Question

Terry transferred $500,000 of real estate into an irrevocable trust for her son, Lee. The trustee was directed to retain income until Lees 21st birthday

Terry transferred $500,000 of real estate into an irrevocable trust for her son, Lee. The trustee was directed to retain income until Lees 21st birthday and then pay him the corpus of the trust. Terry retained the power to require the trustee to pay income to Lee at any time, and the right to the assets if Lee predeceased her.

What amount of the trust, if any, will be included in Terrys estate?

2.

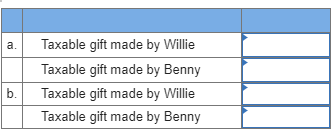

Willie purchased a whole-life insurance policy on his brother, Benny. Under the policy, the insurance company will pay the named beneficiary $100,000 upon the death of the insured, Benny. Willie names Tess the beneficiary, and upon Bennys death, Tess receives the proceeds of the policy, $100,000. Identify the transfer tax implications of this arrangement.

Required:

- At the time of purchase of the policy.

- Upon Bennys death.

(For all requirements, leave no answer blank. Enter zero if applicable.)

3.

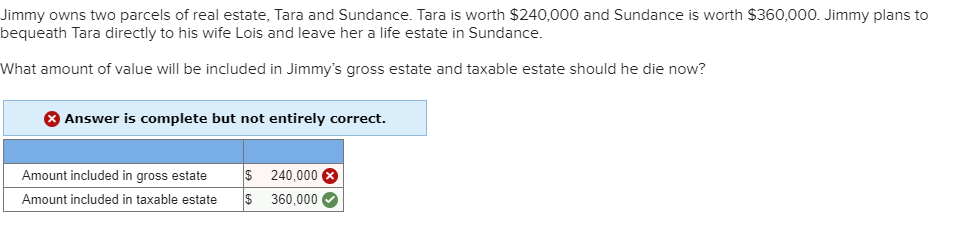

Amount to be included in Terry's estate a. Taxable gift made by Willie Taxable gift made by Benny bTaxable gift made by Willie Taxable gift made by Benny Jimmy owns two parcels of real estate, Tara and Sundance. Tara is worth $240,000 and Sundance is worth $360,000. Jimmy plans to bequeath Tara directly to his wife Lois and leave her a life estate in Sundance. What amount of value will be included in Jimmy's gross estate and taxable estate should he die now? Answer is complete but not entirely correct Amount included in gross estate Amount included in taxable estate $ 240,000 360,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started