Answered step by step

Verified Expert Solution

Question

1 Approved Answer

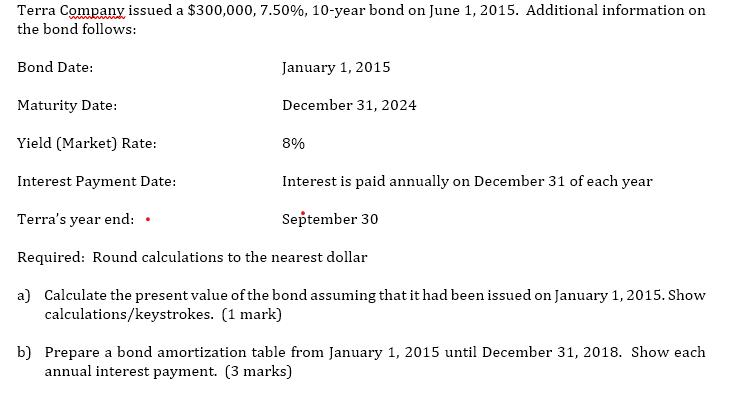

Terra Company issued a $300,000, 7.50%, 10-year bond on June 1, 2015. Additional information on the bond follows: Bond Date: January 1, 2015 Maturity

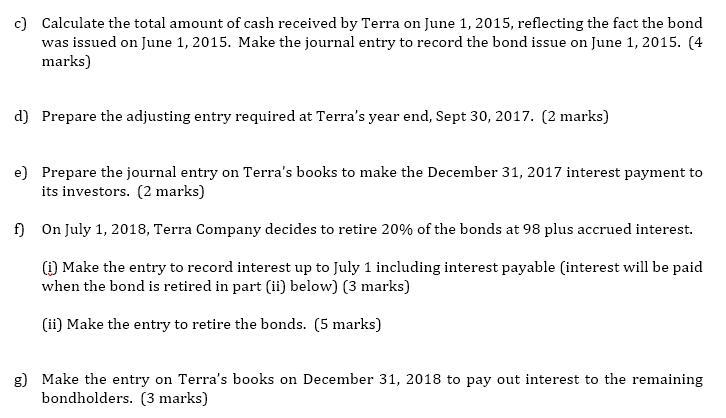

Terra Company issued a $300,000, 7.50%, 10-year bond on June 1, 2015. Additional information on the bond follows: Bond Date: January 1, 2015 Maturity Date: December 31, 2024 Yield (Market) Rate: 8% Interest Payment Date: Interest is paid annually on December 31 of each year Terra's year end: September 30 Required: Round calculations to the nearest dollar a) Calculate the present value of the bond assuming that it had been issued on January 1, 2015. Show calculations/keystrokes. (1 mark) b) Prepare a bond amortization table from January 1, 2015 until December 31, 2018. Show each annual interest payment. (3 marks) c) Calculate the total amount of cash received by Terra on June 1, 2015, reflecting the fact the bond was issued on June 1, 2015. Make the journal entry to record the bond issue on June 1, 2015. (4 marks) d) Prepare the adjusting entry required at Terra's year end, Sept 30, 2017. (2 marks) e) Prepare the journal entry on Terra's books to make the December 31, 2017 interest payment to its investors. (2 marks) f) On July 1, 2018, Terra Company decides to retire 20% of the bonds at 98 plus accrued interest. (1) Make the entry to record interest up to July 1 including interest payable (interest will be paid when the bond is retired in part (ii) below) (3 marks) (ii) Make the entry to retire the bonds. (5 marks) g) Make the entry on Terra's books on December 31, 2018 to pay out interest to the remaining bondholders. (3 marks)

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Face Value 300000 Coupon Payment 22500 Rate 8 Period 10 Present Value of Bonds 28993488 b ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started