Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blue Rock Limited is planning to raise N$11 200 000 through a rights issue. The new shares will be offered at a 20% discount

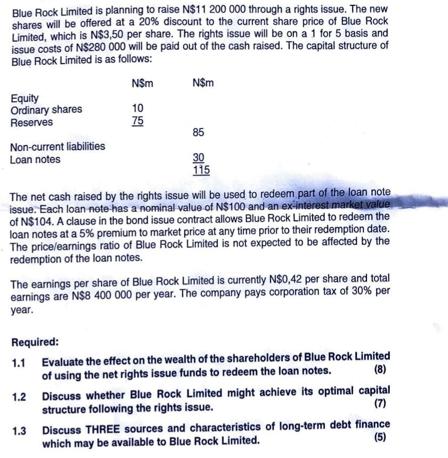

Blue Rock Limited is planning to raise N$11 200 000 through a rights issue. The new shares will be offered at a 20% discount to the current share price of Blue Rock Limited, which is N$3,50 per share. The rights issue will be on a 1 for 5 basis and issue costs of N$280 000 will be paid out of the cash raised. The capital structure of Blue Rock Limited is as follows: N$m 10 75 Equity Ordinary shares Reserves Non-current liabilities Loan notes N$m 85 30 115 The net cash raised by the rights issue will be used to redeem part of the loan note issue. Each loan note has a nominal value of N$100 and an ex-interest market value of N$104. A clause in the bond issue contract allows Blue Rock Limited to redeem the loan notes at a 5% premium to market price at any time prior to their redemption date. The price/earnings ratio of Blue Rock Limited is not expected to be affected by the redemption of the loan notes. The earnings per share of Blue Rock Limited is currently N$0,42 per share and total earnings are N$8 400 000 per year. The company pays corporation tax of 30% per year. Required: 1.1 Evaluate the effect on the wealth of the shareholders of Blue Rock Limited of using the net rights issue funds to redeem the loan notes. (8) 1.2 1.3 Discuss whether Blue Rock Limited might achieve its optimal capital structure following the rights issue. (7) Discuss THREE sources and characteristics of long-term debt finance which may be available to Blue Rock Limited. (5)

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

11 To evaluate the effect on the wealth of the shareholders we need to consider the impact of using the net rights issue funds to redeem the loan notes First lets calculate the number of new shares to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started