Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tesla, Inc. (NASDAQ:TSLA) CEO Elon Musk announced in March 2021 that Tesla vehicles can be purchased with bitcoin (BTC). Since corporate taxes must be

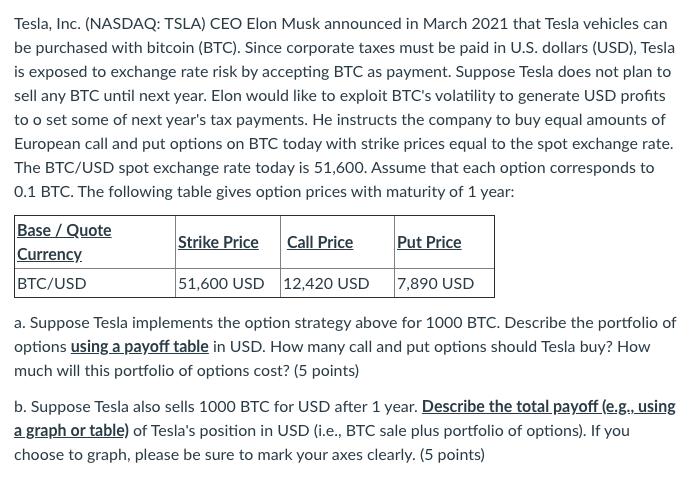

Tesla, Inc. (NASDAQ:TSLA) CEO Elon Musk announced in March 2021 that Tesla vehicles can be purchased with bitcoin (BTC). Since corporate taxes must be paid in U.S. dollars (USD), Tesla is exposed to exchange rate risk by accepting BTC as payment. Suppose Tesla does not plan to sell any BTC until next year. Elon would like to exploit BTC's volatility to generate USD profits to o set some of next year's tax payments. He instructs the company to buy equal amounts of European call and put options on BTC today with strike prices equal to the spot exchange rate. The BTC/USD spot exchange rate today is 51,600. Assume that each option corresponds to 0.1 BTC. The following table gives option prices with maturity of 1 year: Base/Quote Currency BTC/USD Strike Price Call Price Put Price 51,600 USD 12,420 USD 7,890 USD a. Suppose Tesla implements the option strategy above for 1000 BTC. Describe the portfolio of options using a payoff table in USD. How many call and put options should Tesla buy? How much will this portfolio of options cost? (5 points) b. Suppose Tesla also sells 1000 BTC for USD after 1 year. Describe the total payoff (e.g., using a graph or table) of Tesla's position in USD (i.e., BTC sale plus portfolio of options). If you choose to graph, please be sure to mark your axes clearly. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started