Answered step by step

Verified Expert Solution

Question

1 Approved Answer

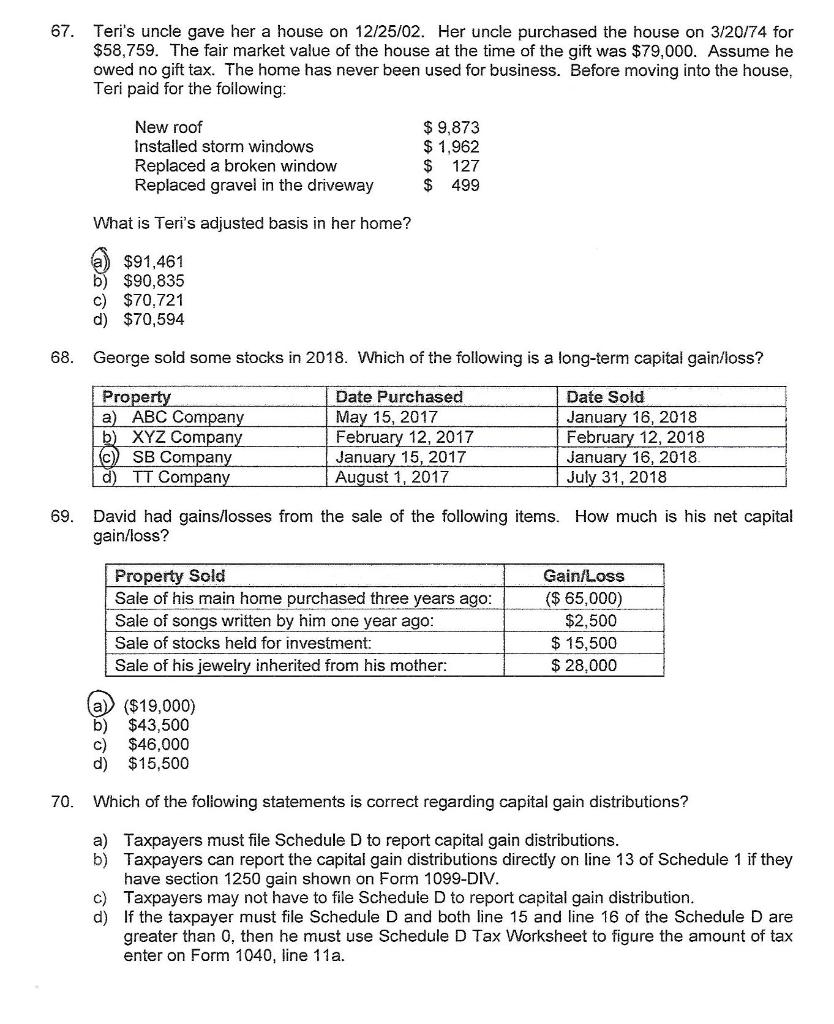

67. Teri's uncle gave her a house on 12/25/02. Her uncle purchased the house on 3/20/74 for $58,759. The fair market value of the

67. Teri's uncle gave her a house on 12/25/02. Her uncle purchased the house on 3/20/74 for $58,759. The fair market value of the house at the time of the gift was $79,000. Assume he owed no gift tax. The home has never been used for business. Before moving into the house, Teri paid for the following: 68. 69. 70. New roof Installed storm windows Replaced a broken window Replaced gravel in the driveway What is Teri's adjusted basis in her home? $91,461 b) $90,835 c) $70,721 d) $70,594 Property a) ABC Company b) XYZ Company George sold some stocks in 2018. Which of the following is a long-term capital gain/loss? Date Purchased May 15, 2017 February 12, 2017 Date Sold January 16, 2018 February 12, 2018 January 16, 2018. January 15, 2017 August 1, 2017 July 31, 2018 (c) SB Company d) TT Company $ 9,873 $ 1,962 $ $ 127 499 David had gains/losses from the sale of the following items. How much is his net capital gain/loss? a) ($19,000) b) $43,500 C) $46,000 d) $15,500 c) d) Property Sold Sale of his main home purchased three years ago: Sale of songs written by him one year ago: Sale of stocks held for investment: Sale of his jewelry inherited from his mother: Gain/Loss ($ 65,000) $2,500 $15,500 $ 28,000 Which of the following statements is correct regarding capital gain distributions? a) Taxpayers must file Schedule D to report capital gain distributions. b) Taxpayers can report the capital gain distributions directly on line 13 of Schedule 1 if they have section 1250 gain shown on Form 1099-DIV. Taxpayers may not have to file Schedule D to report capital gain distribution. If the taxpayer must file Schedule D and both line 15 and line 16 of the Schedule D are greater than 0, then he must use Schedule D Tax Worksheet to figure the amount of tax enter on Form 1040, line 11a.

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Question 67 Question 68 Option C would be the proper response to this This is the correct response since a schedule D is not necessary when just a cap...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started