Answered step by step

Verified Expert Solution

Question

1 Approved Answer

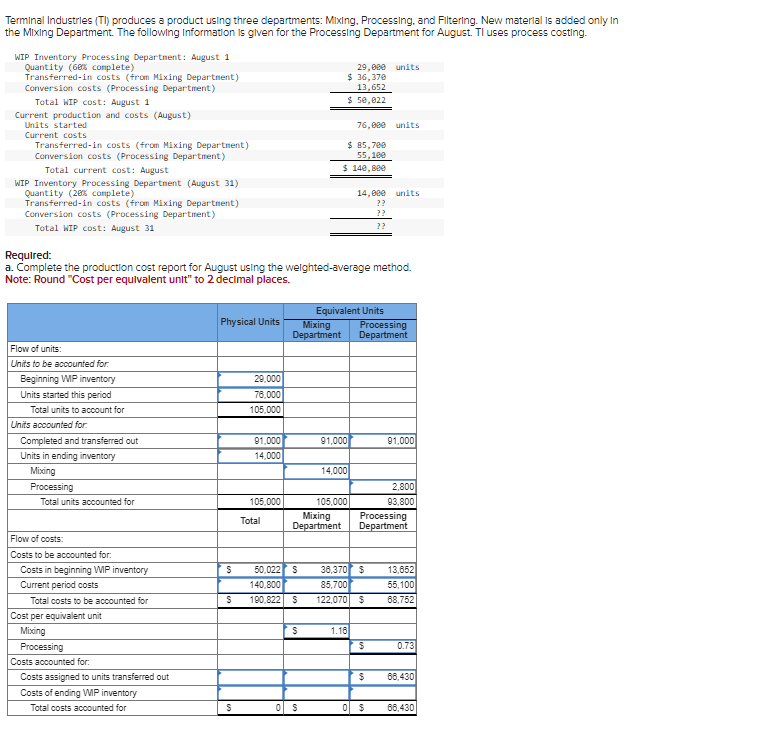

Terminal Industries (TI) produces a product using three departments: Mixing, Processing, and Filtering. New material is added only in the Mixing Department. The following

Terminal Industries (TI) produces a product using three departments: Mixing, Processing, and Filtering. New material is added only in the Mixing Department. The following Information is given for the Processing Department for August. Tl uses process costing. WIP Inventory Processing Department: August 1 Quantity (68% complete) Transferred-in costs (from Mixing Department) Conversion costs (Processing Department) Total WIP cost: August 1 Current production and costs (August) Units started Current costs Transferred-in costs (from Mixing Department) Conversion costs (Processing Department) Total current cost: August WIP Inventory Processing Department (August 31) Quantity (20% complete) Transferred-in costs (from Mixing Department) Conversion costs (Processing Department) Total WIP cost: August 31 Required: 29,000 units $ 36,370 13,652 $ 50,022 76,000 units $ 85,700 55,100 $ 140,800 14,000 units ?? ?? ?? a. Complete the production cost report for August using the weighted-average method. Note: Round "Cost per equivalent unit" to 2 decimal places. Equivalent Units Physical Units Mixing Department Processing Department Flow of units: Units to be accounted for. Beginning WIP inventory 29,000 Units started this period 78,000 Total units to account for 105,000 Units accounted for. Completed and transferred out 91,000 91,000 91,000 Units in ending inventory 14,000 Mixing 14,000 Processing 2,800 Total units accounted for 105,000 105,000 93,800 Mixing Processing Total Department Department Flow of costs: Costs to be accounted for: Costs in beginning WIP inventory S 50,022 $ 38,370 $ 13,652 Current period costs Total costs to be accounted for S 140,800 190,822 $ 85,700 55,100 122,070 $ 68,752 Cost per equivalent unit Mixing Processing S 1.16 $ 0.73 Costs accounted for: Costs assigned to units transferred out $ 66,430 Costs of ending WIP inventory Total costs accounted for $ 0 $ 0 $ 66,430

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started