Answered step by step

Verified Expert Solution

Question

1 Approved Answer

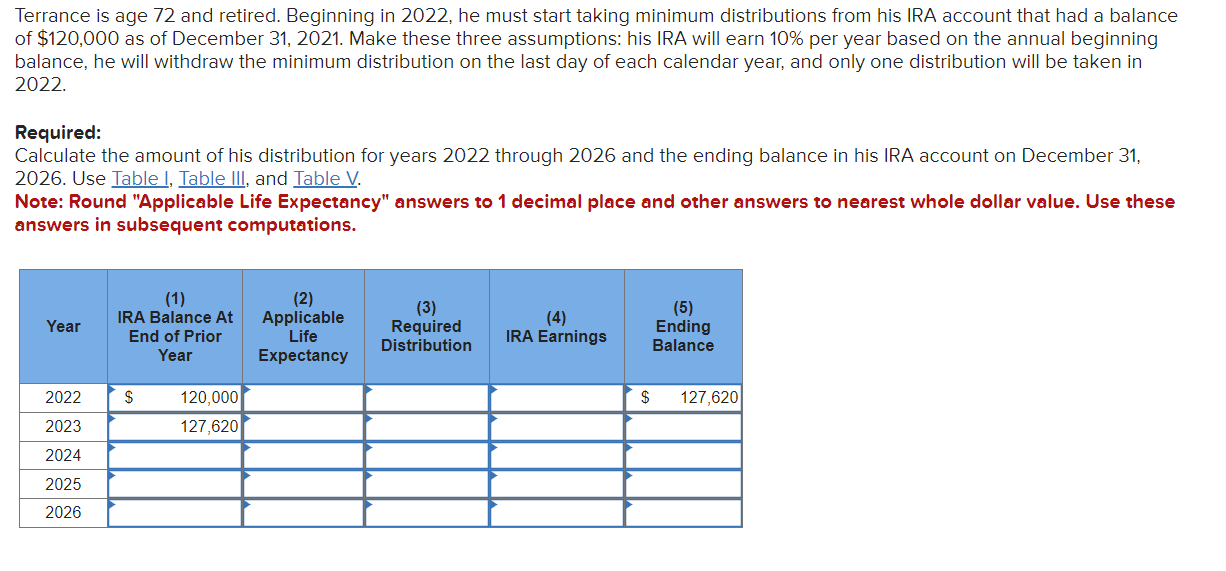

Terrance is age 72 and retired. Beginning in 2022, he must start taking minimum distributions from his IRA account that had a balance of

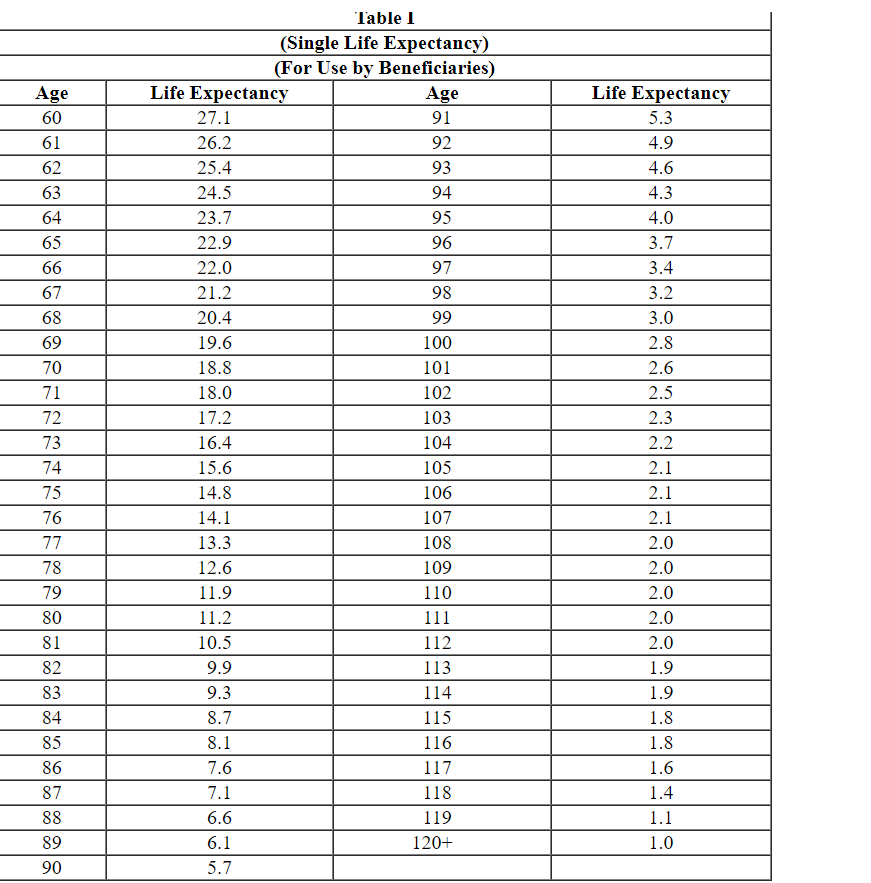

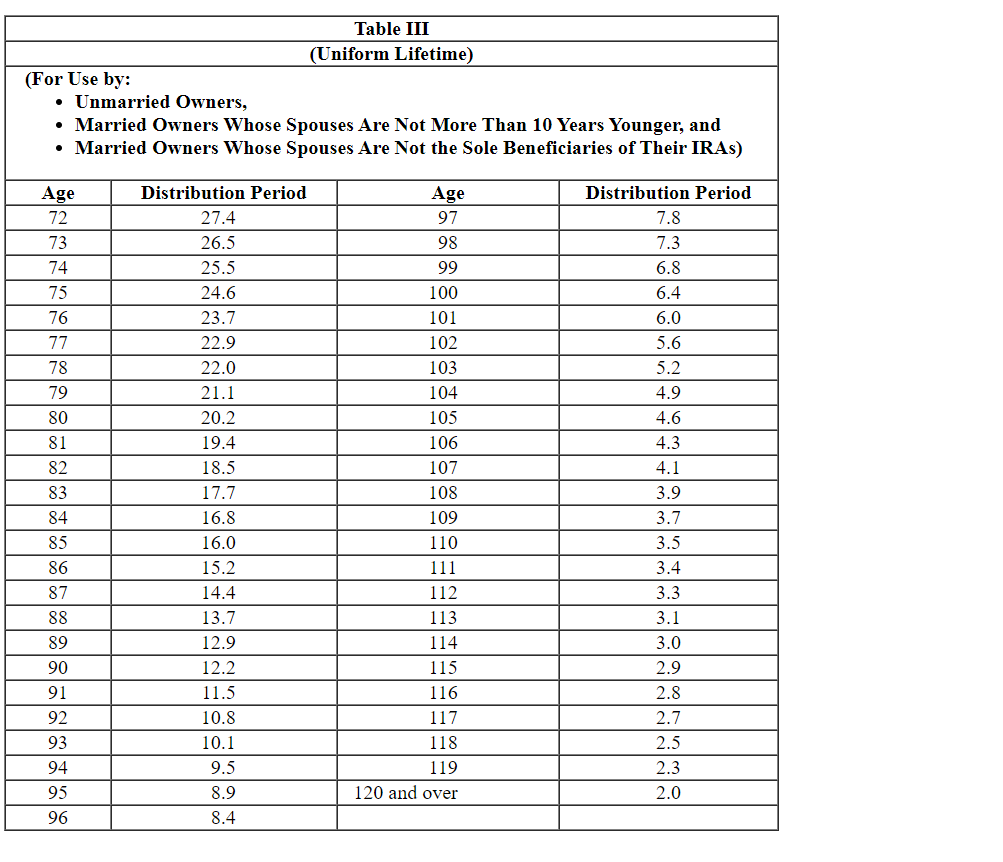

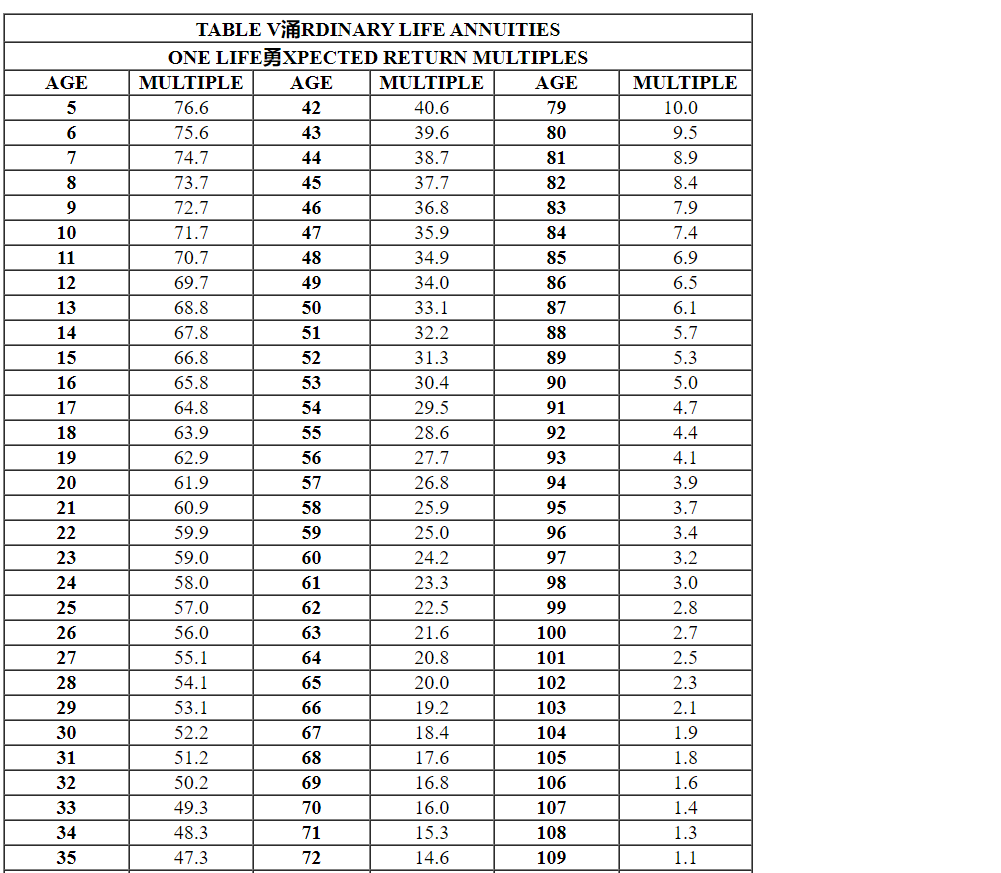

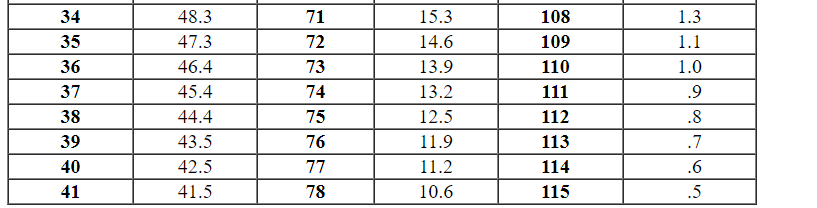

Terrance is age 72 and retired. Beginning in 2022, he must start taking minimum distributions from his IRA account that had a balance of $120,000 as of December 31, 2021. Make these three assumptions: his IRA will earn 10% per year based on the annual beginning. balance, he will withdraw the minimum distribution on the last day of each calendar year, and only one distribution will be taken in 2022. Required: Calculate the amount of his distribution for years 2022 through 2026 and the ending balance in his IRA account on December 31, 2026. Use Table I, Table III, and Table V. Note: Round "Applicable Life Expectancy" answers to 1 decimal place and other answers to nearest whole dollar value. Use these answers in subsequent computations. (1) IRA Balance At Year End of Prior Year (2) Applicable Life Expectancy (3) Required Distribution (4) IRA Earnings (5) Ending Balance 2022 $ 120,000 $ 127,620 2023 127,620 2024 2025 2026 Table 1 (Single Life Expectancy) (For Use by Beneficiaries) Age Life Expectancy Age Life Expectancy 60 27.1 91 5.3 61 26.2 92 4.9 62 25.4 93 4.6 63 24.5 94 4.3 64 23.7 95 4.0 65 22.9 96 3.7 66 22.0 97 3.4 67 21.2 98 3.2 68 20.4 99 3.0 69 19.6 100 2.8 70 18.8 101 2.6 71 18.0 102 2.5 72 17.2 103 2.3 73 16.4 104 2.2 74 15.6 105 2.1 75 14.8 106 2.1 76 14.1 107 2.1 77 13.3 108 2.0 78 12.6 109 2.0 79 11.9 110 2.0 80 11.2 111 2.0 81 10.5 112 2.0 82 9.9 113 1.9 83 9.3 114 1.9 84 8.7 115 1.8 85 8.1 116 1.8 86 7.6 117 1.6 87 7.1 118 1.4 88 6.6 119 1.1 89 6.1 120+ 1.0 90 5.7 (For Use by: Unmarried Owners, Table III (Uniform Lifetime) Distribution Period 27.4 Married Owners Whose Spouses Are Not More Than 10 Years Younger, and Married Owners Whose Spouses Are Not the Sole Beneficiaries of Their IRAs) Age 72 Age Distribution Period 97 7.8 73 26.5 98 7.3 74 25.5 99 6.8 75 24.6 100 6.4 76 23.7 101 6.0 77 22.9 102 5.6 78 22.0 103 5.2 79 21.1 104 4.9 80 20.2 105 4.6 81 19.4 106 4.3 82 18.5 107 4.1 83 17.7 108 3.9 84 16.8 109 3.7 85 16.0 110 3.5 86 15.2 111 3.4 87 14.4 112 3.3 222222222 88 13.7 113 3.1 89 12.9 114 3.0 90 12.2 115 2.9 91 11.5 116 2.8 92 10.8 117 2.7 93 10.1 118 2.5 94 9.5 119 2.3 95 8.9 120 and over 2.0 96 8.4 TABLE VIRDINARY LIFE ANNUITIES ONE LIFEXPECTED RETURN MULTIPLES AGE MULTIPLE AGE MULTIPLE AGE MULTIPLE 5 76.6 42 40.6 79 10.0 6 75.6 43 39.6 80 9.5 7 74.7 44 38.7 81 8.9 8 73.7 45 37.7 82 8.4 9 72.7 46 36.8 83 7.9 10 71.7 47 35.9 84 7.4 11 70.7 48 34.9 85 6.9 12 69.7 49 34.0 86 6.5 13 68.8 50 33.1 87 6.1 14 67.8 51 32.2 88 5.7 15 66.8 52 31.3 89 5.3 16 65.8 53 30.4 90 5.0 17 64.8 54 29.5 91 4.7 18 63.9 55 28.6 92 4.4 19 62.9 56 27.7 93 4.1 20 61.9 57 26.8 94 3.9 21 60.9 58 25.9 95 3.7 22 59.9 59 25.0 96 3.4 23 59.0 60 24.2 97 3.2 24 58.0 61 23.3 98 3.0 25 57.0 62 22.5 99 2.8 26 56.0 63 21.6 100 2.7 27 55.1 64 20.8 101 2.5 28 54.1 65 20.0 102 2.3 29 53.1 66 19.2 103 2.1 30 52.2 67 18.4 104 1.9 31 51.2 68 17.6 105 1.8 32 50.2 33 49.3 34 48.3 35 47.3 6772 69 16.8 106 1.6 70 16.0 107 1.4 71 15.3 108 1.3 14.6 109 1.1 34 48.3 71 15.3 108 1.3 35 47.3 72 14.6 109 1.1 36 46.4 73 13.9 110 1.0 37 45.4 74 13.2 111 .9 38 44.4 75 12.5 112 .8 39 43.5 76 11.9 113 .7 40 42.5 77 11.2 114 .6 41 41.5 78 10.6 115 .5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started