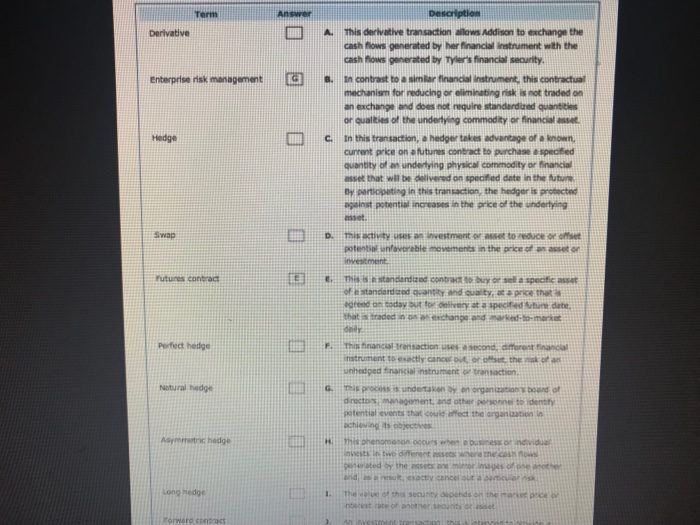

Term Answer This derlvative transaction ailows Addison to enchange the cash fows generated by her financial instrument with the cash fiows generated by Tyler's financial security enterprise risk managment G In contrast to a simer financia nstument, this contractual mechanism for reducing or eliminating risk is not traded on an exchang and does not require standerdized quantities or qualties of the undertying commodity or financial asset Hedge C In this transaction, a hedger takes advantage of a known current price on futures contract to prchase spected quantity of an underying physical commodity or financial asset that will be delivered on specified date in the utue Dy perticpnting in this transaction the hedger is protcted against potential increaps in the price of the underlying Swap D. this activity uses an investment or asset to reduce or offt potential unfavoreble movements in the price of as asset on Putures contrac T stnddizod contrat to buy or sell a specific asset ofestanderdized qanty and uaity, at a price that s greed on today t o delivery at a specited tune dets that is traded ioa exchange and marked-ormarkt Perfect hetdge P This financsl arensaction usessecond, fferent tnancal nstrument to esactly CaNor offset the nisk of an unhedpednancialnstrument or transaction drectosmanagement, and other personne to identy potential events that could offect the organatin achieving its ojectives Asrmmetric hedge Long hedge 1. The value of his security pnds n th narest rate of anctner security or usset rorware coneract Term Answer This derlvative transaction ailows Addison to enchange the cash fows generated by her financial instrument with the cash fiows generated by Tyler's financial security enterprise risk managment G In contrast to a simer financia nstument, this contractual mechanism for reducing or eliminating risk is not traded on an exchang and does not require standerdized quantities or qualties of the undertying commodity or financial asset Hedge C In this transaction, a hedger takes advantage of a known current price on futures contract to prchase spected quantity of an underying physical commodity or financial asset that will be delivered on specified date in the utue Dy perticpnting in this transaction the hedger is protcted against potential increaps in the price of the underlying Swap D. this activity uses an investment or asset to reduce or offt potential unfavoreble movements in the price of as asset on Putures contrac T stnddizod contrat to buy or sell a specific asset ofestanderdized qanty and uaity, at a price that s greed on today t o delivery at a specited tune dets that is traded ioa exchange and marked-ormarkt Perfect hetdge P This financsl arensaction usessecond, fferent tnancal nstrument to esactly CaNor offset the nisk of an unhedpednancialnstrument or transaction drectosmanagement, and other personne to identy potential events that could offect the organatin achieving its ojectives Asrmmetric hedge Long hedge 1. The value of his security pnds n th narest rate of anctner security or usset rorware coneract