Answered step by step

Verified Expert Solution

Question

1 Approved Answer

teresa purchased a necklace for 100 in 1966 teresa gave the necklace to her granddaughter in 2016. at the time the gift had an appraised

teresa purchased a necklace for 100 in 1966 teresa gave the necklace to her granddaughter in 2016. at the time the gift had an appraised value of 850 granddaughter sold necklace for 1200 what is the granddaughters gain from sale

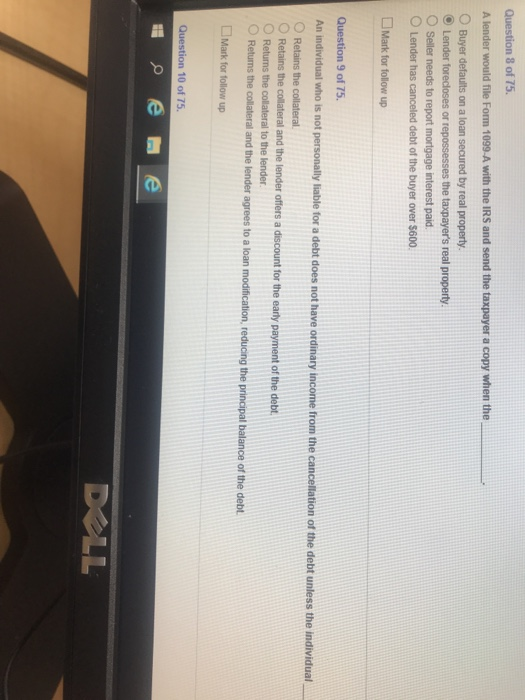

Question 8 of 75. A lender would file Form 1099-A with the IRS and send the taxpayer a copy when the Buyer defaults on a loan secured by real property. Lender forecloses or repossesses the taxpayer's real property. Seller needs to report mortgage interest paid. Lender has canceled debt of the buyer over $600 Mark for follow up Question 9 of 75. An individual who is not personally liable for a debt does not have ordinary income from the cancellation of the debt unless the individual Retains the collateral Retains the collateral and the fender offers a discount for the early payment of the debt. O Returns the collateral to the lender Returns the collateral and the lender agrees to a loan modification, reducing the principal balance of the debt Mark for follow up Question 10 of 75. e e DELL Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started