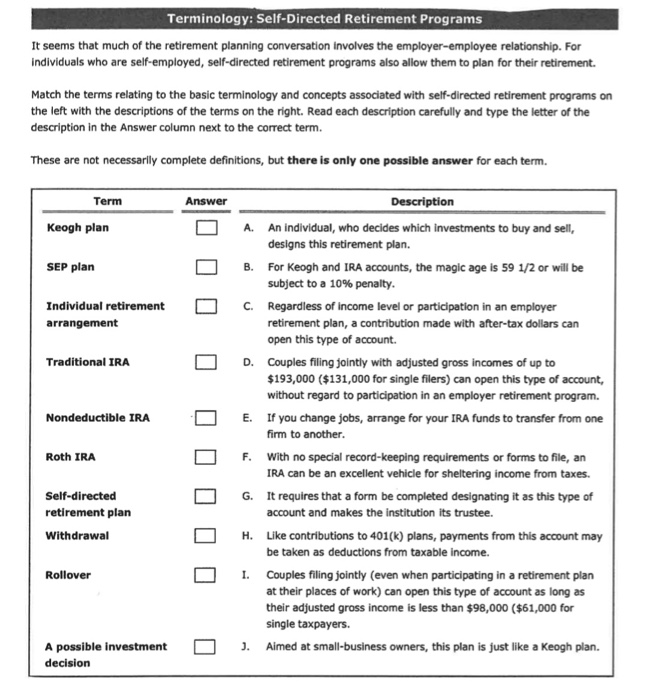

Terminology: Self-Directed Retirement Programs It seems that much of the retirement planning conversation involves the employer-employee relationship. For individuals who are self-employed, self-directed retirement programs also allow them to plan for their retirement. Match the terms relating to the basic terminology and concepts associated with self-directed retirement programs on the left with the descriptions of the terms on the right. Read each description carefully and type the letter of the description in the Answer column next to the correct term. These are not necessarily complete definitions, but there is only one possible answer for each term. Term Answer Description A An individual, who decides which investments to buy and sell, Keogh plan designs this retirement plan. SEP plan B. For Keogh and IRA accounts, the magic age is 59 1/2 or will be subject to a 10% penalty Individual retirement c. Regardless of income level or particdpation in an employer arrangement retirement plan, a contribution made with after-tax dollars can open this type of account. Traditional IRA D. Couples filing jointly with adjusted gross incomes of up to 193,000 ($131,000 for single filers) can open this type of account, without regard to participation in an employer retirement program. If you change jobs, arrange for your IRA funds to transfer from one firm to another Nondeductible IRAE. F. With no special record-keeping requirements or forms to file, an G. requires that a form be completed designating it as this type of H. Like contributions to 401(k) plans, payments from this account may Roth IRA IRA can be an excellent vehicle for sheltering income from taxes. Self-directed retirement plan Withdrawal account and makes the institution its trustee. be taken as deductions from taxable income. Rollover I Couples filing jointly (even when participating in a retirement plan at their places of work) can open this type of account as long as their adjusted gross income is less than $98,000 ($61,000 for single taxpayers. A possible investment . Aimed at smll-business owners, this plan is just like a Keogh plan. decision Terminology: Self-Directed Retirement Programs It seems that much of the retirement planning conversation involves the employer-employee relationship. For individuals who are self-employed, self-directed retirement programs also allow them to plan for their retirement. Match the terms relating to the basic terminology and concepts associated with self-directed retirement programs on the left with the descriptions of the terms on the right. Read each description carefully and type the letter of the description in the Answer column next to the correct term. These are not necessarily complete definitions, but there is only one possible answer for each term. Term Answer Description A An individual, who decides which investments to buy and sell, Keogh plan designs this retirement plan. SEP plan B. For Keogh and IRA accounts, the magic age is 59 1/2 or will be subject to a 10% penalty Individual retirement c. Regardless of income level or particdpation in an employer arrangement retirement plan, a contribution made with after-tax dollars can open this type of account. Traditional IRA D. Couples filing jointly with adjusted gross incomes of up to 193,000 ($131,000 for single filers) can open this type of account, without regard to participation in an employer retirement program. If you change jobs, arrange for your IRA funds to transfer from one firm to another Nondeductible IRAE. F. With no special record-keeping requirements or forms to file, an G. requires that a form be completed designating it as this type of H. Like contributions to 401(k) plans, payments from this account may Roth IRA IRA can be an excellent vehicle for sheltering income from taxes. Self-directed retirement plan Withdrawal account and makes the institution its trustee. be taken as deductions from taxable income. Rollover I Couples filing jointly (even when participating in a retirement plan at their places of work) can open this type of account as long as their adjusted gross income is less than $98,000 ($61,000 for single taxpayers. A possible investment . Aimed at smll-business owners, this plan is just like a Keogh plan. decision