Answered step by step

Verified Expert Solution

Question

1 Approved Answer

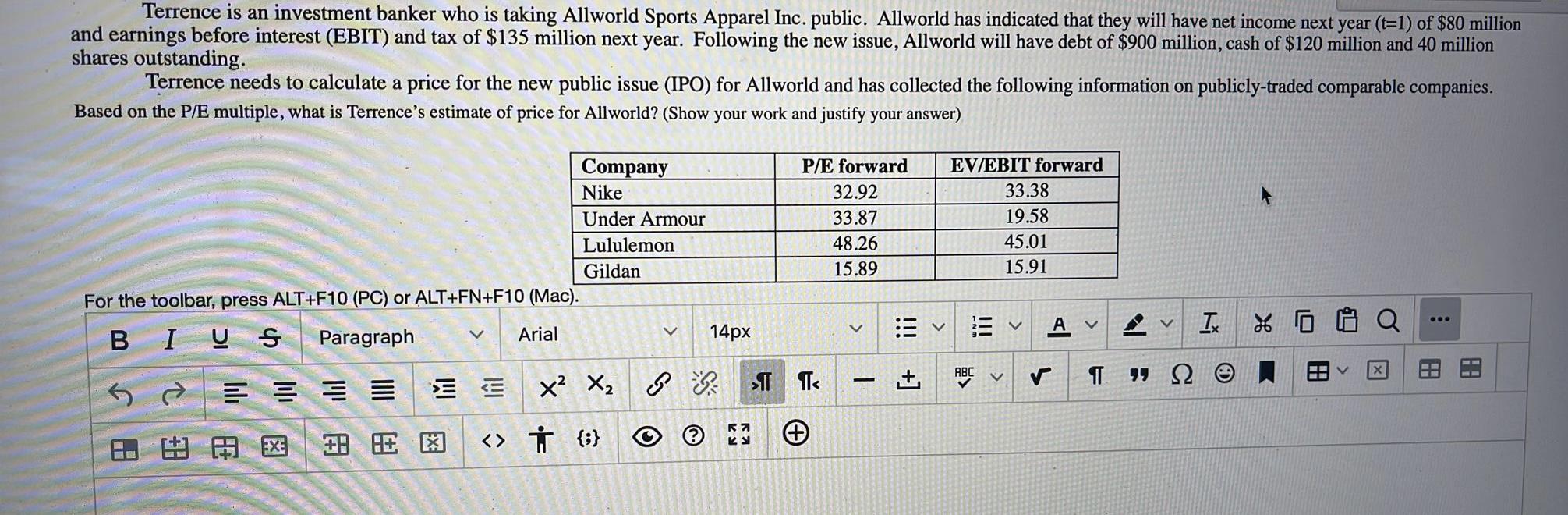

Terrence is an investment banker who is taking Allworld Sports Apparel Inc. public. Allworld has indicated that they will have net income next year

Terrence is an investment banker who is taking Allworld Sports Apparel Inc. public. Allworld has indicated that they will have net income next year (t-1) of $80 million and earnings before interest (EBIT) and tax of $135 million next year. Following the new issue, Allworld will have debt of $900 million, cash of $120 million and 40 million shares outstanding. Terrence needs to calculate a price for the new public issue (IPO) for Allworld and has collected the following information on publicly-traded comparable companies. Based on the P/E multiple, what is Terrence's estimate of price for Allworld? (Show your work and justify your answer) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph v Arial 5 C |||| = = = = E +8 8:0 Company Nike Under Armour Lululemon Gildan X X {;} V 14px 28 P/E forward 32.92 33.87 48.26 15.89 >ITT < R7 KU (+) V - + EV/EBIT forward ABC 33.38 19.58 45.01 15.91 V A V V Ix X Q X : 8.80 QUESTION 2 Based on the EV/EBIT, what is Terrence's estimate of price for Allworld? (show your work and justify your answer). For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph v Arial A EE EEEE X X EXE 38 80 13 T 14px < 57 KD + V : v - +] V A V I 15 HV

Step by Step Solution

★★★★★

3.47 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

To estimate the price for Allworld Sports Apparel Inc using the PE multiple and EVEBIT multiple Terrence can use the following calculations PE Multipl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started