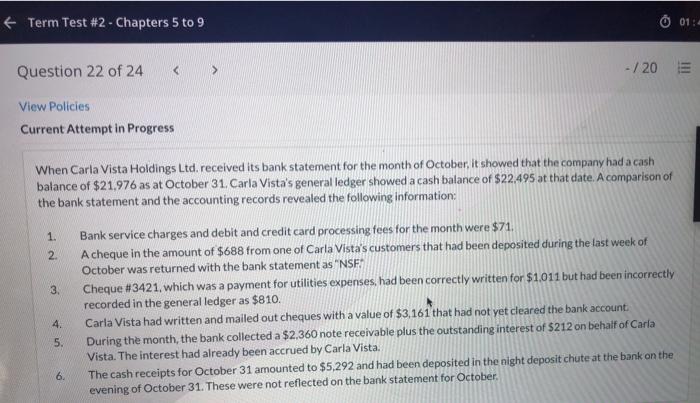

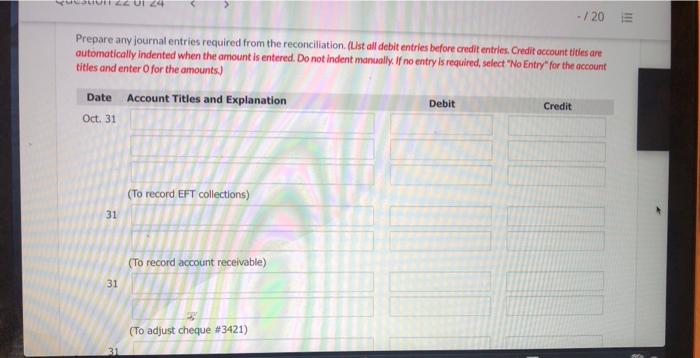

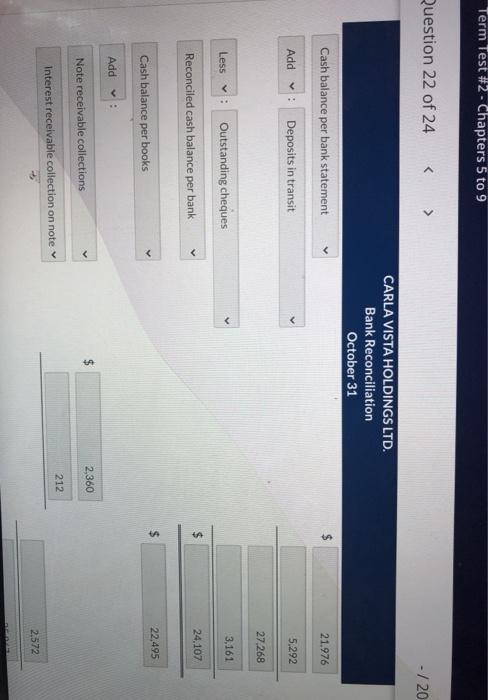

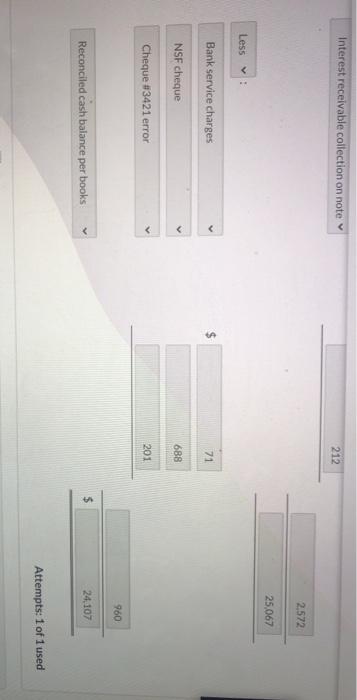

+ Term Test #2 - Chapters 5 to 9 01:4 Question 22 of 24 > - /20 View Policies Current Attempt in Progress When Carla Vista Holdings Ltd. received its bank statement for the month of October, it showed that the company had a cash balance of $21.976 as at October 31. Carla Vista's general ledger showed a cash balance of $22.495 at that date. A comparison of the bank statement and the accounting records revealed the following information: 1. 2. 3. Bank service charges and debit and credit card processing fees for the month were $71. Acheque in the amount of $688 from one of Carla Vista's customers that had been deposited during the last week of October was returned with the bank statement as "NSE Cheque #3421, which was a payment for utilities expenses, had been correctly written for $1011 but had been incorrectly recorded in the general ledger as $810. Carla Vista had written and mailed out cheques with a value of $3,161 that had not yet cleared the bank account. During the month, the bank collected a $2,360 note receivable plus the outstanding interest of 5212 on behalf of Caria Vista. The interest had already been accrued by Carla Vista. The cash receipts for October 31 amounted to $5,292 and had been deposited in the night deposit chute at the bank on the evening of October 31. These were not reflected on the bank statement for October. 4. 5. 6. - /20 E Prepare any journal entries required from the reconciliation (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Tities and Explanation Oct. 31 Debit Credit (To record EFT collections 31 (To record account receivable) 31 (To adjust cheque #3421) Term Test #2 - Chapters 5 to 9 Question 22 of 24 - /20 CARLA VISTA HOLDINGS LTD. Bank Reconciliation October 31 Cash balance per bank statement 21.976 Add : Deposits in transit 5.292 27 268 Less Outstanding cheques 3,161 TA 24.107 Reconciled cash balance per bank $ 22,495 Cash balance per books Add 2,360 Note receivable collections 212 Interest receivable collection on note 2,572 Interest receivable collection on note 212 2,572 25.067 Less: Bank service charges A 71 NSF cheque 688 Cheque #3421 error 201 960 Reconciled cash balance per books 24.107 Attempts: 1 of 1 used