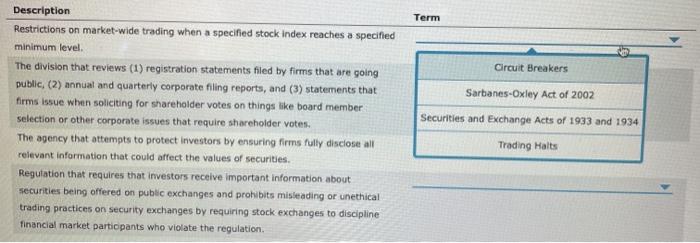

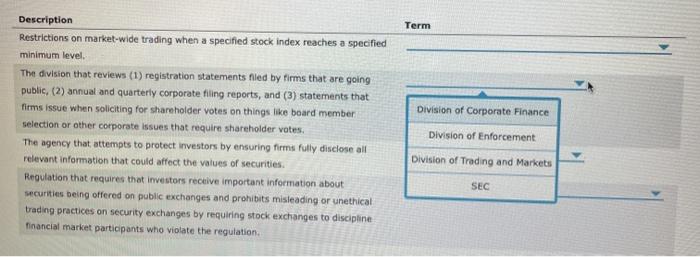

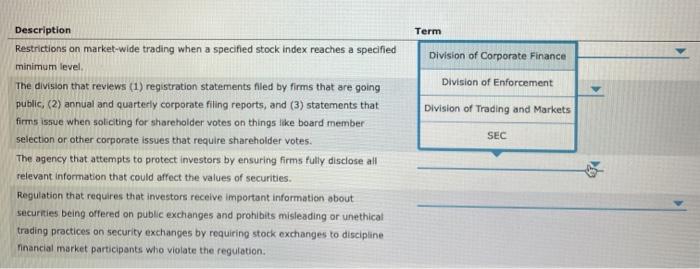

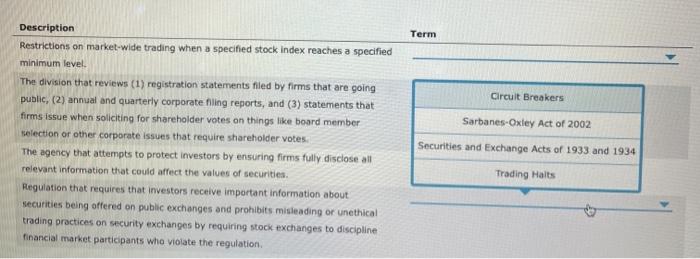

Term Circuit Breakers Description Restrictions on market-wide trading when a specified stock Index reaches a specified minimum level The division that reviews (1) registration statements filed by firms that are going public, (2) annual and quarterly corporate filing reports, and (3) statements that firms issue when soliciting for shareholder votes on things like board member selection or other corporate issues that require shareholder votes. The agency that attempts to protect Investors by ensuring firms fully disclose all relevant information that could affect the values of securities Regulation that requires that investors receive important information about securities being offered on public exchanges and prohibits misleading or unethical trading practices on security exchanges by requiring stock exchanges to discipline financial market participants who violate the regulation Sarbanes-Oxley Act of 2002 Securities and Exchange Acts of 1933 and 1934 Trading Halts Term Division of Corporate Finance Description Restrictions on market-wide trading when a specified stock index reaches a specified minimum level. The division that reviews (1) registration statements filed by firms that are going public, (2) annual and quarterly corporate filing reports, and (3) statements that firms issue when soliciting for shareholder votes on things like board memberi selection or other corporate Issues that require shareholder votes The agency that attempts to protect investors by ensuring firms fully disclose all relevant information that could affect the values of securities. Regulation that requires that investors receive important information about securities being offered on public exchanges and prohibits misleading or unethical trading practices on security exchanges by requiring stock exchanges to discipline financial market participants who violate the regulation Division of Enforcement Division of Trading and Markets SEC Term Division of Corporate Finance Division of Enforcement Division of Trading and Markets SEC Description Restrictions on market-wide trading when a specified stock index reaches a specified minimum level The division that reviews (1) registration statements filed by firms that are going public, (2) annual and quarterly corporate filing reports, and (3) statements that firms issue when soliciting for shareholder votes on things like board member selection or other corporate issues that require shareholder votes. The agency that attempts to protect investors by ensuring firms fully disclose all relevant information that could affect the values of securities. Regulation that requires that investors receive important information about securities being offered on public exchanges and prohibits misleading or unethicat trading practices on security exchanges by requiring stock exchanges to discipline Tinancial market participants who violate the regulation Term Circuit Breakers Sarbanes-Oxley Act of 2002 Description Restrictions on market-wide trading when a specified stock Index reaches a specified minimum level The division that reviews (1) registration statements filed by firms that are going public, (2) annual and quarterly corporate filing reports, and (3) statements that firms issue when soliciting for shareholder votes on things like board member selection or other corporate issues that require shareholder votes The agency that attempts to protect investors by ensuring firms fully disclose all relevant information that could affect the values of securities Regulation that requires that investors receive important information about securities being offered on public exchanges and prohibits misleading or unethical trading practices on security exchanges by requiring stock exchanges to discipline financial market participants who violate the regulation Securities and Exchange Acts of 1933 and 1934 Trading Haits