.9 & -9.9 \\ 5 & Depreciation & & -14.5 & -14.5 \\ 6 & EBIT & & 39.4 & 39.4 \\ 7 & Taxes at 25\% & & -9.9 & -9.9 \\ 8 & Unlevered Net Income & & 29.5 & 29.5 \\ 9 & Depreciation & & +14.5 & +14.5 \\ 10 & Additions to Net Working Capital & -5.5 & -5.5 \\ 11 & Capital Expenditures & -145.1 & & \\ 12 & Continuation Value & & & +12.4 \\ 13 & Free Cash Flows & -145.1 & 38.5 & 50.9 \\ \hline \end{tabular} a. For this bane-case ecenario, what is the NPV of the piant to manufacture Ightwoight trucks? The NPV of the plant to manufacture lightweight trucks, based on the estimated free cash flow is \& million. (Round to one decimad place.) b. Hnsed on input from the marketing department, Baver is uncertain about its revenue forecast in particulde, management would like to examine the sensitily of the Npy to the fevanue assumptions. What is the NPV of thin project if covenues are 8% higher than forecast? What is the NPV if revenues are 8% lower than forecast? The NPvof this project if revenues are 8 higher than forecast is s millon. (Round to one decimal place.) The NPV of this project if revenues are aN, lower than forecast is 5 milion (Round to one decimat place.) If revenues, manufacturing expenses, and marketing eupenses grow by 2% per year avery year starting in year 2. the NPV of the eatrratad frae cash flow is I decimal place.) If revenues, marstacturing expenses, and markeling exponses grow by 5\% per year every yoer atarting in ynar 2, the NPV of the eatimaled froe cash fow in s. decimal place.) The fapy Is positive tor discourd rates below the IRR of 14. (Reund to tao decimat places