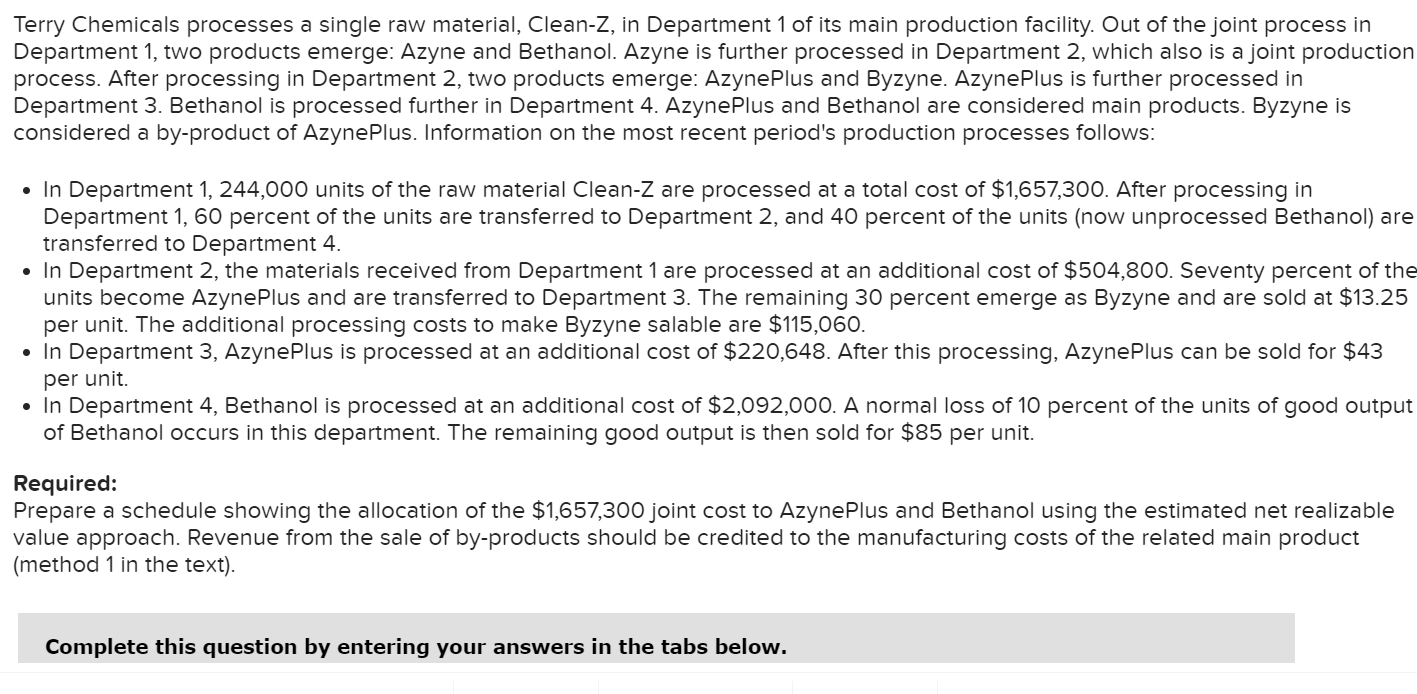

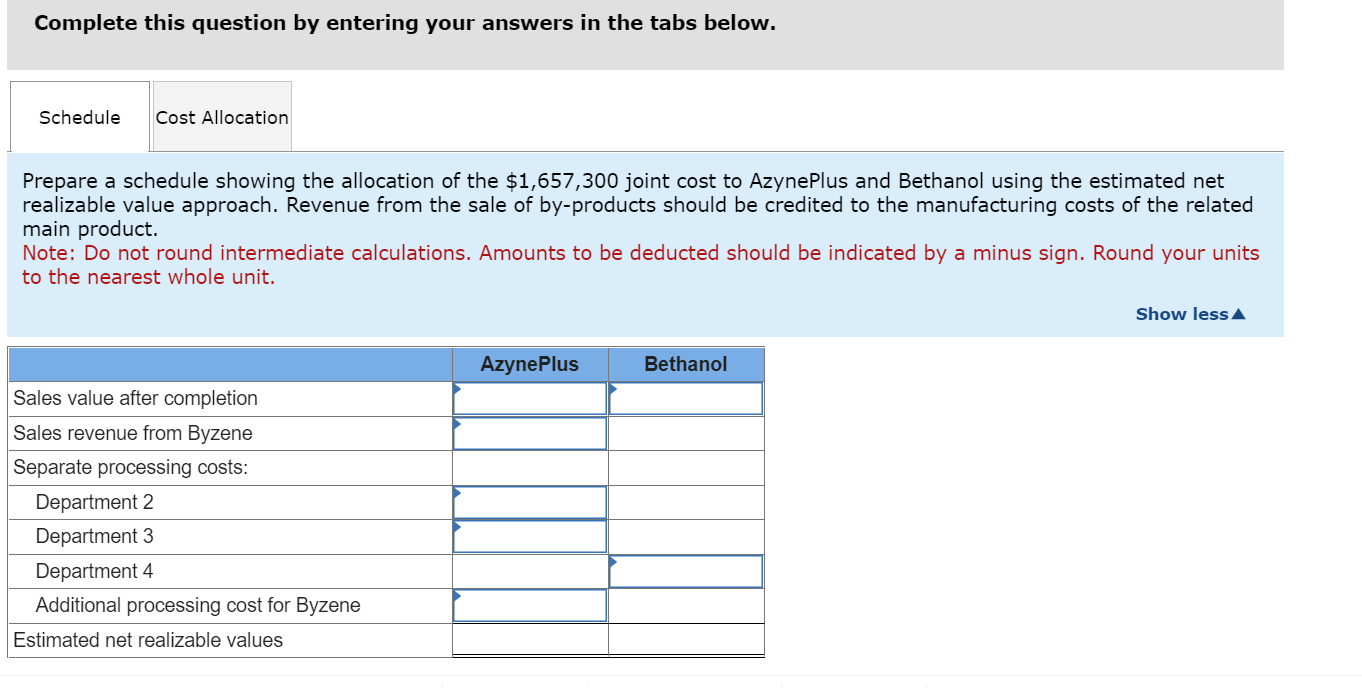

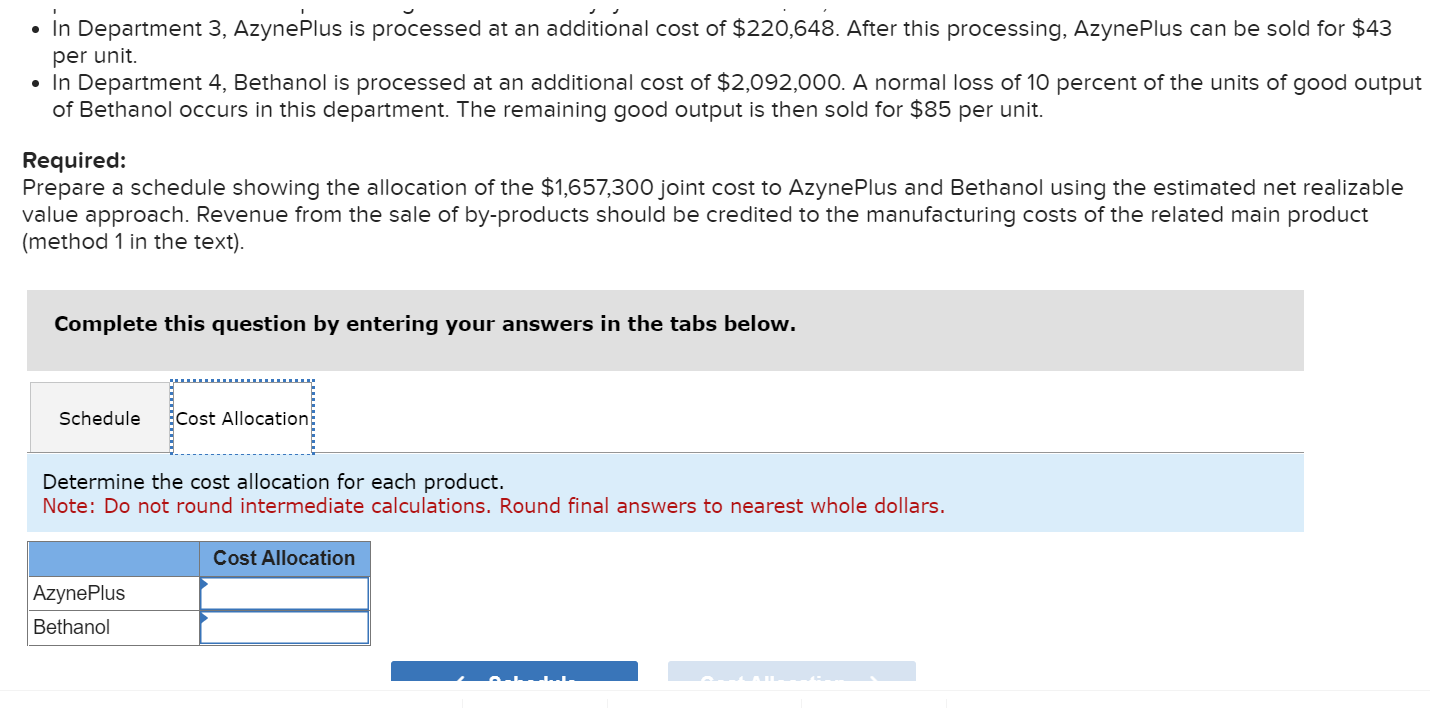

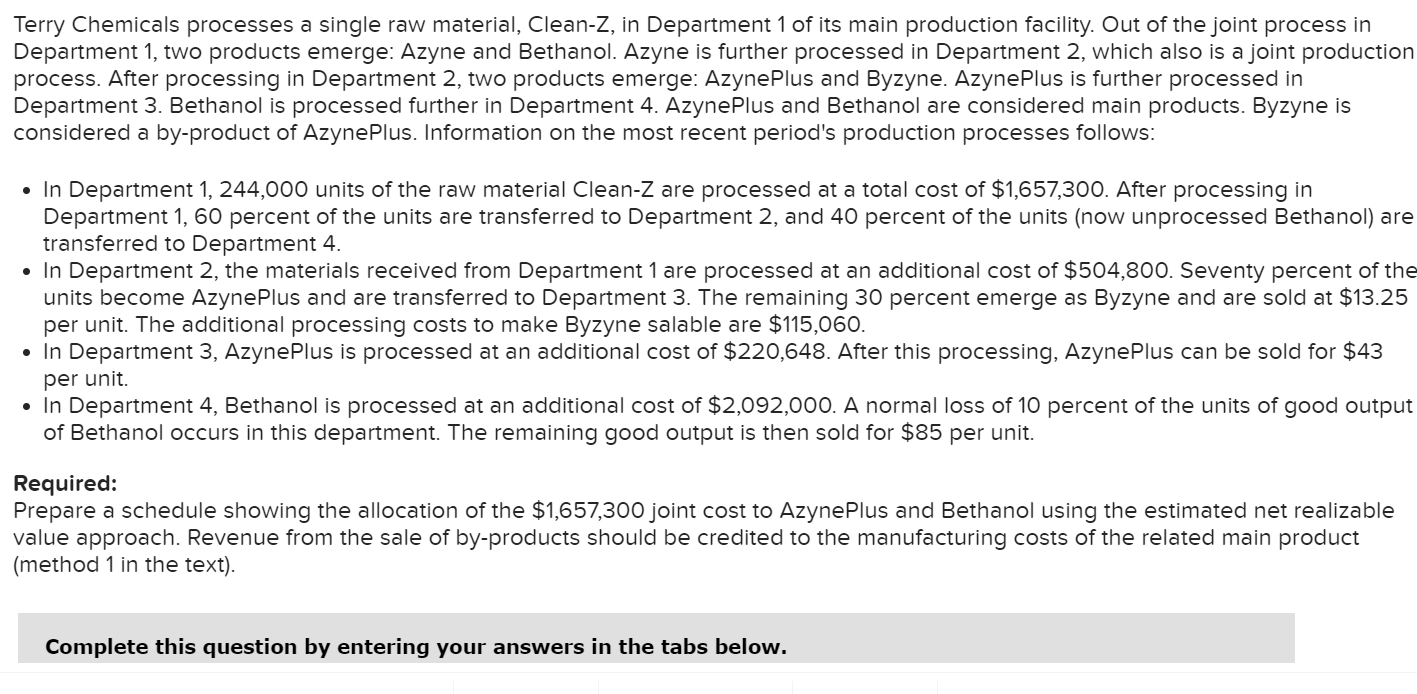

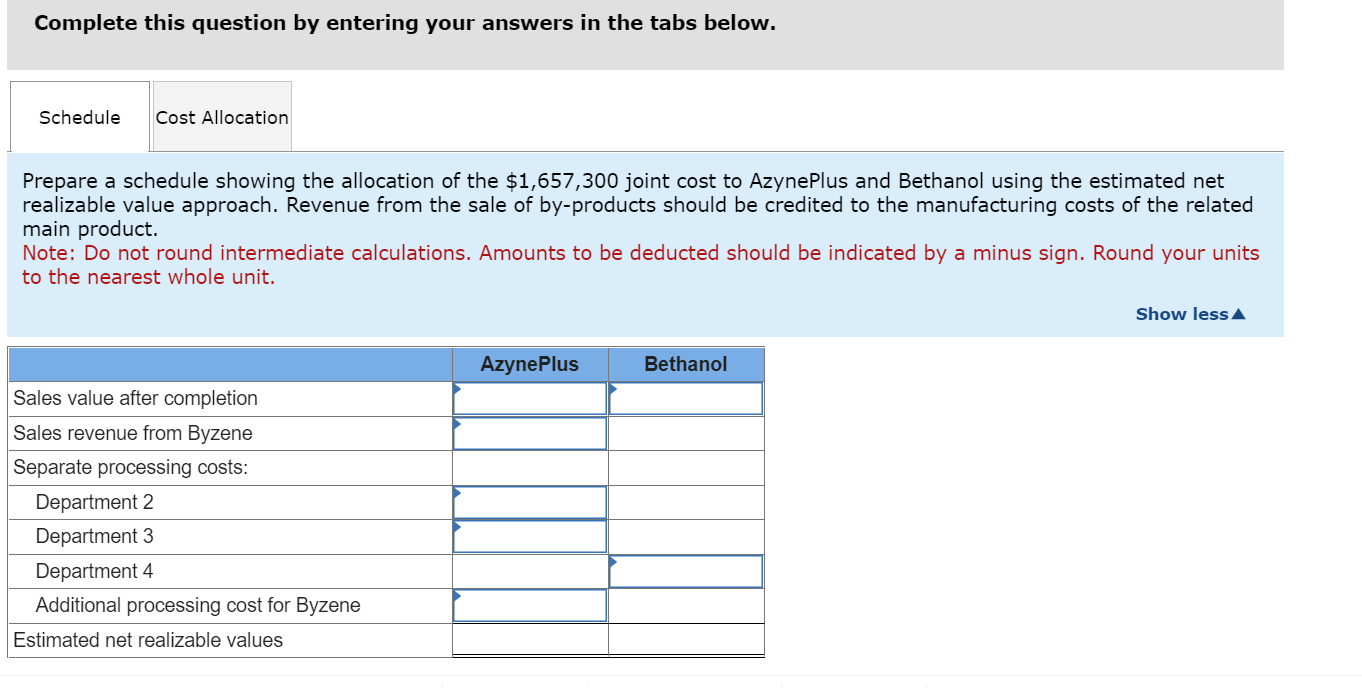

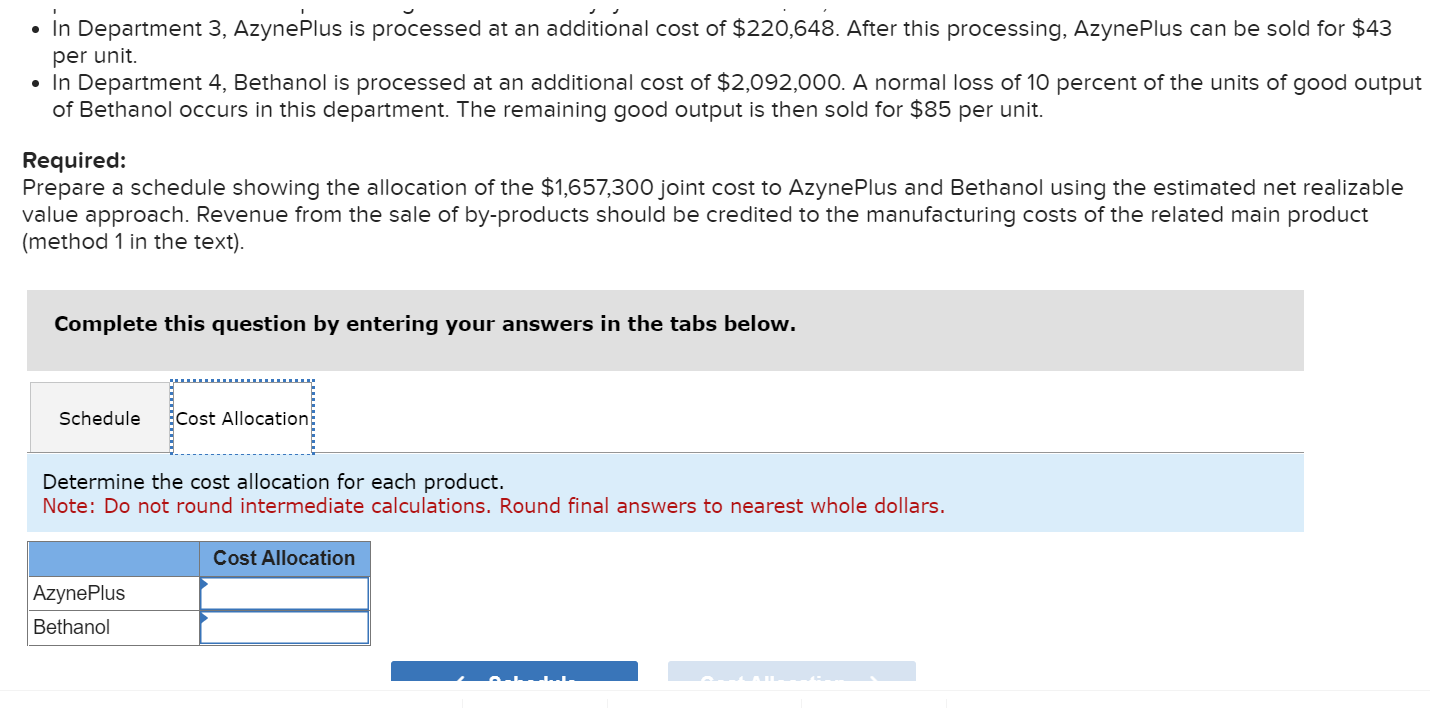

Terry Chemicals processes a single raw material, Clean-Z, in Department 1 of its main production facility. Out of the joint process in Department 1, two products emerge: Azyne and Bethanol. Azyne is further processed in Department 2, which also is a joint production process. After processing in Department 2, two products emerge: AzynePlus and Byzyne. AzynePlus is further processed in Department 3. Bethanol is processed further in Department 4. AzynePlus and Bethanol are considered main products. Byzyne is considered a by-product of AzynePlus. Information on the most recent period's production processes follows: - In Department 1, 244,000 units of the raw material Clean-Z are processed at a total cost of $1,657,300. After processing in Department 1, 60 percent of the units are transferred to Department 2, and 40 percent of the units (now unprocessed Bethanol) are transferred to Department 4. - In Department 2, the materials received from Department 1 are processed at an additional cost of $504,800. Seventy percent of the units become AzynePlus and are transferred to Department 3. The remaining 30 percent emerge as Byzyne and are sold at $13.25 per unit. The additional processing costs to make Byzyne salable are $115,060. - In Department 3, AzynePlus is processed at an additional cost of $220,648. After this processing, AzynePlus can be sold for $43 per unit. - In Department 4, Bethanol is processed at an additional cost of $2,092,000. A normal loss of 10 percent of the units of good output of Bethanol occurs in this department. The remaining good output is then sold for $85 per unit. Required: Prepare a schedule showing the allocation of the $1,657,300 joint cost to AzynePlus and Bethanol using the estimated net realizable value approach. Revenue from the sale of by-products should be credited to the manufacturing costs of the related main product (method 1 in the text). Complete this question by entering your answers in the tabs below. Prepare a schedule showing the allocation of the $1,657,300 joint cost to AzynePlus and Bethanol using the estimated net realizable value approach. Revenue from the sale of by-products should be credited to the manufacturing costs of the related main product. Note: Do not round intermediate calculations. Amounts to be deducted should be indicated by a minus sign. Round your units to the nearest whole unit. - In Department 3, Azyne'Plus is processed at an additional cost of $220,648. After this processing, AzynePlus can be sold for $43 per unit. - In Department 4, Bethanol is processed at an additional cost of $2,092,000. A normal loss of 10 percent of the units of good output of Bethanol occurs in this department. The remaining good output is then sold for $85 per unit. Required: Prepare a schedule showing the allocation of the $1,657,300 joint cost to AzynePlus and Bethanol using the estimated net realizable value approach. Revenue from the sale of by-products should be credited to the manufacturing costs of the related main product (method 1 in the text). Complete this question by entering your answers in the tabs below. Determine the cost allocation for each product. Note: Do not round intermediate calculations. Round final answers to nearest whole dollars. Terry Chemicals processes a single raw material, Clean-Z, in Department 1 of its main production facility. Out of the joint process in Department 1, two products emerge: Azyne and Bethanol. Azyne is further processed in Department 2, which also is a joint production process. After processing in Department 2, two products emerge: AzynePlus and Byzyne. AzynePlus is further processed in Department 3. Bethanol is processed further in Department 4. AzynePlus and Bethanol are considered main products. Byzyne is considered a by-product of AzynePlus. Information on the most recent period's production processes follows: - In Department 1, 244,000 units of the raw material Clean-Z are processed at a total cost of $1,657,300. After processing in Department 1, 60 percent of the units are transferred to Department 2, and 40 percent of the units (now unprocessed Bethanol) are transferred to Department 4. - In Department 2, the materials received from Department 1 are processed at an additional cost of $504,800. Seventy percent of the units become AzynePlus and are transferred to Department 3. The remaining 30 percent emerge as Byzyne and are sold at $13.25 per unit. The additional processing costs to make Byzyne salable are $115,060. - In Department 3, AzynePlus is processed at an additional cost of $220,648. After this processing, AzynePlus can be sold for $43 per unit. - In Department 4, Bethanol is processed at an additional cost of $2,092,000. A normal loss of 10 percent of the units of good output of Bethanol occurs in this department. The remaining good output is then sold for $85 per unit. Required: Prepare a schedule showing the allocation of the $1,657,300 joint cost to AzynePlus and Bethanol using the estimated net realizable value approach. Revenue from the sale of by-products should be credited to the manufacturing costs of the related main product (method 1 in the text). Complete this question by entering your answers in the tabs below. Prepare a schedule showing the allocation of the $1,657,300 joint cost to AzynePlus and Bethanol using the estimated net realizable value approach. Revenue from the sale of by-products should be credited to the manufacturing costs of the related main product. Note: Do not round intermediate calculations. Amounts to be deducted should be indicated by a minus sign. Round your units to the nearest whole unit. - In Department 3, Azyne'Plus is processed at an additional cost of $220,648. After this processing, AzynePlus can be sold for $43 per unit. - In Department 4, Bethanol is processed at an additional cost of $2,092,000. A normal loss of 10 percent of the units of good output of Bethanol occurs in this department. The remaining good output is then sold for $85 per unit. Required: Prepare a schedule showing the allocation of the $1,657,300 joint cost to AzynePlus and Bethanol using the estimated net realizable value approach. Revenue from the sale of by-products should be credited to the manufacturing costs of the related main product (method 1 in the text). Complete this question by entering your answers in the tabs below. Determine the cost allocation for each product. Note: Do not round intermediate calculations. Round final answers to nearest whole dollars