Answered step by step

Verified Expert Solution

Question

1 Approved Answer

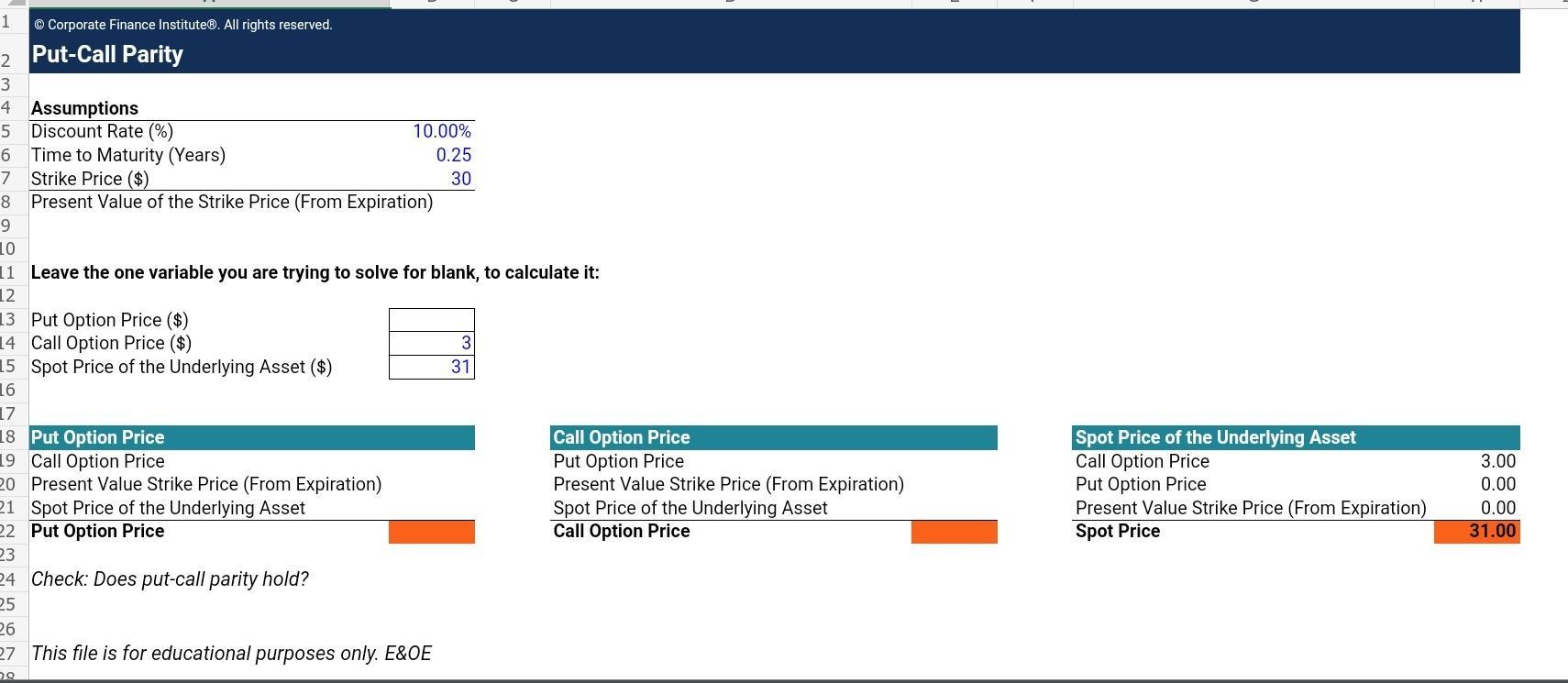

1 Corporate Finance Institute. All rights reserved. Put-Call Parity 2 3 4 Assumptions 5 Discount Rate (%) 6 Time to Maturity (Years) 7 Strike

1 Corporate Finance Institute. All rights reserved. Put-Call Parity 2 3 4 Assumptions 5 Discount Rate (%) 6 Time to Maturity (Years) 7 Strike Price ($) 8 Present Value of the Strike Price (From Expiration) 9 10 11 Leave the one variable you are trying to solve for blank, to calculate it: 12 13 Put Option Price ($) 14 Call Option Price ($) 15 Spot Price of the Underlying Asset ($) 16 17 18 Put Option Price 19 Call Option Price 20 10.00% 0.25 30 Present Value Strike Price (From Expiration) 21 Spot Price of the Underlying Asset 22 Put Option Price 23 24 Check: Does put-call parity hold? 25 26 27 This file is for educational purposes only. E&OE 28 3 31 Call Option Price Put Option Price Present Value Strike Price (From Expiration) Spot Price of the Underlying Asset Call Option Price Spot Price of the Underlying Asset Call Option Price Put Option Price Present Value Strike Price (From Expiration) Spot Price 3.00 0.00 0.00 31.00

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 PutCall Parity Assuming that the underlying asset is a stock putcall parity states that the following relationship holds C S P PVK where C call option price S spot price of the underlying asset P pu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started